25 July 2017

Motilal Oswal values your support in the

Asiamoney Brokers Poll 2017 for India

Research, Sales and Trading team.

We

request your ballot.

Today’s top research theme

THEMATIC | Radio: Well tuned to flourish

v

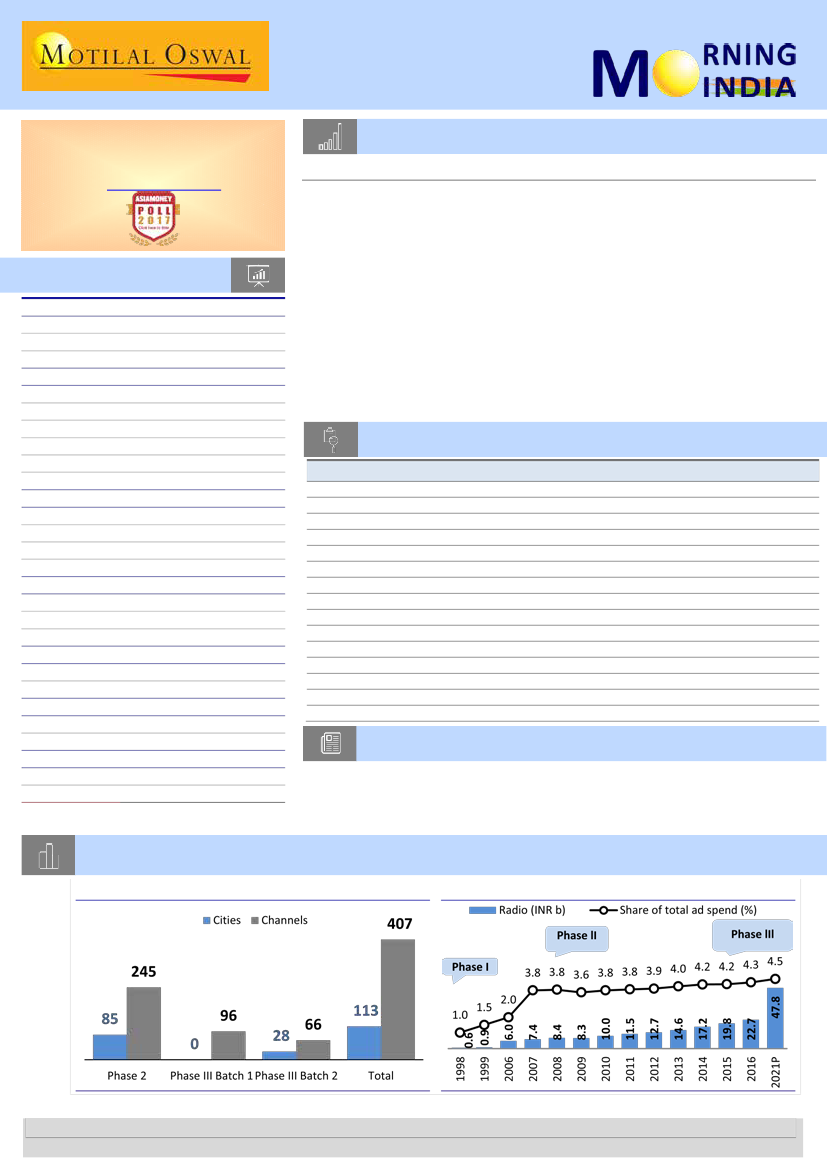

Over the past 18 months, the Indian radio industry has witnessed a 66% increase in

the number of channels to reach 407, led by phase-III auctions and phase-II license

renewals. This is likely to drive radio industry revenue CAGR of 16% over CY16-21E,

~1.4x of traditional media (ex-digital). Also, despite the evolution of the digital

medium, radio remains a stable advertising medium globally, backed by its localized

and interactive content.

v

Entertainment Network India Limited (ENIL)/Music Broadcast’s (MBL) with market

shares of 30%/14% have strong execution capabilities. Inventory addition should help

ENIL/MBL to record revenue growth of 16%/15% and EBITDA CAGR of 30%/20% over

FY17-20. RoIC too will improve to 20%/25% by FY20, led by improving EBITDA margins

and asset turns. Overall, their FCF yield should improve to ~5% by FY20.

v

We initiate coverage on ENIL with a Neutral rating and a TP of INR 928, assigning 20x

on FY19E EBITDA of INR2.1b. We initiate coverage on MBL with Buy rating and a TP of

INR 469, assigning 18x EV/EBITDA on FY19E EBITDA of INR1.3b.

Market snapshot

Equities - India

Close

Chg .%

Sensex

32,246

0.7

Nifty-50

9,966

0.5

Nifty-M 100

18,304

0.2

Equities-Global

Close

Chg .%

S&P 500

2,470

-0.1

Nasdaq

6,411

0.4

FTSE 100

7,378

-1.0

DAX

12,209

-0.3

Hang Seng

10,821

0.3

Nikkei 225

19,976

-0.6

Commodities

Close

Chg .%

Brent (US$/Bbl)

48

1.8

Gold ($/OZ)

1,257

0.7

Cu (US$/MT)

5,995

0.4

Almn (US$/MT)

1,891

-0.1

Currency

Close

Chg .%

USD/INR

64.3

0.0

USD/EUR

1.2

0.0

USD/JPY

110.7

-0.9

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.4

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

24-Jul

MTD

FIIs

-0.1

0.2

DIIs

0.1

0.4

Volumes (INRb)

24-Jul

MTD*

Cash

306

287

F&O

5,488

5,501

Note: YTD is calendar year, *Avg

YTD.%

21.1

21.8

27.5

YTD.%

10.3

19.1

3.3

6.3

15.2

4.5

YTD.%

-13.0

8.4

8.5

10.9

YTD.%

-5.2

10.4

-5.4

YTDchg

-0.1

-0.1

YTD

8.6

3.7

YTD*

286

4,978

Research covered

Cos/Sector

Radio

HDFC Bank

Avenue Supermarts

Zee Entertainment

Ambuja Cement

Indiabulls Hsg Fin

United Spirits

Ashok Leyland

Cummins India

Info Edge

D B Corp

J&K Bank

Metals Weekly

Results Flash

Results Expectation

Key Highlights

(Thematic) Well tuned to flourish

Stellar performance on all fronts

Results in-line; geographical expansion to drive growth

Ad performance in-line

Sharp pricing improvement drives multi-year-high EBITDA/t

Strong growth, stable performance overall

Highway alcohol sale ban to impact volumes over coming quarters

Higher staff cost, one-off costs, negative operating leverage hurt EBITDA margin

Infrastructure spend to drive domestic growth

Ahead of estimates, but uncertainty clouds near term

In-line quarter; maintain estimates and target price

Balance sheet clean-up phase

Chinese export steel prices continue to trend higher

BHIN| MMFS | TCOM | LTI | DELTA

APNT | AXSB | BHARTI | GETD | GLXO | HMCL | PIDI | VEDL

Piping hot news

DoT, Finance Ministry to ease burden of debt-laden telecom sector

v

The Department of Telecommunications (DoT) and the finance ministry have

broadly agreed on relief measures for the debt-laden telecom sector…

Chart of the Day: Radio – Well tuned to flourish

Phase-III –Total number of channels increased by two thirds

Strong growth expected with addition of new licenses

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.