27 July 2017

Motilal Oswal values your support in the

Asiamoney Brokers Poll 2017 for India

Research, Sales and Trading team.

We

request your ballot.

Today’s top research idea

India Strategy: Nifty hits 10k mark after a stirring 22-year journey

v

Nifty yesterday crossed and closed above the 10K mark – an all-time high. Against

this backdrop, we take a trip down the memory lane and compare various aspects

of Nifty now and 22 years ago.

v

Since its inception, Nifty has delivered 11% CAGR returns. Over the same period,

Mcap of Nifty companies has expanded at 20% CAGR. Notably, 30% of Nifty

constituents have been part of the index since inception, delivering market cap

CAGR of 18%.

v

Private Banks – which had the lowest weight in Nifty at 0.4% then – now hold the

highest weight of 23.9%. Consumer – which had the highest weight then at 17% –

now accounts for 10%.

v

Meanwhile, valuations are rich, with Nifty trailing P/E at 25% premium to LPA and

trailing P/B at 10% premium to LPA.

Market snapshot

Equities - India

Close

Chg .%

Sensex

32,382

0.5

Nifty-50

10,021

0.6

Nifty-M 100

18,429

0.3

Equities-Global

Close

Chg .%

S&P 500

2,478

0.0

Nasdaq

6,423

0.2

FTSE 100

7,452

0.2

DAX

12,305

0.3

Hang Seng

10,832

0.5

Nikkei 225

20,050

0.5

Commodities

Close

Chg .%

Brent (US$/Bbl)

50

0.3

Gold ($/OZ)

1,248

-0.3

Cu (US$/MT)

6,298

1.6

Almn (US$/MT)

1,921

0.6

Currency

Close

Chg .%

USD/INR

64.4

-0.1

USD/EUR

1.2

-0.1

USD/JPY

111.9

0.5

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.4

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

26-Jul

MTD

FIIs

0.0

0.2

DIIs

0.1

0.6

Volumes (INRb)

26-Jul

MTD*

Cash

331

290

F&O

6,947

5,569

Note: YTD is calendar year, *Avg

YTD.%

21.6

22.4

28.4

YTD.%

10.7

19.3

4.3

7.2

15.3

4.9

YTD.%

-9.0

7.6

14.0

12.7

YTD.%

-5.2

10.4

-4.4

YTDchg

-0.1

-0.1

YTD

8.7

3.9

YTD*

286

4,994

Research covered

Cos/Sector

India Strategy

HDFC

Yes Bank

Bharti Airtel

Nestle India

Pidilite Inds

Federal Bank

Amara Raja Batt.

MphasiS

Bharat Financial

PVR

Delta Corp

Orient Cement

Healthcare

Key Highlights

Nifty hits 10k mark after a stirring 22-year journey

Core operating performance helped by pick-up in non-retail loans

Stellar all-round performance

Decent quarter; light at the end of the tunnel

Results miss estimates, higher RM costs impact margins

Results below expectation; expect normalcy from 3QFY18

Slippages dent profitability; Underlying story intact

Annual Report | Strengthening products and market presence

HP-driven beat topped with deal wins worth USD183m

Up-fronting provisions; stressed loans pool declines

Expansion in southern market to lead growth

Steady growth in gaming drives revenue beat

Profitability uptick led by high pricing

Moderate growth in June 2017

BIOS | CIFC | CROMPTON | DRRD | EXID | GNP | HCLT | ICICIBV | IDEA |

Results Expectation

IDFCBK | ITC| MSIL | ONGC | TELX

Piping hot news

US Federal Reserve keeps benchmark interest rate unchanged

v

The Federal Reserve kept interest rates unchanged on Wednesday and said it

expected to start winding down its massive holdings of bonds "relatively soon"

in a sign of confidence in the U.S. economy.

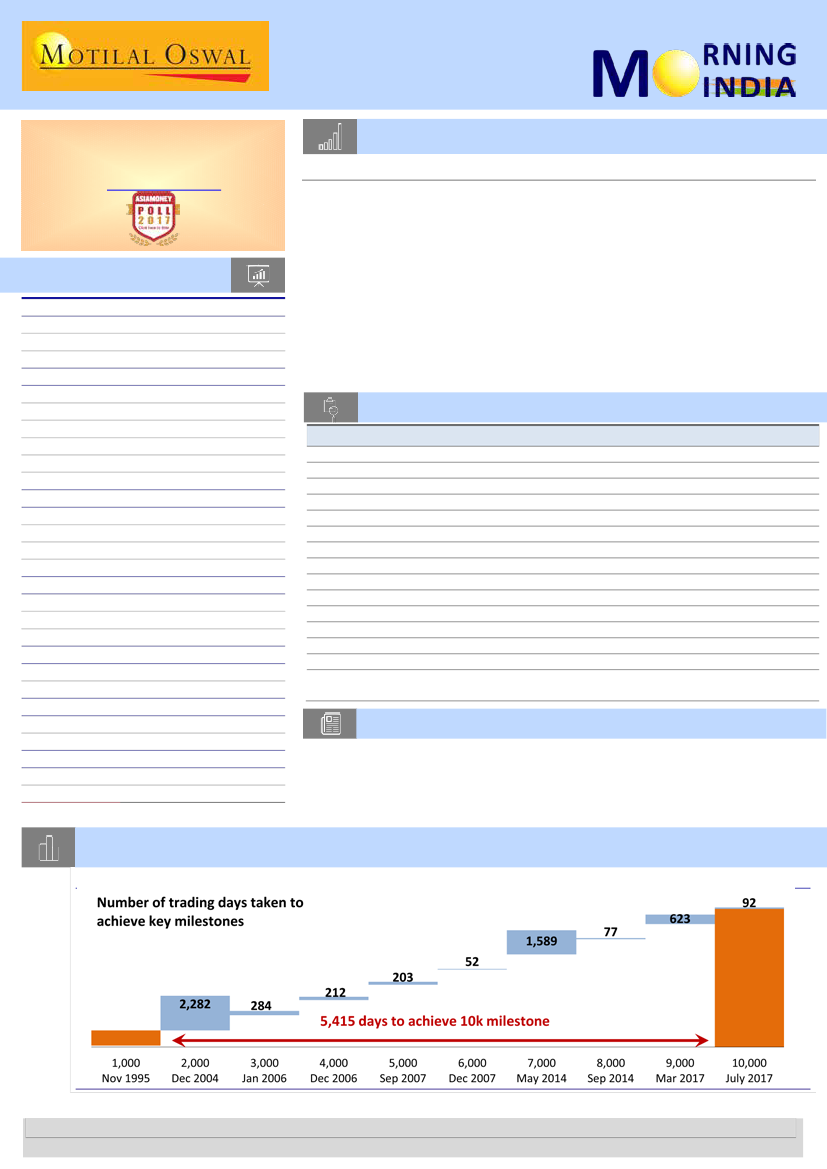

Chart of the Day: India Strategy - Nifty hits 10k mark after a stirring 22-year journey

The journey of Nifty from 1K to 10K…

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.