26 July 2017

1QFY18 Results Update | Sector: Financials

Federal Bank

Buy

BSE SENSEX

32,382

S&P CNX

10,021

CMP: INR115

TP:INR139 (+21%)

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2017 for

India Research, Sales and Trading

team. We

request your ballot.

Slippages dent profitability; Underlying story intact

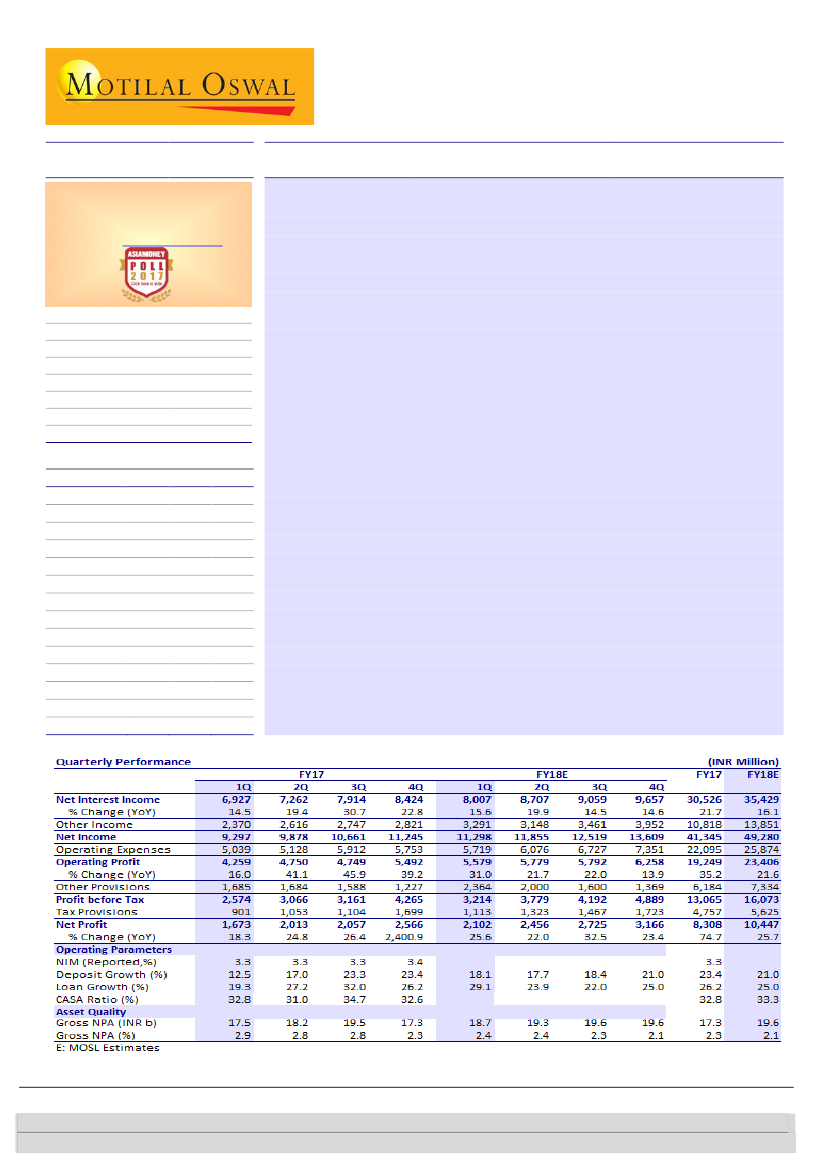

Federal Bank’s (FB) 1QFY18 PAT declined 18% QoQ (+26% YoY) to INR2.1b (14%

miss), despite in-line PPoP (+2%/31% QoQ/YoY), due to the twin impact on NII

and provisions from a spike in corporate slippages, with a restructured account

slipping into NPA.

NII growth came in at -5%/16% QoQ/YoY (7% miss) owing to interest reversals

of ~INR160m, adjusted for which, calculated NIM would stand at 3.11% instead

of 3.05%. Capital raise benefit (+15bp) will help near-term NIMs. Other income

grew 17%/39% QoQ/YoY due to a lumpy contribution of INR2b of treasury

income. CI ratio improved 60bp QoQ to 50.6%.

Loan growth of 4%/29% QoQ/YoY was broad-based, with strong growth across

segments. Corporate growth was the strongest at 6%/39% QoQ/YoY. Retail &

agri loans grew by 3%/27% QoQ/YoY, and SME loans by 3%/17% QoQ/YoY.

Asset quality deteriorated, with one bulky restructured account of INR1.05b

(62% of corporate slippages) slipping into NPA; GNPA/NNPA increased to

2.42%/1.39% (+9bp/+11bp QoQ), with slippage ratio shooting up to 2.88% v/s

1.68% in 4QFY17. Recoveries and upgrades declined 34% QoQ. During the

quarter, the bank sold ~INR480m from existing accounts to ARCs.

Other highlights: a) CASA increased 33% YoY led by 28% CA growth. b) Growth

picking up outside Kerala with 20%/25% growth in loans/SA, while overall

loans/SA growth was 14%/19%.

Valuation and view:

We believe FB’s asset quality concerns, which are largely

legacy issues, are largely behind. The bank is ahead of corporate lending peer

banks on the asset quality curve, especially with opportunistic entry into the

mid-commercial segment. Considering asset quality distractions in the PSU

space, we believe FB is well positioned to gain market share in highly rated

corporates. Post QIP, the bank is comfortably positioned with respect to capital

(Tier 1 ratio of 14.7%). We largely maintain estimates for FY18/19 and reiterate

Buy

with a target price of INR139 (2x June 2019 BV) based on RI model.

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

FB IN

1,719.0

139.2/2.1

82/41

13/61/40

414

100.0

Financials & Valuations (INR b)

Y/E Mar

2018E 2019E 2020E

NII

35.4

43.4

52.0

OP

23.4

27.5

33.9

NP

10.4

13.3

16.7

NIM (%)

3.1

3.1

3.0

EPS (INR)

5.4

6.8

8.6

EPS Gr. (%)

11.6

27.0

25.7

BV/Sh. (INR)

62.3

67.7

74.6

ABV/Sh. (INR) 58.9

64.1

71.7

ROE (%)

10.0

10.5

12.1

ROA (%)

0.8

0.9

0.9

Payout (%)

20.3

19.7

19.7

Valuations

P/E(X)

21.3

16.7

13.3

P/BV (X)

1.8

1.7

1.5

Alpesh Mehta - Research analyst

(Alpesh.Mehta@MotilalOswal.com); +91 22 6129 1526

Subham Banka - Research analyst

(Subham.Banka@MotilalOswal.com)

/

Anirvan Sarkar - Research analyst

(Anirvan.Sarkar@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.