L&T Finance Holdings

BSE SENSEX

32,383

S&P CNX

10,021

27 July 2017

1QFY18 Results Update | Sector: Financials

CMP: INR161

n

TP: INR200 (+24%)

Buy

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2017 for

India Research, Sales and Trading

team. We

request your ballot.

Strong fee income traction; meaningful asset quality improvement

n

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

LTFH IN

1,817

293 / 4.6

167 / 79

11/43/74

662

35.8

2019E

42.1

42.9

19.3

10.6

60.0

2.3

19.1

14.8

15.2

2.7

0.8

n

Financials & Valuations (INR b)

Y/E March

2017 2018E

NII

31.4

37.6

PPP

26.7

37.0

PAT

9.2

13.3

EPS (INR)

5.2

7.3

BV/Sh. (INR)

44.3

50.9

RoAA (%)

1.5

1.9

RoE (%)

12.4

15.6

Payout (%)

19.8

15.2

Valuation

P/E (x)

30.8

22.0

P/BV (x)

3.6

3.2

Div. Yield (%)

0.6

0.6

n

n

Estimate change

TP change

Rating change

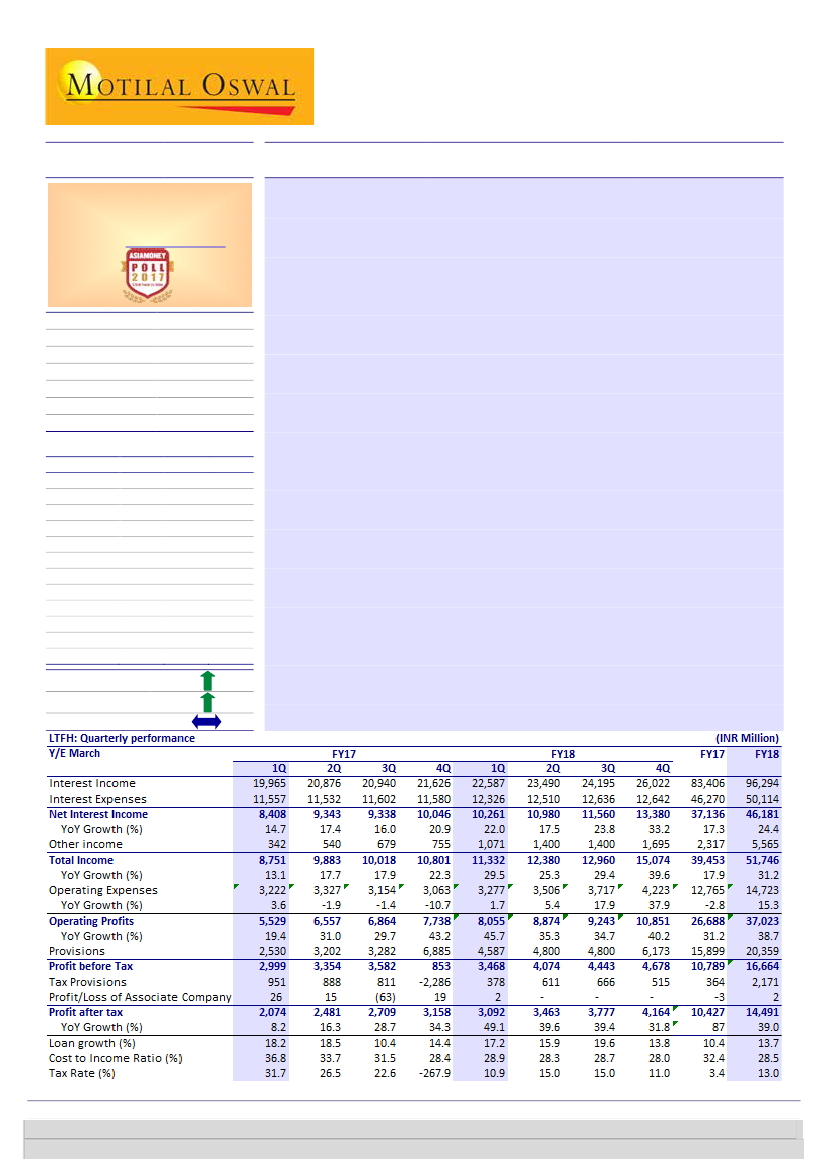

L&T Finance Holding’s (LTFH) 1QFY18 PAT grew 49% YoY to INR3.09b. Robust

core disbursement growth of 95% YoY, strong fee income across all lending

segments, sharp reduction in the GNPL ratio and shoring up of the provision

buffer were key highlights of the quarter.

Rural business:

2W/tractor disbursements increased 82%/169% YoY. While

such strong growth in the tractors segments was expected (LTFH has been

gaining market share from the lows of 4% in FY16 to 11% now), growth in the

2W financing segment was a positive surprise. With PPoP margins improving

180bp YoY to 10.72%, management chose to incur higher provisions and

maintain RoE at 21-22% levels.

Housing business:

Growth in the retail home loan/LAP segment remains

sluggish, but was compensated by 4x disbursements in the builder loans

segment. Consequently, strong fee income helped improve RoA/RoE to

3.2%/30% in 1QFY18. However, we expect RoE to normalize to 18-19% by

FY19.

Wholesale business:

LTFH has also started last mile financing for road projects

in the past few quarters. This, coupled with a large number of operational

projects coming up for refinance, drove 4.5x disbursement growth in the

quarter. While margins are under pressure, fee income traction is strong. RoE

remained largely stable YoY at 10%.

Valuation view:

LTFH has scripted an impressive turnaround over the past five

quarters, with a renewed focus on profitable segments. It has delivered strong

growth and consistent improvement in profitability. We are also encouraged by

the strong fee income traction witnessed this quarter – we believe this will play

a key role in achieving 18%+ RoE by FY19/20. We marginally reduce our FY18E

EPS to factor in higher provisions, but increase our FY19/20 estimates by 5-7%.

Buy

with a TP of INR200 (3.3x FY19E BVPS).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Piran Engineer

(Piran.Engineer@motilaloswal.com); +91 22 6129 1539

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 6129 1526;

Anirvan Sarkar

(Anirvan.Sarkar@MotilalOswal.com);