Sector Update|

2

August 2017

Automobiles

Bajaj Auto

CMP: INR2,823

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

BJAUT IN

289.4

3122/2510

-5/-15/-14

TP: INR3,281 (+16%)

Buy

Overall July volumes down 6.7% YoY to 307.7k

Domestic volumes decline 5.8% YoY; exports down 8% YoY

M.Cap. (INR b) / (USD b) 840.6/13.1

Financial & Valuation (INR b)

Y/E MARCH

2018E 2019E

Sales

241

271

EBITDA

44.2 53.0

NP

39.7 47.3

Adj. EPS (INR) 137

164

EPS Gr. (%)

3.7 19.2

BV/Sh. (INR)

648

713

RoE (%)

22.2 24.0

RoCE (%)

24.6 23.0

Payout (%)

57.0 60.0

Valuation

P/E (x)

20.6 17.3

P/BV (x)

4.4

4.0

EV/EBITDA (x) 14.8 12.2

Div. Yield (%)

2.3

2.8

2020E

308

62.3

55.2

191

16.7

761

25.9

24.7

75.0

14.8

3.7

10.3

4.4

BJAUT’s July 2017 sales declined 6.7% YoY to 307,727 units, lower than our estimate of

322,200 units. Domestic volumes declined 5.8% YoY (but grew 47% MoM); exports

declined 8% YoY. To meet our volume estimate of 3.91m units for FY18, the required

residual monthly run rate is 339.3k units.

Overall motorcycle volumes declined 7% YoY. Domestic motorcycle dispatches

declined 5.4% YoY to 164.9k, as growth continues to be under pressure. Motorcycle

exports declined 9.8% YoY.

The management indicated improvement in sales in the months to come: “Domestic

motorcycle sales will be more than 200k units in September. The company has already

commenced production and launch of

CT100

electric start version. There is good

product action planned for

Platina

and

V.

All these products will be placed well before

the festive season.”

Total

Dominar

volumes in July 2017 were ~3k units compared to ~2k units in June;

BJAUT sold 10.5k units of KTM in July.

3W volumes have still not recovered and declined 4% YoY. Domestic 3W volumes

declined 8.9% YoY. Exports retained growth momentum for the fourth consecutive

month and grew 1.7% YoY.

The stock trades at 20.6x FY18E and 17.3x FY19E EPS. Maintain Buy.

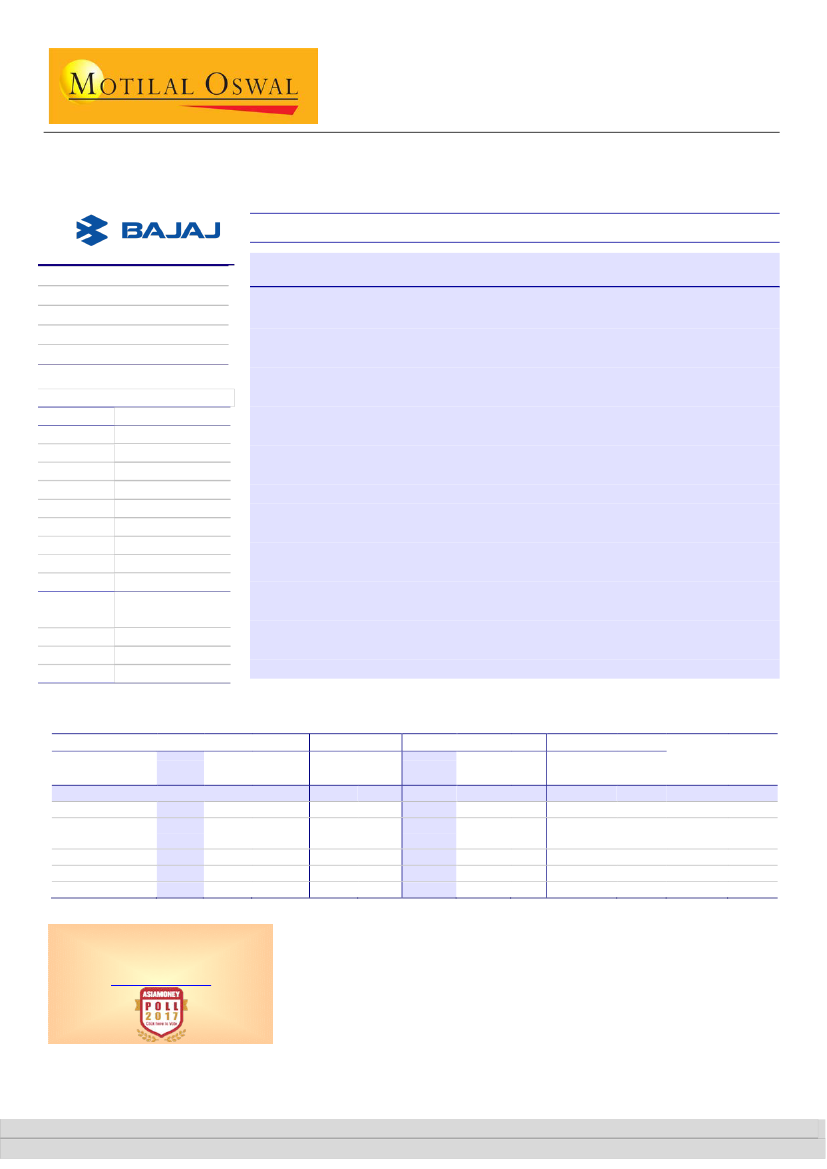

Snapshot of volumes for July-17

YoY

Company Sales

Bajaj Auto

Motorcycles

Total Two-

Wheelers

Three-Wheelers

Domestic

Exports

YoY (%)

chg

307,727 329,833

-6.7

265,182 285,527

-7.1

Jul-17

Jul-16

265,182

42,545

186,497

121,230

285,527

44,306

198,022

131,811

-7.1

-4.0

-5.8

-8.0

MoM

MoM

(%)

Jun-17

FY18YTD FY17YTD

(%) chg

chg

244,878 25.7 1,196,161 1,324,566 -9.7

204,667 29.6 1,040,896 1,158,067 -10.1

204,667

40,211

126,975

117,903

29.6

5.8

46.9

2.8

1,040,896

155,265

665,406

530,755

1,158,067

166,499

822,106

502,460

-10.1

-6.7

-19.1

5.6

FY18

estimate

3,910,922

3,446,114

3,446,114

464,808

2,348,816

1,562,106

Residual

Residual

Monthly

Gr. (%) Growth (%)

Run rate

6.7

15.9

339,345

7.0

16.7

300,652

7.0

4.2

4

10.7

16.7

10.7

17.5

13.5

300,652

38,693

210,426

128,919

Motilal Oswal values your support in the

Asiamoney Brokers Poll 2017 for India

Research, Sales and Trading team. We

request your ballot.

Jinesh Gandhi - Research Analyst

(Jinesh@MotilalOswal.com); +91 22 6129 1524

Deep A Shah - Research Analyst

(Deep.S@MotilalOswal.com);+912261291533/

Jigar Shah - Research Analyst

(Jigar.Shah@MotilalOswal.com);+912239825402

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.