8 August 2017

Motilal Oswal values your support in the

Asiamoney Brokers Poll 2017 for India

Research, Sales and Trading team.

We

request your ballot.

Today’s top research idea

Strides Shasun - Initiating Coverage: Making great strides

v

Strides (STR) is set to deliver 42% earnings CAGR over FY17-20 on the back of

significant investments the company has made in the last 2-3 years.

v

Through Solara, which will house its API business, it is well-placed to capitalize

on the good opportunity in the API space. Its niche portfolio, consistent

compliance, and sizable manufacturing capacity stand it in good stead.

v

US revenue should multiply ~3x over FY17-20, driven by existing ANDAs

pending for approval and aggressive filing.

v

By expanding its product offerings, tying up with the largest distributor, and

enhancing reach by catering to standalone pharmacies, we expect STR to be

on a strong growth trajectory in Australia as well.

v

We initiate coverage with a

BUY

rating and an SOTP-based target price of

INR1,300.

Market snapshot

Equities - India

Close

Chg .%

Sensex

32,274

-0.2

Nifty-50

10,057

-0.1

Nifty-M 100

18,570

1.1

Equities-Global

Close

Chg .%

S&P 500

2,481

0.2

Nasdaq

6,384

0.5

FTSE 100

7,532

0.3

DAX

12,257

-0.3

Hang Seng

11,054

0.5

Nikkei 225

20,056

0.5

Commodities

Close

Chg .%

Brent (US$/Bbl)

52

-0.1

Gold ($/OZ)

1,258

-0.1

Cu (US$/MT)

6,384

0.6

Almn (US$/MT)

1,946

3.0

Currency

Close

Chg .%

USD/INR

63.8

0.4

USD/EUR

1.2

0.1

USD/JPY

110.7

0.0

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.5

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

7-Aug

MTD

FIIs

0.0

-0.2

DIIs

0.0

0.4

Volumes (INRb)

7-Aug

MTD*

Cash

283

295

F&O

2,981

5,492

Note: YTD is calendar year, *Avg

YTD.%

21.2

22.9

29.4

YTD.%

10.8

18.6

5.4

6.8

17.7

4.9

YTD.%

-6.5

9.2

15.6

14.2

YTD.%

-6.1

12.1

-5.3

YTDchg

-0.1

-0.1

YTD

8.6

4.4

YTD*

288

5,056

Research covered

Cos/Sector

Strides Shasun

Tata Steel

Hindalco (Novelis)

Britannia Inds.

Amara Raja Batt.

Eveready Inds.

Metals Weekly

Key Highlights

Initiating Coverage (Making great strides)

Strong operating performance; Strong markets have given flip to FY18

outlook

Novelis delivers strong operating performance

Broadly in-line performance; base business volume growth at ~1%

Below estimate; Adverse mix, competitive pressure dents profitability

LED segment robust; Flashlight segment to recover from GST setbacks

Domestic steel prices gain, sponge prices rise sharply

Results Expectation BOI | ENDU | GLXO | JAGP | JSPL | KSCL | MUTH | SRF | TMX

Hike in GST cess on luxury cars will dent Make in India, say carmakers

Piping hot news

v

Makers of sports utility vehicles (SUVs) and luxury cars are protesting the GST

Council’s plan to raise the cess on such products from 15% to as much as 25%,

warning that the move will lead to production cuts and job losses and dent the

“Make in India” initiative.

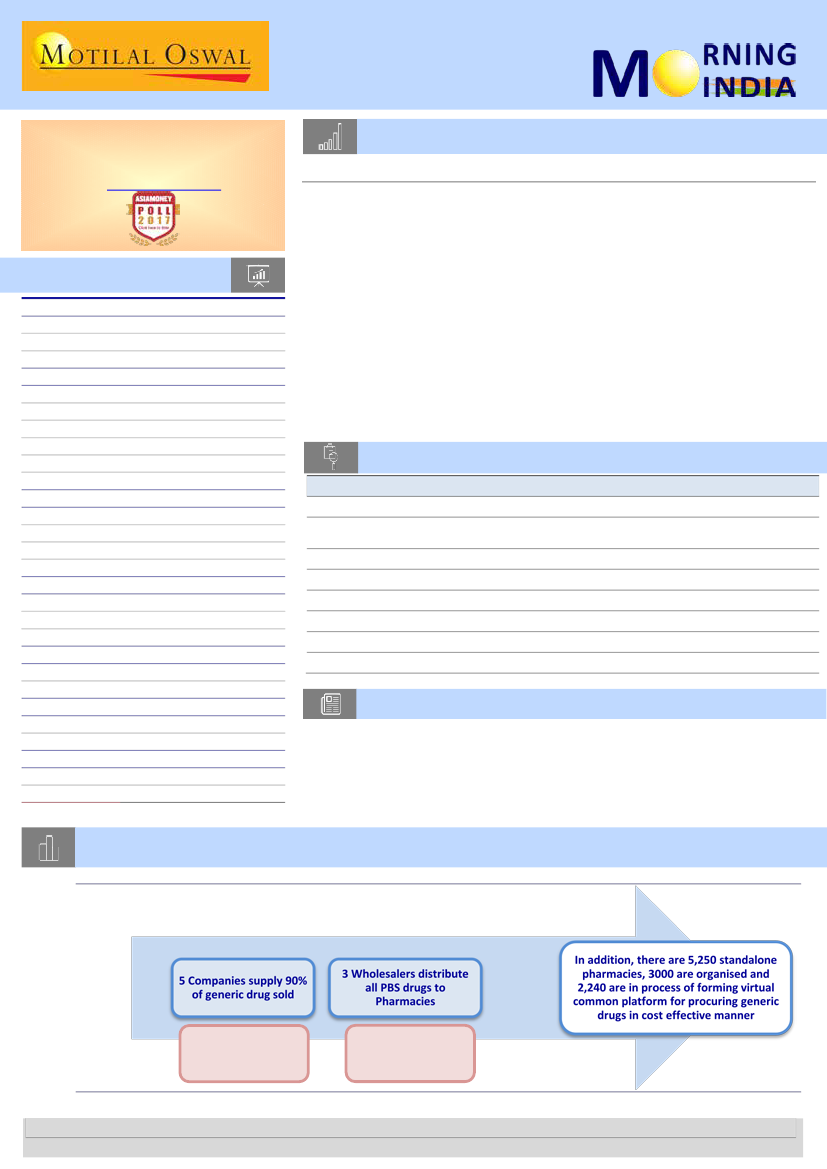

Chart of the Day: Strides Shasun - Initiating Coverage: Making great strides

Structure of Australian generic pharma market

Apotex | Mylan |

Arrow | Sandoz

Amneal

Sigma

Symbion

API

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.