Alkem Laboratories

BSE SENSEX

31,214

S&P CNX

9,711

12 August 2017

1QFY18 Results Update | Sector: Healthcare

CMP: INR1,707

TP: INR1,830(+7%)

Neutral

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2017 for

India Research, Sales and Trading

team. We

request your ballot.

Weak 1Q due to GST impact; recovery expected in coming quarters

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

ALKEM IN

120

263.9 / 4.1

2238 / 1400

-5/-17/-5

97

33.0

Financials & Valuations (INR b)

2017 2018E 2019E

Y/E Mar

Net Sales

58.5

63.8

74.4

EBITDA

10.0

10.9

13.5

PAT

9.0

8.8

11.0

EPS (INR)

75.7

73.5

91.6

Gr. (%)

7.5

-2.9

24.7

BV/Sh (INR)

353.4 410.4 481.4

RoE (%)

23.4

19.2

20.5

RoCE (%)

21.3

17.7

22.6

P/E (x)

22.5

23.2

18.6

P/BV (x)

4.8

4.2

3.5

Estimate change

TP change

Rating change

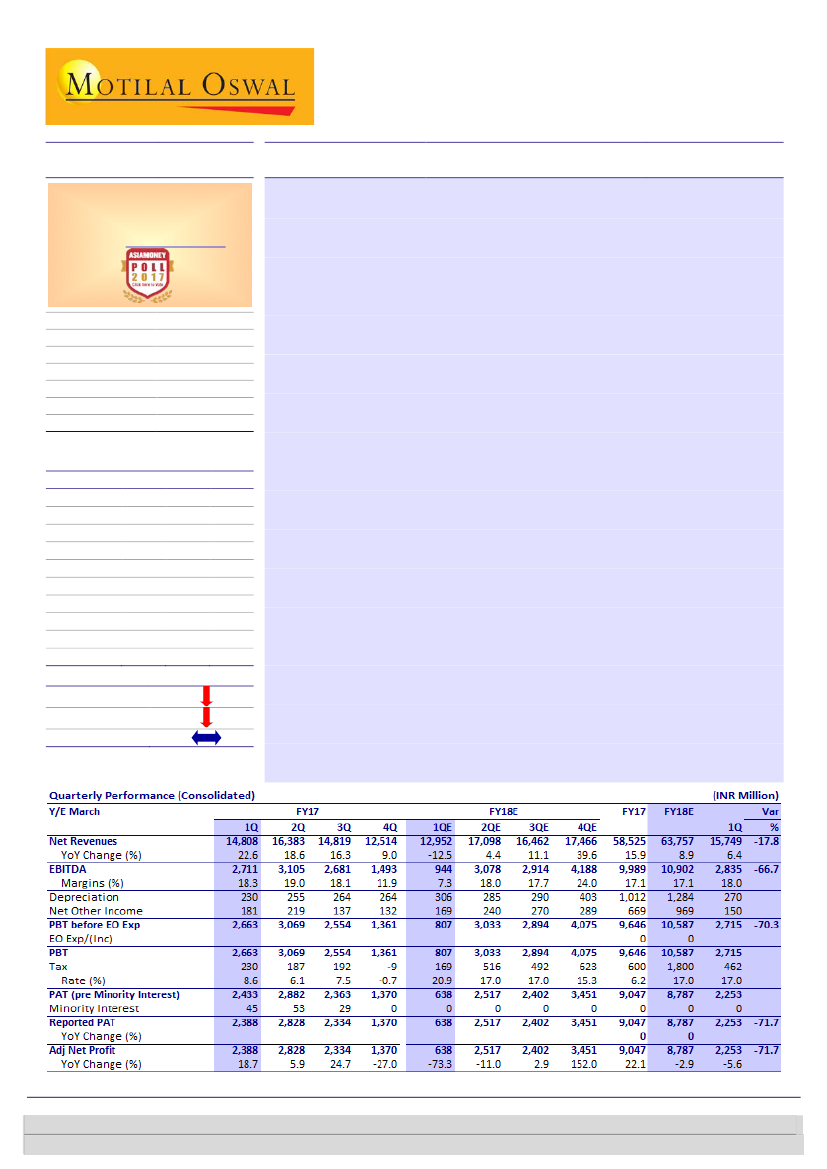

Revenue declined 12.5% YoY to INR12.9b (17% miss). Adjusted for accounting

treatment of excise duty cost of INR520m, gross margin remained flat. EBITDA

stood at INR944m, with the margin of ~7% coming in significantly below our

estimate due to poor performance in the domestic business (-21% YoY). R&D

expense stood at INR701m (5.4% of sales). PAT was at INR638m v/s INR2.4b in

1QFY17.

Weak domestic business growth; recovery expected in coming quarters:

Alkem’s domestic business declined 21% YoY to INR8.7b. The company lost

almost one month of sales due to destocking in the channel prior to GST

implementation. Given that 1H is seasonally strong, if full recovery of sales

does not happen by 2Q-end, then company may lose some sales in FY18. Full-

year growth guidance for the domestic business has been brought down to

low-double-digits from mid-teens earlier.

US – continues to grow at steady pace:

US sales came in at USD45m (up

~12.5% YoY). We expect ramp-up in the US business in the coming quarters, led

by the expected launch of 8-10 products in FY18. Also, 2H is seasonally strong

for Alkem due to products like Benzonatate.

Key concall takeaways:

a) Guided for low to mid-teens growth in 2QFY18. b)

Inventory days declined to 17 days by end of June as against 40 days in May . c)

Expect higher than market growth rate going ahead. d) Planning to file 12-15

ANDAs in FY18. e) Tax rate guidance of ~MAT rate in FY18E and 12-15% in

FY19E (lower in FY19E due to annual impact of tax benefit from the new Sikkim

plant).

Maintain Neutral:

We continue believing that Alkem is the best way to play the

domestic growth story (>70% of revenue and >85% of EBITDA came from India

in FY17). Having said that, at current valuations, the stock provides limited

room for upside. Our target price of INR1,830 for Alkem is based on 20x FY19E

PER (v/s INR1,900 @ 20x FY19E PER). We have cut our FY18/19E EPS estimate

by 8%/4%, as we build in the impact of slower domestic growth and INR

appreciation.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Ankeet Pandya

(Ankeet.Pandya@MotilalOswal.com );