24 August 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

31,568

0.9

Nifty-50

9,853

0.9

Nifty-M 100

17,857

1.2

Equities-Global

Close

Chg .%

S&P 500

2,444

-0.3

Nasdaq

6,278

-0.3

FTSE 100

7,383

0.0

DAX

12,174

-0.5

Hang Seng

10,955

0.0

Nikkei 225

19,435

0.3

Commodities

Close

Chg .%

Brent (US$/Bbl)

52

1.3

Gold ($/OZ)

1,287

0.1

Cu (US$/MT)

6,537

-0.2

Almn (US$/MT)

2,101

0.7

Currency

Close

Chg .%

USD/INR

64.1

0.0

USD/EUR

1.2

0.2

USD/JPY

109.5

0.1

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.5

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

23-Aug

MTD

FIIs

-0.1

-2.0

DIIs

0.1

2.0

Volumes (INRb)

23-Aug

MTD*

Cash

269

304

F&O

7,159

6,631

Note: YTD is calendar year, *Avg

YTD.%

18.6

20.4

24.4

YTD.%

9.2

16.6

3.4

6.0

16.6

1.7

YTD.%

-6.5

11.0

18.4

23.3

YTD.%

-5.5

11.7

-6.5

YTDchg

0.0

-0.1

YTD

6.8

6.0

YTD*

289

5,200

Today’s top research idea

Trident - Initiating Coverage: An attractive utilization play

v

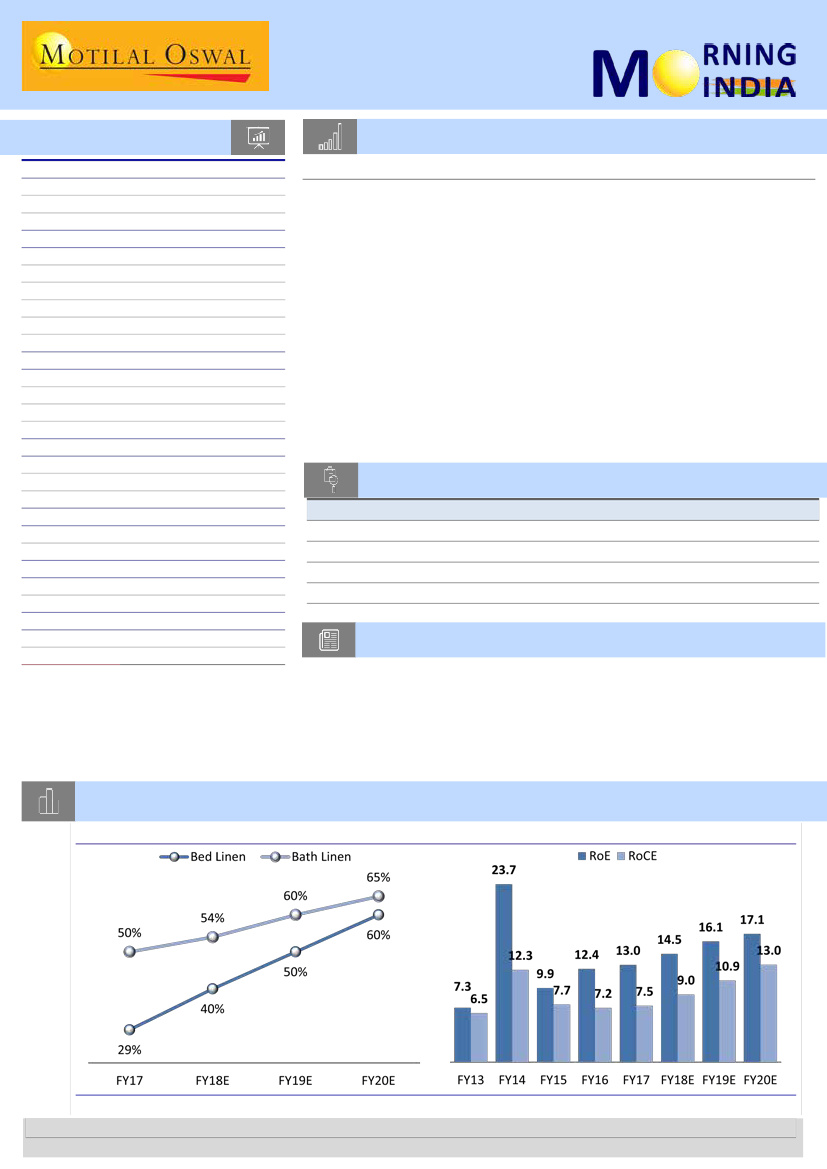

TRID is set to deliver CAGR of 9% in revenue and 24% in earnings over FY17-

20, driven by revenue CAGR of 44% in bed linen and 12% in bath linen.

v

The recently ventured bed linen segment is expected to turn EBITDA

profitable by 3QFY18 as utilization touches 40%. The segment’s share in

overall revenue should increase from 4% in FY17 to 9% in FY20.

v

After significant capacity expansion in bath linen in FY15, TRID is expected to

reap its benefits and witness higher utilization (65% in FY20 v/s 50% in FY17),

which would not require further addition of spindles as yarn capacity would

be utilized in-house.

v

The rising share of copier paper should lead to paper business margin

expansion of 340bp to 38% in FY20.

v

We value TRID at 11x FY19E EPS, arriving at a TP of INR114. Initiating with Buy.

Research covered

Cos/Sector

Trident

India Strategy

P & G Hygiene

Castrol India

Key Highlights

An attractive utilization play

Contrarian Investing: Digging deeper; Exploring more angles

P&G Hygiene And Healthcare: Downgrade to Neutral

EBITDA below estimate; lower volumes due to pre-GST destocking

Piping hot news

Infosys row: Chorus grows for Seshasayee’s exit, Nandan Nilekani’s entry

v

Infosys Ltd chairman R. Seshasayee may be on his way out even as a chorus

calling for the return of co-founder Nandan Nilekani grows louder, five days

after CEO Vishal Sikka abruptly resigned and the board blamed former

chairman and promoter N.R. Narayana Murthy for the exit.

Chart of the Day: Trident - An attractive utilization play

Increased utilization in home textile to bolster growth

Higher utilization to improve return ratios

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.