6 September 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

31,810

0.3

Nifty-50

9,952

0.4

Nifty-M 100

18,557

1.0

Equities-Global

Close

Chg .%

S&P 500

2,458

-0.8

Nasdaq

6,376

-0.9

FTSE 100

7,373

-0.5

DAX

12,124

0.2

Hang Seng

11,192

0.1

Nikkei 225

19,386

-0.6

Commodities

Close

Chg .%

Brent (US$/Bbl)

53

2.0

Gold ($/OZ)

1,340

0.5

Cu (US$/MT)

6,870

-0.3

Almn (US$/MT)

2,072

-1.2

Currency

Close

Chg .%

USD/INR

64.0

0.2

USD/EUR

1.2

-0.2

USD/JPY

110.3

0.1

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.5

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

5-Sep

MTD

FIIs

-0.1

-2.1

DIIs

0.1

2.6

Volumes (INRb)

5-Sep

MTD*

Cash

307

302

F&O

3,264

6,846

Note: YTD is calendar year, *Avg

YTD.%

19.5

21.6

29.3

YTD.%

9.8

18.4

3.2

5.6

19.1

1.4

YTD.%

-4.5

16.3

24.4

21.6

YTD.%

-5.7

12.8

-5.7

YTDchg

0.0

-0.1

YTD

6.7

6.7

YTD*

290

5,280

Today’s top research idea

Hindalco: Remains focused on delivering stakeholder value

We hosted Mr Satish Pai, MD of Hindalco Industries, as part of ‘CEO Track’ at our

annual conference. Key takeaways:

Business model has become robust, with cost leadership and stability in Indian

upstream operations, leadership in global downstream operations, and

strengthened B/S.

Superior technology selection for smelters helped it achieve stable operations.

Novelis will continue expanding in auto space, where it enjoys global

leadership in supplying flat rolled products. Expect new investments in

US/China. Pricing pressure in can business has eased. Electric vehicles should

accelerate light weighting of vehicles, driving aluminum demand.

Continues focusing on deleveraging and allocation of capital in downstream

(less capital-intensive); pre-paid INR78b debt, plans to prepay another INR30b

in FY18.

Focus on deleveraging, operational excellence, customer centricity and cash

conservation to deliver stakeholder value.

Research covered

Cos/Sector

AGIC: CEO Track

Takeaways

AGIC: Management Says

India Electricals

Key Highlights

Hindalco | Larsen & Toubro | Bank of Baroda

Auto | Capital Goods | Cement |Consumer | Financials |

Healthcare| Metals | Oil & Gas | Telecom | Utilities | Others

Energy Efficiency Services Limited (EESL) order tracker

Piping hot news

IndiGo may buy stake in Jet Airways if Air India bid fails

InterGlobe Aviation Ltd-run IndiGo is convinced there is an opportunity for a

large India-based airline with a significant international footprint, and may

consider investing in Jet Airways (India) Ltd…

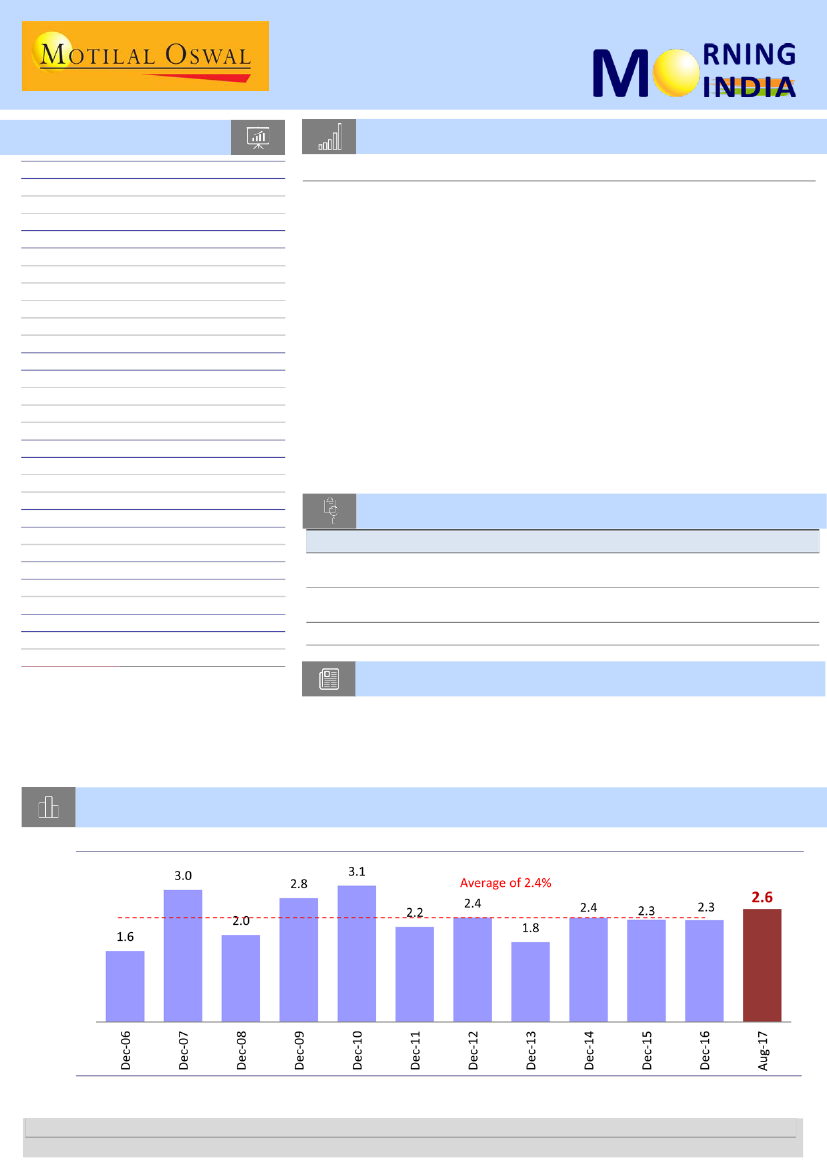

Chart of the Day: India’s share in world market cap above historical average

Trend in India's contribution to world market cap (%)

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.