MOSt Quantitative

Outlook Weekly

Index

Nifty

Sensex

8th Sep 2017

CMP

9935

31688

Support

9850 / 9775

31500 / 31300

Resistance

9980 / 10080

31900 / 32300

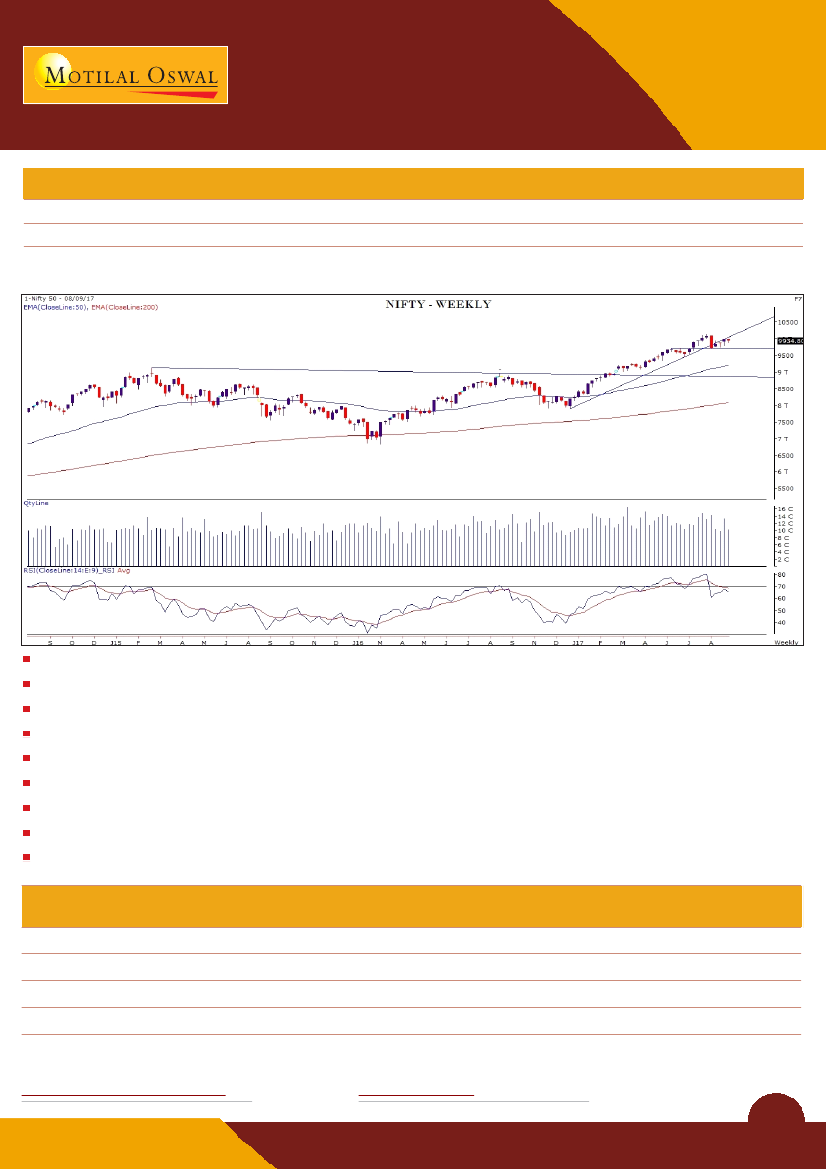

NIFTY WEEKLY

Nifty made an inside bar, a small bodied candle

The participants seem lost for direction and a range breakout is required

Markets did not attract follow up buyers and sellers were unable to push it to lower zones

Index mostly traded in a range between 9988-9861

The weekly traded range of around 120 points is the smallest in last many weeks

The sideways action in Nifty is forming an ascending triangle pattern.

The future direction of the market depends on a decisive range breakout on either side

A break out above 9988 would mean a rally to 10080 then 10138

On the lower side a break below 9850 could mean a drop towards 9775 then 9710 levels

SECTOR

NAME

Banking

NBFC

Auto

Metals

Chandan Taparia

Derivatives & Technical Analyst

OUTLOOK

FOR THE WEEK

Positive

Positive

Positive

Positive

Manish Shah

Technical Analyst

POTENTIAL

MOVERS & SHAKERS

Indusind Bank, Kotak Bank

M&M Finance, Bajaj Finance

Maruti, Ashok Leyland

JSW Steel, Vedl

1