Sector Update | 19 September 2017

Utilities

Merchant power price spike – a nine-day wonder

Peak load growing faster than energy demand in recent months

Power exchange (IEX) prices have doubled from the average of last two years

to more than INR5/kWh in the recent weeks. Interestingly, there is sharper

increase in evening peak prices compared to the rest-of-day prices.

The increase is due to a combination of factors – increase in demand, fall in

hydro and nuclear generation, increased outages at gas plants, and low coal

stocks at power plants.

Demand growth has already moderated in mid-September. Hydro and nuclear

generation has relatively improved. Coal-based generation growth has

decelerated and plant outage has declined. Improving coal supply will trigger

correction in IEX prices, in our view.

Peak demand growth was lagging energy demand growth until August 2016

but has since been outpacing. The trend could accelerate as ‘Power for All’

pushes domestic electricity consumption, which has an evening bias. ‘DEEP’

data is also suggesting rise in demand for part-of-day contracts.

If the trend in sharper growth of peak load continues, the demand for hydro

and gas plants will increase. Rising share of solar power generation will further

drive demand for hydro and gas plants, which can ramp up quickly on

demand.

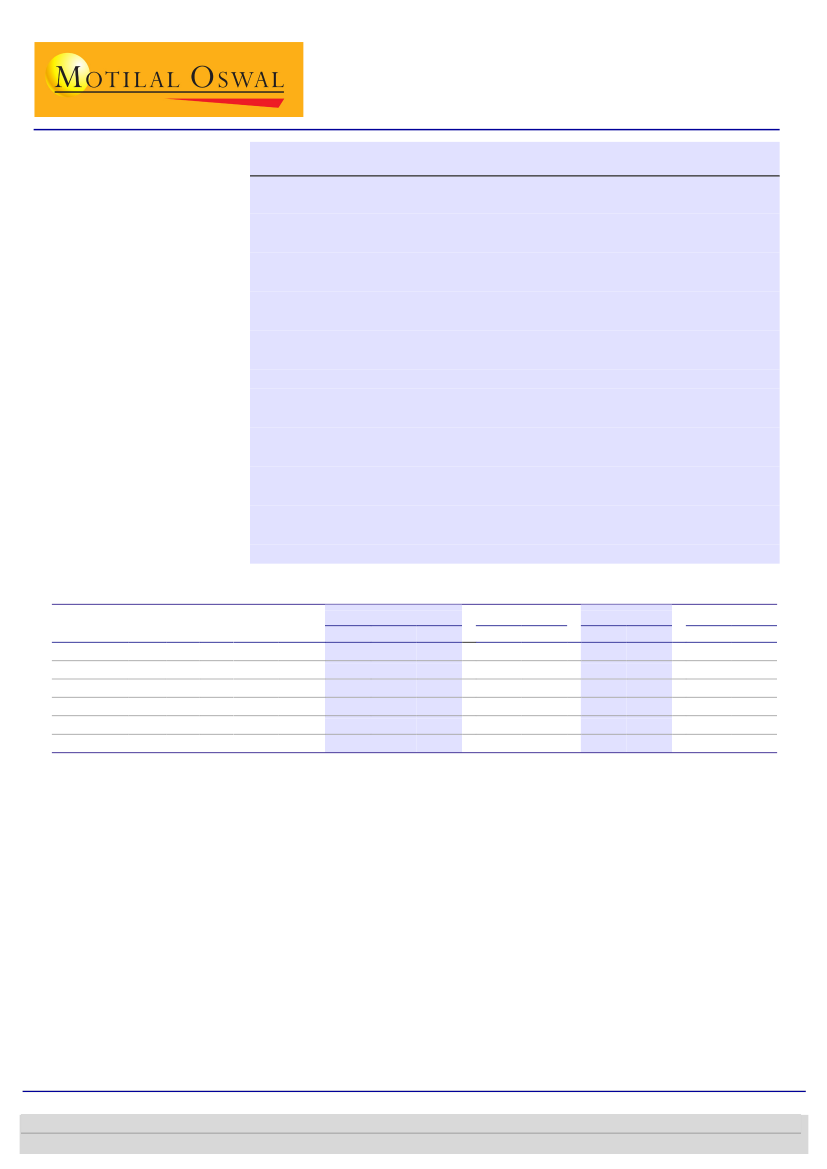

Exhibit 1: Utilities sector valuation

Rating CMP

(INR)

Buy

215

Buy

169

Buy

79

Buy

1,072

Sell

85

Buy

258

TP Up/(dw) MCAP

(USD M) FY17E

(INR)

%

262

22

17,509 14.2

211

25

21,639 12.0

49

-38

2,013

3.9

1,360

27

2,218

51.9

71

-17

3,566

7.4

305

18

25,340 14.9

EPS

FY18E

17.4

13.3

3.4

88.9

7.3

19.8

FY19E

20.6

15.7

2.7

99.3

7.3

22.0

P/E (x)

FY18E FY19E

12.4

10.5

12.7

10.8

23.2

29.2

12.1

10.8

11.7

11.5

13.1

11.7

P/B(x)

FY18E FY19E

2.0

1.7

1.3

1.2

1.2

1.2

1.2

1.1

1.8

1.5

6.2

5.9

RoE (%)

FY18E FY19E

17.3

17.8

10.9

11.9

5.3

4.2

10.6

10.8

15.8

14.2

48.8

51.8

Powergrid

NTPC

JSW Energy

CESC

Tata Power

Coal India

Source: MOSL, Company

Sanjay Jain - Research analyst

(SanjayJain @MotilalOswal.com); +91 22 3982 5412

Dhruv Muchhal - Research analyst

(Dhruv.Muchhal@MotilalOswal.com); +91 22 3027 8033

8 August 2016

1

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.