21 September 2017

India Strategy

BSE Sensex: 32,401

S&P CNX: 10,141

Sectoral weights in Nifty: A journey down the memory lane

Financials lord over the indices; set to gain further strength

Over the years, the sectoral representation in Nifty-50 has undergone a sea change, in

consonance with the changes in the underlying economy – new sectors have evolved,

while some of the erstwhile dominant sectors of the economy have lost relative

importance in the new India.

In this report, we take a deep dive to understand how the weights of various

sectors/companies in Nifty-50 have changed in the last 15 years.

Index moving to free float basis

have boosted weight of Pvt.

Financials

Banks-PVT

Free float weight

from 2009

BFSI and Oil account for almost half of the index

NBFC

Free float weight

from 2009

Banks-PSU

Free float weight

from 2009

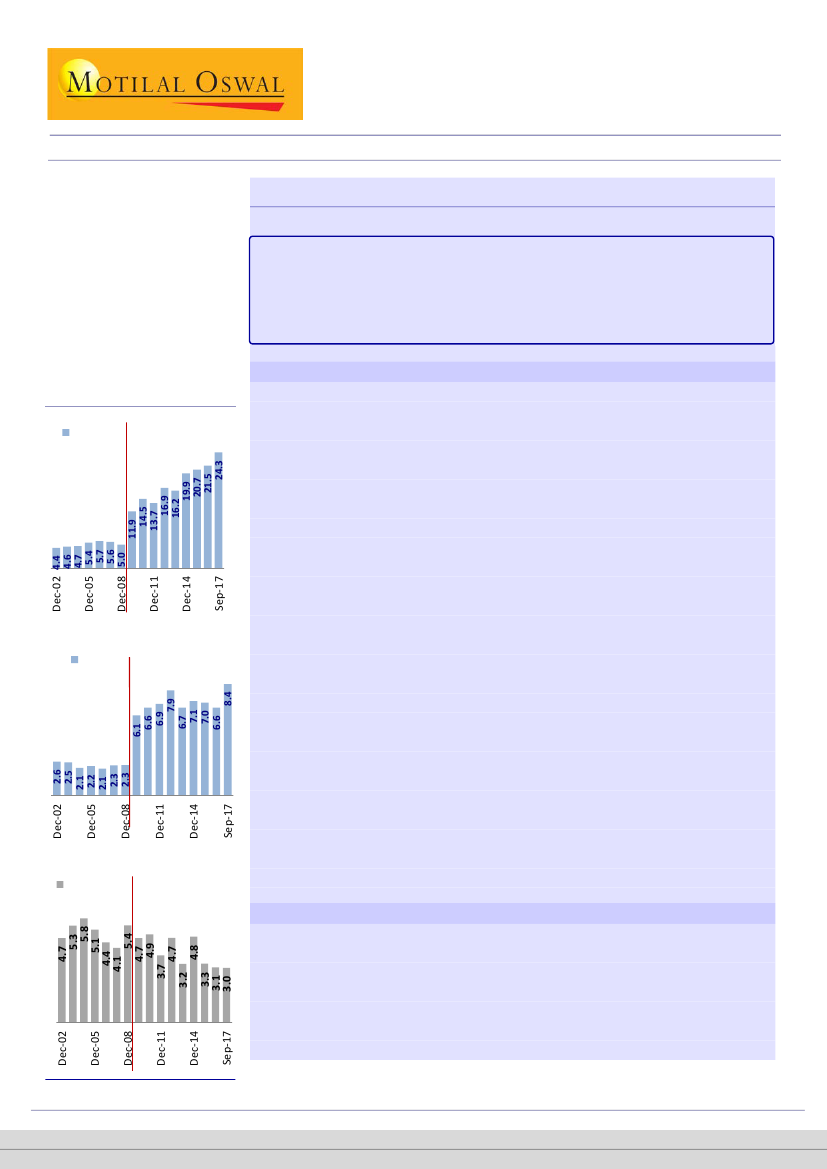

The weight of Financials has seen a secular rise in the benchmark indices. BFSI

now contributes 35.6% (+3.1x in 15 years) of Nifty-50. The share of Private

Banks/NBFC in the index has gone up, led by

a) better earnings performance,

coupled with capital raising from the markets (this boosted the free float of

Financials), b) sub-par earnings growth witnessed in other sections of the

market over the last eight years and c) index moving to a free float basis from

June 2009.

As more Insurance companies are listed and the relevance of NBFCs goes up

(given the wider financialization of savings and broad-basing of financial

disintermediation), we expect the weight of BFSI to inch up further.

We note that 15 years back, PSU Banks’ weight (4.7%) was higher than Private

Banks (4.4%) in the index, with SBI alone contributing 4.4% of Nifty-50. Today,

at 24.3%, Private Banks have the highest weight in Nifty-50, while PSU Banks

have just 3% weight. HDFC Bank, at 9.8%, is the highest weighted stock today,

much higher than 1.8% 15 years back.

Six out of the nine BFSI companies in Nifty-50 today are private banks. In India,

there are 22 listed PSU banks and only 17 listed private banks. This is

significantly different from how things were 15 years back in Nifty-50 – five BFSI

companies, of which only two were private banks. Notably, of the 19 listed

private banks in December 2002, eight have merged till-date.

Weight of Oil & Gas in the index has fluctuated significantly over the last 15

years, in line with the underlying volatile earnings stream of the sector. The

sector weight was at 17.6% around 15 years back. However, with the inclusion

of ONGC, it gradually climbed to the 1

st

position a decade ago to 25.4%. The

sector’s weight has been stable at ~11-12% over the last five years with

moderation in earnings growth.

Out of the 50 stocks in Nifty, 22 have been part of the index since 15 years. Of

these 22, three each are from Technology and Auto (they have been in the

index for 15 years now). Private Banks, Consumer, Oil & Gas, Metals,

Healthcare and Cement have two stocks each, while NBFC, Capital Goods, PSU

Banks and Utilities have one stock in the index.

Combined weight of these 22 stocks declined to 62.7% v/s 75.3% 15 years back,

but is up from 44.3% as of December 2007.

44% of Nifty-50 constituents unchanged over 15 years

Gautam Duggad – Research Analyst

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Deven

2017

– Research Analyst

(Deven@MotilalOswal.com); +91 22 3982 5440

June

Mistry

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

1