25 September 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

31,922

-1.4

Nifty-50

9,964

-1.6

Nifty-M 100

18,394

-2.9

Equities-Global

Close

Chg .%

S&P 500

2,502

0.1

Nasdaq

6,427

0.1

FTSE 100

7,311

0.6

DAX

12,592

-0.1

Hang Seng

11,109

-0.8

Nikkei 225

20,296

-0.3

Commodities

Close

Chg .%

Brent (US$/Bbl)

57

1.3

Gold ($/OZ)

1,296

0.2

Cu (US$/MT)

6,416

-0.4

Almn (US$/MT)

2,137

-0.5

Currency

Close

Chg .%

USD/INR

64.8

-0.1

USD/EUR

1.2

0.5

USD/JPY

112.1

-0.2

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.7

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

22-Sep

MTD

FIIs

-0.2

-1.1

DIIs

0.1

1.5

Volumes (INRb)

22-Sep

MTD*

Cash

340

322

F&O

6,997

5,637

Note: YTD is calendar year, *Avg

YTD.%

19.9

21.7

28.2

YTD.%

11.8

19.4

2.3

9.7

18.2

6.2

YTD.%

2.2

11.8

16.2

25.4

YTD.%

-4.5

13.5

-4.3

YTDchg

0.1

0.0

YTD

5.7

8.1

YTD*

292

5,323

Today’s top research idea

Dish TV India: Cost synergies not fully factored in stock price;

Expect healthy EBITDA growth for merged entity in FY19

v

Videocon D2H’s merger should drive synergies of INR2.4b/INR4b in FY19/20

(management expects synergies of INR5.1b in FY19), implying combined

EBITDA of INR26.8b/INR31.9b in FY19/20.

v

DITV’s ARPU should gradually recover, as (a) the effects of demonetization

wane, (b) HD contribution rises, (c) GST leads to better tax compliance by

LCOs and (d) competitive intensity diminishes with consolidation.

v

DD Freedish remains a near-term risk, but the FTA market may not favorably

offset broadcaster’s loss of Pay TV subscription revenue. Thus, the risk of DD

Freedish may subside beyond 1-2 years.

v

We expect DTH operators to be insulated from RJio’s wireline launch, given it

will be more urban-specific with slow scalability and high ARPU offerings.

v

DITV is trading at EV of 5.8x FY19E EBITDA, including merger synergies. Buy

with a TP of INR106 (8x FY19E EBITDA of INR26.8b, incl. synergies).

Research covered

Cos/Sector

Dish TV

Hindustan Unilever

Cement

Key Highlights

Cost synergies not fully factored in stock price

Expect gradual improvement

North companies better placed for 2HFY18

Piping hot news

Opec, Russia hold steady on cuts as oil market improves

v

The Organization of Petroleum Exporting Countries (Opec) and Russia said

they were about halfway toward clearing a global oil glut and urged fellow

producers to stay focused and finish the job, while stopping short of additional

action to reassure a jittery market.

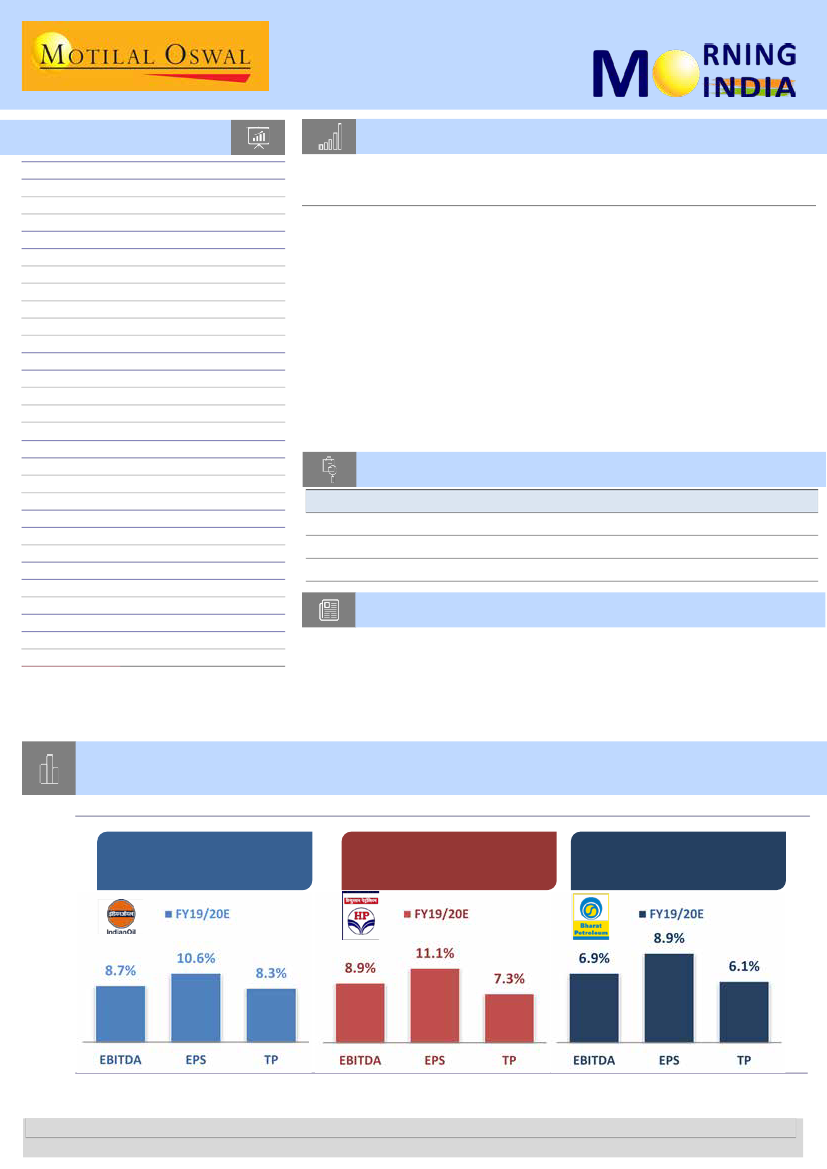

Chart of the Day: OMCs’ earnings are highly sensitive to GRM; expect OMCs to clock

strong GRM in 2QFY18

Sensitivity to USD1/bbl change in GRM (%)

IOC

Expect USD9.5/bbl GRM in 2QFY18 vs

USD6.5/bbl in 1QFY18 and USD4.3/bbl

in 2QFY17

HPCL

Expect USD10/bbl GRM in 2QFY18 vs

USD8.8/bbl in 1QFY18 and USD4.2/bbl

in 2QFY17

BPCL

Expect USD10/bbl GRM in 2QFY18 vs

USD4.9/bbl in 1QFY18 and USD4.6/bbl

in 2QFY17

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.