9 October 2017

A

nnual

R

eport

T

hreadbare

INDIGO’s FY17 annual report highlights PBT declining 24% to

INR21.4b due to weak operating performance. PBT was, however,

supported by higher other income at INR7.9b, 37%of PBT). Further,

deferred incentive recognized increased to INR5.3b

(FY16:INR3.6b).Operating cash flow improved to INR37.7b (FY16:

INR30.0b) due to rise in supplementary rent payables by INR8.3b

and incentives on aircraft acquisition by INR7.1b. Sale (at INR6.1b)

and lease back of aircraft acquired from IPO proceeds helped FCF

to remain high at INR41.4b (FY16: INR28.5b). Dividend payout ratio

remained high at 89.2% (FY16: 99.7%). In FY18, INDIGO raised

INR25.3b by diluting 6% of the equity to pursue change in its

business strategy to owning more aircraft. This could impact

dividend payouts and return ratios. Net unhedged forex exposure

was high at INR57.0b (1.5x of NW). Non-core assets at INR93.4b

(2.4x of NW) led to RoCE of 21.4% despite high RoIC of 70.0%.

Declining yield, rising fuel costs impact EBITDA:

INDIGO’s yield

declined 10% to INR3.5 leading to fall in revenue per available seat

kilometer (RASK); while, the load factor increased 100bps to 85%.

Rising crude oil prices led to increase in aircraft fuel expenses to

INR63.4b,34% of revenue (FY16:INR47.8b,30% of revenue). EBITDA

declined 31% to INR21.4b. Profitability was, however, supported

by recognition higher other income at INR7.9b (FY16:INR5.2b).

Further, deferred incentives recognized increased to INR5.3b

(FY16:INR3.6b).

Rising supplementary rents and incentives boost cash flows:

Contribution of working capital changes to OCF increased to

INR21.1b (FY16: INR3.1b), boosting OCF to INR37.7b. Increased

deferred incentives, supplementary rent payables and forward

sales added INR18.6b to OCF. In the last five years, incentives and

net supplementary rent payables contributed INR12.7b and

INR29.3b, respectively to operating cash flows.

High dividend payout; equity dilution to acquire aircrafts:

INDIGO

has consistently maintained its dividend payout (at 80-100%). The

company has declared dividend of INR14.8b (FY16:INR19.8b)

including dividend tax. Also, it has raised INR12.1b through an IPO

in FY16 (5% dilution) and INR25.3b through a QIP in FY18 (6%

dilution) for the acquisition of aircrafts.

Low R&M and S&D cost a differentiator; may increase:

Short-term

lease of six years and single kind of aircraft in its fleet helped

INDIGO to gain an edge over peers in terms of repair and

maintenance (R&M) expenses. Though 200bp higher for FY17,

INDIGO’s R&M was INR6.9b – 4% of revenue, still the lowest

among peers. Also, its S&D cost at INR1.2b (1% of revenue) are

lowest amongst peers, due to low cost of global distribution

system. Owning of aircraft, introduction of ATR fleet, and foray

into long-haul international operations could increase these costs.

INTERGLOBE AVIATION FY17

The

ART

of annual report analysis

Other income stood high

at INR7.9b (37% of PBT)

Deferred incentives

recognized increased to

INR5.3b (25% of PBT)

Rising supplementary rents and incentives

boost cash flows by INR15.4b

Aircraft acquired via IPO proceeds, sold and

lease back at INR6.1b

Auditor’s name

B S R & Co LLP

Statutory

Stock Info

Bloomberg

CMP (INR)

Equity Shares (m)

52-Week Range (INR)

M.Cap. (INR b)/(USD b)

1,6,12 Rel. Perf. (%)

INDIGO IN

1,107

383.9

1346/807

422.3/6.3

-12/0/5

Shareholding pattern (%)

As on

Promoter

DII

FII

Others

Sep-17

85.9

2.8

5.8

5.5

Jun-17

85.9

1.6

6.4

6.1

Sep-16

85.9

1.6

5.9

6.6

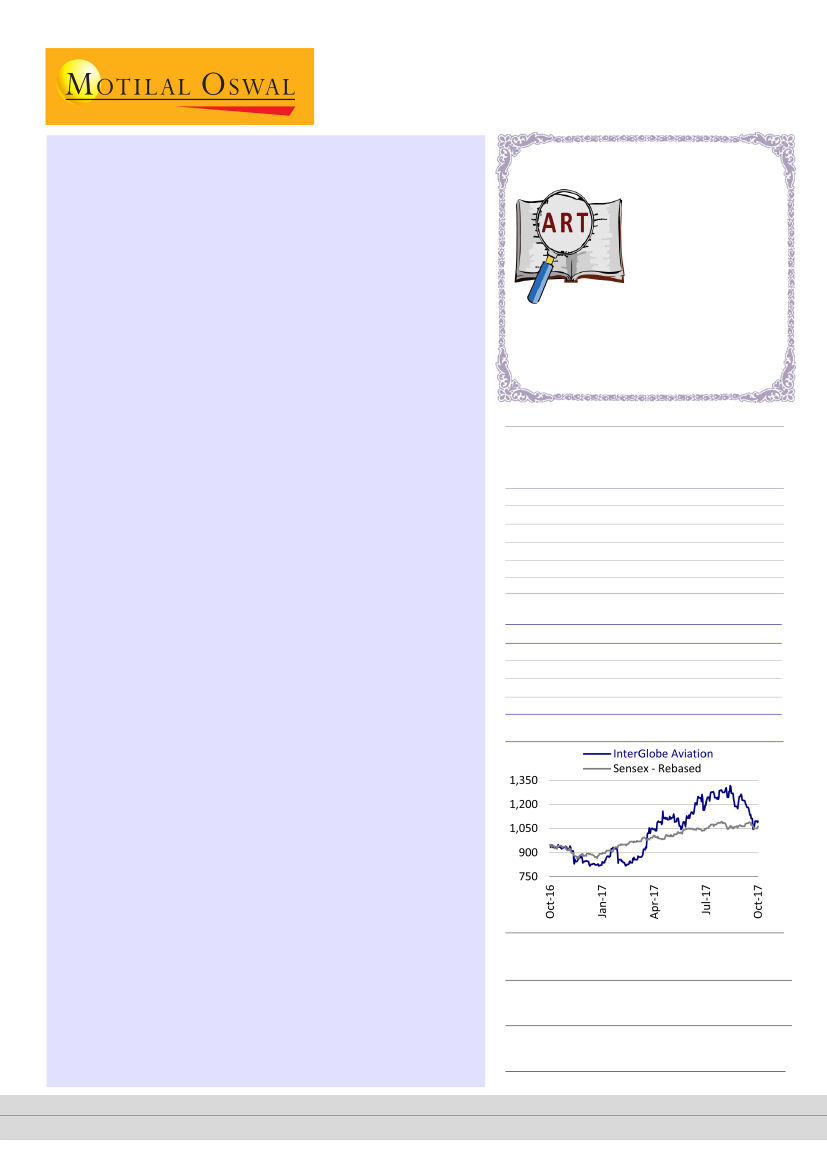

Stock Performance (1-year)

Sandeep Ashok Gupta

(S.Gupta@MotilalOswal.com); +91 22 3982 5544

Mohit Baheti

(Mohit.Baheti@MotilalOswal.com); +91 22 3010 2492

Somil Shah

(Somil.Shah@MotilalOswal.com); +91 22 3312 4975

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.