10 October 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

31,847

0.1

Nifty-50

9,989

0.1

Nifty-M 100

18,524

0.0

Equities-Global

Close

Chg .%

S&P 500

2,545

-0.2

Nasdaq

6,580

-0.2

FTSE 100

7,508

-0.2

DAX

12,976

0.2

Hang Seng

11,385

-0.6

Nikkei 225

20,691

0.0

Commodities

Close

Chg .%

Brent (US$/Bbl)

56

0.1

Gold ($/OZ)

1,283

1.1

Cu (US$/MT)

6,615

0.0

Almn (US$/MT)

2,150

0.9

Currency

Close

Chg .%

USD/INR

65.4

0.1

USD/EUR

1.2

0.3

USD/JPY

113.0

113.0

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.8

0.0

10 Yrs AAA Corp

7.7

0.0

Flows (USD b)

9-Oct

MTD

FIIs

-0.1

-0.5

DIIs

0.0

0.6

Volumes (INRb)

9-Oct

MTD*

Cash

282

287

F&O

3,719

4,992

Note: YTD is calendar year, *Avg

YTD.%

19.6

22.0

29.1

YTD.%

13.7

22.2

5.1

13.0

21.2

8.2

YTD.%

0.5

10.6

19.8

26.2

YTD.%

-3.6

11.4

-3.5

YTDchg

0.3

0.1

YTD

4.7

10.4

YTD*

293

5,412

Today’s top research idea

Tata Steel: Site visit to Jamshedpur and Kalinganagar

A benchmark in operational excellence, sustainability and CSR

We visited Tata Steel’s (TATA) highly profitable 10mtpa plant at Jamshedpur

(JSR), recently commissioned new greenfield 3mtpa plant at Kalinganagar (KPO)

and also met top management.

JSR is a benchmark in operational excellence, sustainability and corporate social

responsibility. It has a rich product mix and has continuously worked toward

branding of its products and retailing, which has helped in de-commoditizing

nearly 50% of revenue. JSR will increase production by 1mtpa over three years

through asset sweating and debottlenecking.

KPO is likely to announce 3-5mtpa expansion in CY17. TATA is also evaluating

inorganic growth to double its capacity in India to 26mtpa in five years. KPO will

be a key growth driver as new projects are attractive. Maintain Neutral.

Research covered

Cos/Sector

Tata Steel

InterGlobe Aviation (ART)

Financials - MCLR

Zee Entertainment

Oil & Gas | Preview 2QFY18

Auto | Preview 2QFY18

Metals Weekly

Key Highlights

Site visit to Jamshedpur and Kalinganagar

High dividend payout; Equity dilution continues

RBI reviews working of MCLR

Acquires 9X Media, expands music portfolio

GRMs up YoY/QoQ; crude prices up YoY/QoQ

Regulatory impact waning – retail improving gradually

India steel exports rise 71% YoY to 1.1mt in September

Piping hot news

September commercial vehicles' sales rise fastest in 6 years, hint at economy

rebound

India’s commercial vehicles sales in September rose at the fastest pace in

nearly six years, suggesting a recovery in the economy…

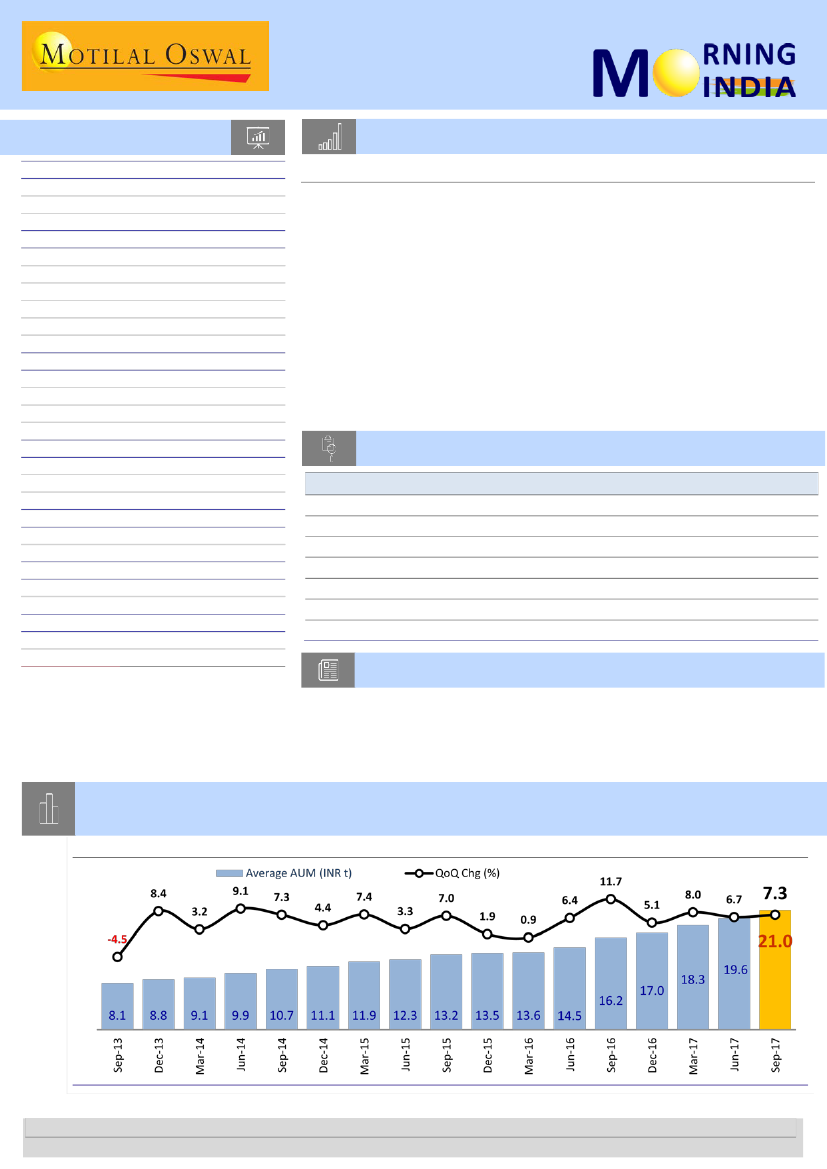

Chart of the Day: MF industry grows for 16th consecutive quarter in 3QCY17; AUM

up 7.3% QoQ to new high of INR21t

Trend in quarterly average AUM

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.