17 October 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

32,634

0.6

Nifty-50

10,231

0.6

Nifty-M 100

18,779

0.3

Equities-Global

Close

Chg .%

S&P 500

2,558

0.2

Nasdaq

6,624

0.3

FTSE 100

7,527

-0.1

DAX

13,004

0.1

Hang Seng

11,603

0.7

Nikkei 225

21,256

0.5

Commodities

Close

Chg .%

Brent (US$/Bbl)

58

1.5

Gold ($/OZ)

1,295

-0.7

Cu (US$/MT)

7,122

3.8

Almn (US$/MT)

2,110

0.0

Currency

Close

Chg .%

USD/INR

64.7

-0.3

USD/EUR

1.2

-0.1

USD/JPY

111.8

-0.1

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.7

0.0

10 Yrs AAA Corp

7.6

-0.1

Flows (USD b)

13-Oct

MTD

FIIs

0.0

-0.7

DIIs

0.0

1.2

Volumes (INRb)

13-Oct

MTD*

Cash

334

308

F&O

6,836

6,096

Note: YTD is calendar year, *Avg

YTD.%

22.6

25.0

30.9

YTD.%

14.2

23.1

5.4

13.3

23.5

11.2

YTD.%

4.5

12.4

29.0

23.8

YTD.%

-4.7

12.3

-4.4

YTDchg

0.2

0.0

YTD

4.5

11.0

YTD*

294

5,458

Today’s top research idea

Prime Focus (Initiating Coverage): Set to run the show

Forte in global media services to drive profitable growth

v

PFL has turned into a strong media service player globally, offering visual

effects, 3D animation and media-focused ERP solutions in India and abroad.

v

The company turned profitable in FY17 post completion of M&A integration in

FY15-16. In our view, the four M&A transactions in the last five years have

allowed PFL to become a strong media service player globally. The company’s

position as one of the top-4 Hollywood VFX service providers and a steady order

book should drive 15%/18% revenue/EBITDA CAGR over FY17-20E.

v

We note that the demons of ~2.8x jump in net debt to INR13.9b and 50% equity

dilution over the last five years are now behind. Improving EBITDA and lower

capex requirement are expected to help generate healthy FCF, improve RoIC to

19%, and reduce net debt by ~68% to INR4.5b by FY20.

v

We initiate coverage with a

Buy

rating and TP of INR130 (+46%), based on SOTP

valuation (10x FY19E EBITDA).

Research covered

Cos/Sector

Prime Focus (IC)

India Strategy

Expert Speak

Fund Folio

Bajaj Finance

Colgate-Palmolive

Federal Bank

Dewan Hsg. Fin.

Delta Corp

DCB Bank

Persistent System

Hindustan Media

Metals Weekly

Results Expectation

Key Highlights

Set to run the show

Contrarian Investing – Quarterly update

GST: A change for the better

AUM rises for the 16th consecutive quarter

Strong growth continues

Volumes miss, but high rural salience to drive performance

Strong operating performance

Growth surprises positively; re-rating to continue

Results in-line (GST adjusted)

Strong Operating Profit, Lower Provisions Aid YoY PAT Growth

Marching upward on profitability

GST and RERA prune ad growth

Alumina continues to rise due to bauxite supply disruption

ACC | Axis Bank | Bajaj Auto | H T Media | Wipro

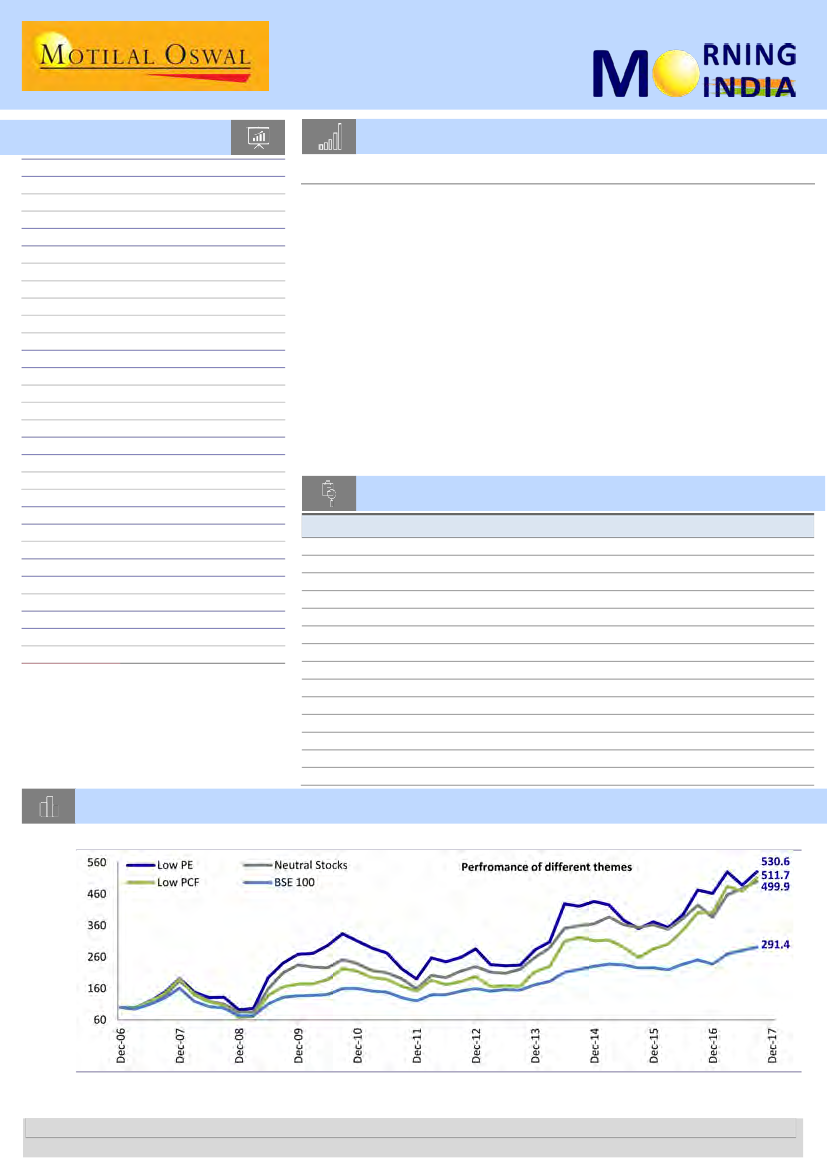

Chart of the Day: India Strategy – A review of our contrarian investment strategies

Out-of-favor stocks have beaten the benchmark convincingly (Indexed Returns)

Source: Bloomberg

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.