18 October 2017

2QFY18 Results Update | Sector: Automobiles

Bajaj Auto

Buy

BSE SENSEX

32,584

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

10,211

BJAUT IN

289

935.2 / 14.4

3310 / 2510

6/3/0

808

50.7

CMP: INR3,232 TP: INR3,753(+16%)

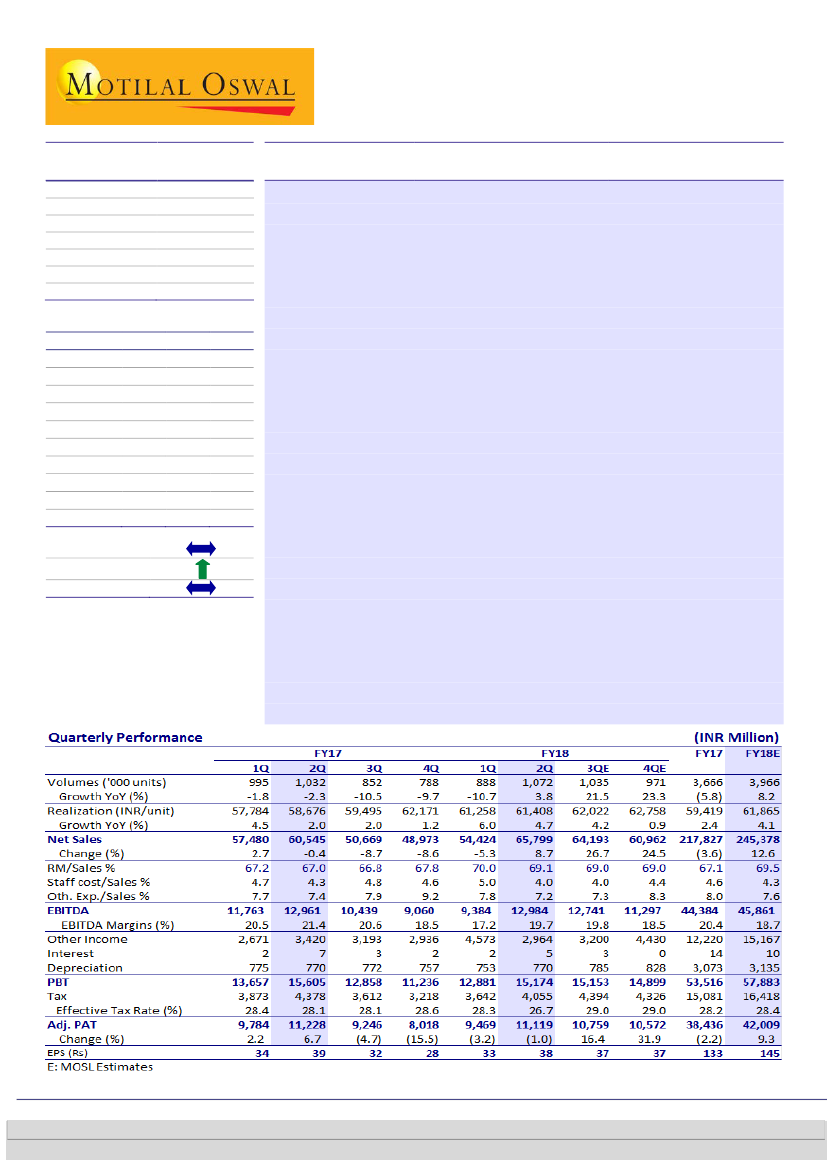

Better mix, lower staff cost drive above-estimate operating performance

Favorable product mix drives realization:

Net sales rose 8.7% YoY (+20.9%

QoQ) to INR65.8b (in-line), led by volume growth of 3.8% YoY (+20.6% QoQ).

Realization improved 4.7% YoY (flat QoQ) due to a favorable mix (higher share

of 3W).

EBITDA margin recovers from multi-quarter low:

EBITDA came in flat YoY at

INR13b (in-line), implying EBITDA margin of 19.7% (-170bp YoY, +250bp QoQ;

est. of 19.1%). Lower-than-estimated RM cost and lower staff cost boosted the

operating performance. The impact of lower other income was diluted by a

lower tax rate. Adj. PAT declined 1% YoY to INR11.1b (est. of INR11.2b).

Management commentary:

(a)

Company expects domestic motorcycle

industry growth at 8-8.5% in FY18, with BJAUT’s domestic motorcycles growth

at ~3% (+20% in 2HFY18). (b) Recent launches of CT100 ES, Platina and Pulsar

160 NS have started on a positive note. (c) Exports are estimated at 1.7m units,

led by ramp-up in nascent markets and recovery in Nigeria. (d) Management

guided for domestic 3W volumes at 300k (~20% growth), as momentum in key

markets remains strong. (e) It guided for EBITDA margin of ~20%. (f) Impact of

higher raw material prices should reflect in 2HFY18, which might be passed on

gradually to customers. (g) It plans to launch a new brand in the 125cc segment

and an Avenger upgrade in 4QFY18. Also, it is in the process of launching a

modified V. (h) Price hikes were taken in export markets in July and October

2017. No price hike was taken in domestic markets in 2QFY18.

Valuation and view:

Valuations at 22.3x/18.5x FY18E/19E standalone EPS are

attractive, considering the worst of volumes and margins is behind. We value

BJAUT at INR3,753 (21x Sep-19 core EPS, and add INR526 cash/share and

INR256/share value of KTM stake), implying Sep-19 PE of 19.8x. Maintain

Buy.

Financials & Valuations (INR b)

Y/E Mar

2018E 2019E 2020E

Net Sales

245

279

319

EBITDA

46.4

57.1

66.5

PAT

42.0

50.7

58.9

EPS (INR)

145

175

204

Gr. (%)

9.8

20.6

16.4

BV/Sh (INR)

656

726

777

RoE (%)

23.3

25.3

27.1

RoCE (%)

22.6

24.6

36.2

P/E (x)

22.3

18.5

15.9

P/BV (x)

4.9

4.5

4.2

Estimate change

TP change

Rating change

Jinesh Gandhi – Research Analyst

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Deep Shah – Research Analyst

(Deep.Shah@MotilalOswal.com) |

Suneeta Kamath – Research Analyst

(Suneeta.Kamath@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.