24 October 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

32,507

0.4

Nifty-50

10,185

0.4

Nifty-M 100

18,845

0.3

Equities-Global

Close

Chg .%

S&P 500

2,565

-0.4

Nasdaq

6,587

-0.6

FTSE 100

7,524

0.0

DAX

13,003

0.1

Hang Seng

11,491

-0.6

Nikkei 225

21,697

1.1

Commodities

Close

Chg .%

Brent (US$/Bbl)

57

-1.5

Gold ($/OZ)

1,276

-0.5

Cu (US$/MT)

6,975

0.8

Almn (US$/MT)

2,125

0.0

Currency

Close

Chg .%

USD/INR

65.0

-0.1

USD/EUR

1.2

-0.5

USD/JPY

113.9

0.4

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.8

0.0

10 Yrs AAA Corp

7.6

0.0

Flows (USD b)

19-Oct

MTD

FIIs

0.0

-0.9

DIIs

0.0

1.5

Volumes (INRb)

19-Oct

MTD*

Cash

331

295

F&O

6,997

6,206

Note: YTD is calendar year, *Avg

YTD.%

22.1

24.4

31.3

YTD.%

14.6

22.4

5.3

13.3

22.3

13.5

YTD.%

3.5

10.0

26.3

24.7

YTD.%

-4.2

11.4

-2.8

YTDchg

0.3

0.0

YTD

4.3

11.3

YTD*

294

5,478

Today’s top research idea

Indiabulls Housing Finance 2QFY18: Strong growth

Stable performance overall

v

IHFL's transformation from a diversified lender to a focused mortgage player

has yielded returns, with RoE/RoA improving from 3%/0.8% in FY09 to

26%/3.4% in FY17.

v

Focus on core mortgage loans and market share gains should drive AUM

growth of 25%+ over the next three years.

v

IHFL is among the lowest-levered HFCs. Asset quality trend is likely to remain

stable.

Research covered

Cos/Sector

Hindustan Zinc

Indiabulls Hsg Fin

Havells India

Oil & Gas

Automobile

Metals Weekly

Results Expectation

Key Highlights

Strong performance as expected; Zinc price outlook bullish

Strong growth, stable performance overall

Operating performance exceeds expectations

Auto fuel consumption remains strong; Positive on OMCs

Growth seen across segments, barring premium (ex RE)

Steel and aluminum production run-rate declines in China in Sep

A B B | Ambuja Cement | Asian Paints | HDFC Bank | Infosys |

Zee Entertainmen

Piping hot news

DII holdings in BSE companies at their highest in 25 quarters

The holdings of domestic mutual funds and insurance companies in India’s largest

listed companies rose to their highest level in at least 25 quarters as household

savings shifted from gold and real estate to financial assets…

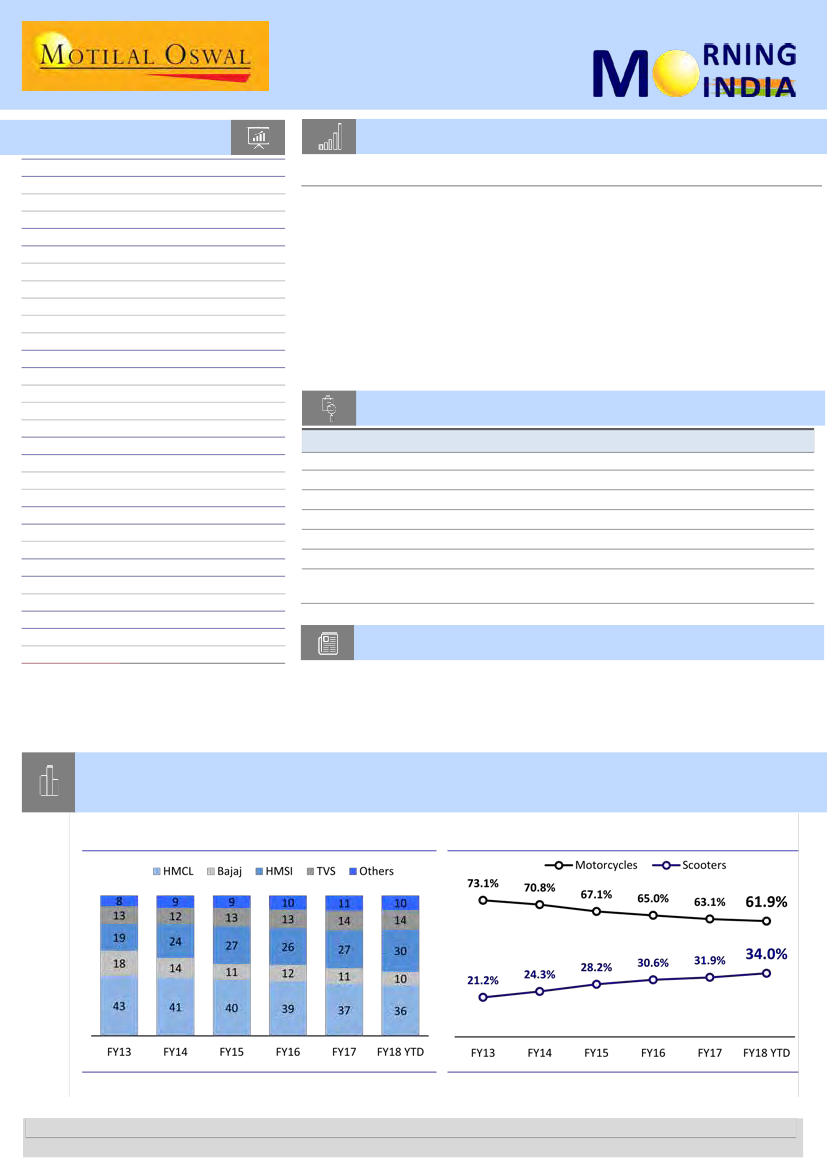

Chart of the Day: Automobiles – Growth seen across segments, barring

premium (ex RE)

Dom. 2W market share: Gap between HMCL and HMSI

gradually narrowing down

Executive 100 segment losing out to Scooters

Source: SIAM, MOSL

Source: SIAM, MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.