Indiabulls Housing Finance

BSE SENSEX

32,507

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

10,185

IHFL IN

421.3

486.6/7.6

1375 / 616

6/24/37

1872

76.4

23 October 2017

2QFY18 Results Update | Sector: Financials

CMP: INR1,343

TP: INR1,550 (+15%)

Buy

Strong growth, stable performance overall

Indiabulls Housing Finance's (IHFL) PAT grew 26% YoY to INR8.6b (4% above

our estimate). Core operating performance was robust, with strong AUM

growth (+33% YoY) and stable spreads. However, other income (income from

the liquid investment book) remains subdued due to lower incremental yields.

Note that IHFL had generated a good spread on its investment book above cost

of funds in FY16 and FY17 - that is beginning to vanish now.

AUM growth was in line with trend at 33% YoY to reach INR1t. This was driven

by 36% YoY growth in disbursements to INR95b. Management is bullish on

pick-up in supply in the affordable housing space.

Despite competitive pressures, IHFL managed to hold spreads steady at 3.25%.

Management continues to guide for incremental spreads in the range of 2.75-

3% and book spreads of 3-3.25%. Incremental cost of funds is around 7.3-7.5%.

The share of home loans in the overall book inched up 100bp to 58%. With the

share continuously inching up (to the target of 66% by FY20), we believe spread

pressure will continue.

Valuation and view:

IHFL's transformation from a diversified lender to a

focused mortgage player has yielded returns, with RoE/RoA improving from

3%/0.8% in FY09 to 26%/3.4% in FY17. Focus on core mortgage loans and

market share gains should drive AUM growth of 25%+ over the next three

years. IHFL is among the lowest-levered HFCs. Asset quality trend is likely to

remain stable. We keep our EPS estimates largely unchanged. Maintain

Buy

with a TP of INR1,550 (4x Sep19E P/B).

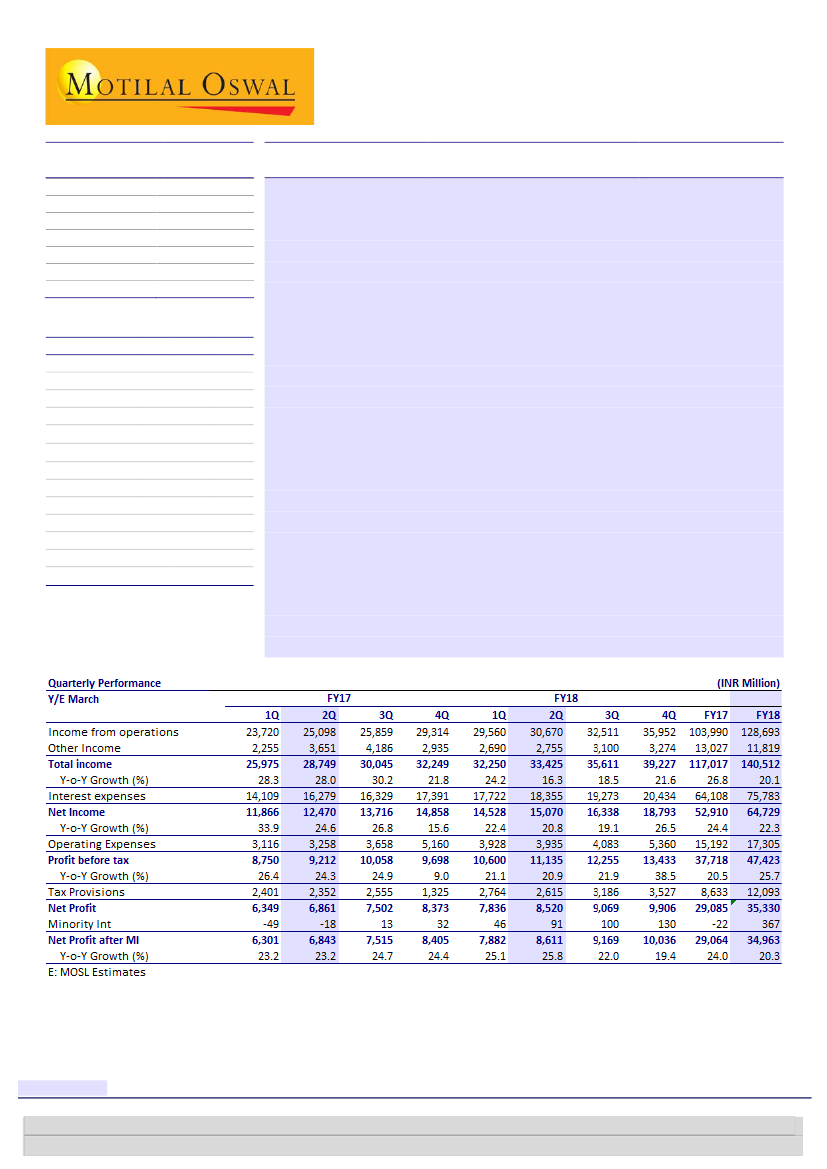

Financials & Valuations (INR b)

Y/E March

2017 2018E 2019E

Net Fin inc

35.3 52.9 65.9

PPP

45.5 55.9 71.0

EPS (INR)

68.6 83.6 105.1

EPS Gr. (%)

23.2 21.9 25.8

BV/Sh. (INR)

286

321

364

RoA on AUM (%)

3.1

2.9

2.8

RoE (%)

25.5 27.6 30.7

Payout (%)

39.3 50.0 50.0

Valuations

P/E (x)

19.6 16.1 12.8

P/BV (x)

4.7

4.2

3.7

P/ABV (x)

4.7

4.2

3.7

Div. Yield (%)

2.0

3.1

3.9

Research Analyst: Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

| Piran Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393

Nitin Aggarwal

(Nitin.Aggarwal@MotilalOswal.com); +91 22 3982 5540

| Anirvan Sarkar

(Anirvan.Sarkar@MotilalOswal.com); +91 22 3982 5505

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.