26 October 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

33,043

1.3

Nifty-50

10,295

0.9

Nifty-M 100

19,212

1.6

Equities-Global

Close

Chg .%

S&P 500

2,557

-0.5

Nasdaq

6,564

-0.5

FTSE 100

7,447

-1.1

DAX

12,953

-0.5

Hang Seng

11,493

0.8

Nikkei 225

21,708

-0.4

Commodities

Close

Chg .%

Brent (US$/Bbl)

58

0.1

Gold ($/OZ)

1,277

0.0

Cu (US$/MT)

6,984

-0.4

Almn (US$/MT)

2,173

1.3

Currency

Close

Chg .%

USD/INR

64.9

-0.3

USD/EUR

1.2

0.4

USD/JPY

113.6

-0.2

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.8

0.0

10 Yrs AAA Corp

7.7

0.0

Flows (USD b)

25-Oct

MTD

FIIs

0.6

-0.4

DIIs

0.0

1.5

Volumes (INRb)

25-Oct

MTD*

Cash

620

318

F&O

12,024

6,624

Note: YTD is calendar year, *Avg

YTD.%

24.1

25.8

33.9

YTD.%

14.2

21.9

4.3

12.8

22.3

13.6

YTD.%

5.0

10.9

26.4

27.5

YTD.%

-4.5

12.3

-2.9

YTDchg

0.3

0.1

YTD

4.8

11.3

YTD*

295

5,518

Today’s top research idea

RBL Bank: Strong growth with improving profitability and healthy asset

quality

v

Key positives are from 2QFY18: a) Loan growth of 8% QoQ and 35% YoY. b) Fee

income growth of 38% YoY, driven by a 150% increase in distribution/CC fees.

c) Margin improvement of 20bp QoQ to 3.7%, driven partly by a reduction in

cost of funds from CASA inflows and partly by capital from QIP

v

Loan growth was led by non-wholesale book growth of 41% YoY, increasing the

share of non-wholesale to 40.4% from 38.8% a year ago. Strong CASA growth of

56% YoY (ahead of deposit growth of 31% YoY) led to CASA ratio improving

380bp YoY (+160bp QoQ) to 23.7

v

With a diverse product portfolio, no legacy issues, highly capable management

and low market share, we expect RBL to report industry-leading loan CAGR of

~35% over FY17-20.

v

We maintain Buy with a TP of INR665 based on 3.5x Sept-19E BV.

Research covered

Cos/Sector

RBL Bank

Hindustan Unilever

Kotak Mah. Bank

HCL Tech

Emami

PNB Housing

M&M Fin. Serv.

Tata Comm

GSK Pharma

Exide Inds.

Quess Corp

PI Inds

Mindtree

Tata Elxsi

Key Highlights

Strong growth with improving profitability and healthy asset quality

Remarkable growth in EBITDA augurs well for future

Steady quarter; loan growth gaining momentum

Organic growth remains the dampener

EBITDA above estimate

Growth story continues

Biting the bullet - Migrated to 90dpd

EBITDA at INR5.6b, up 1% QoQ, 4% below estimate

Revenue impacted by GST rollout

EBITDA margin below estimate

Strong broad-based revenue performance

Revenue below estimate

In-line operating performance

Revenue, EBITDA in line

BIOS | CROMPTON | KKC | EQUITAS | JUBI | LTFH | MPHL | UNSP

Results Expectation

| YES

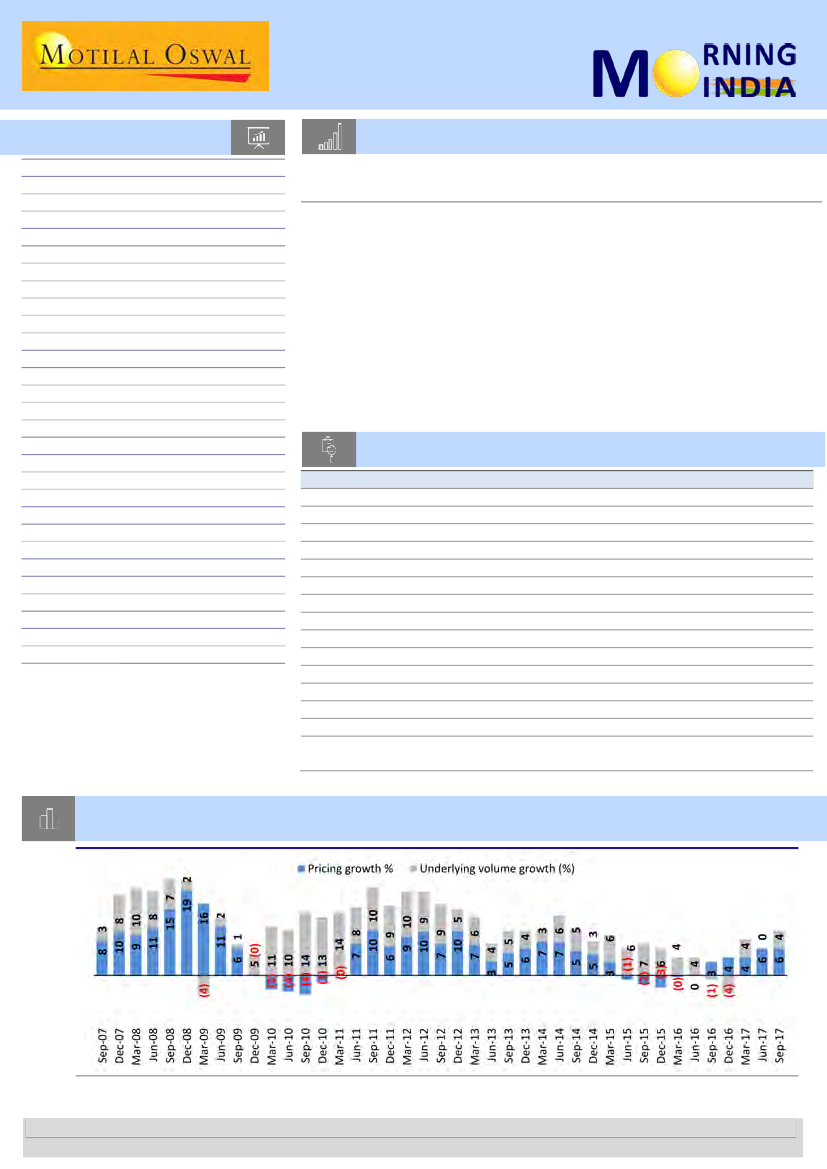

Chart of the Day: Hindustan Unilever – Consumer business sales growth of 10% minus volume growth of

4% minus ~3% price reduction in 2QFY18 plus ~3% input credit is equal to ~6% realization growth

Source: Company, MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.