Kotak Mahindra Bank

BSE SENSEX

33,043

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

10,295

KMB IN

Steady quarter; loan growth gaining momentum

1,839

Standalone results:

PAT grew 22% YoY to INR9.94b (3% miss). Operating

1,853 / 28.5

profit increased 20% YoY, led by healthy NII growth (+16% YoY, even as NIM

1114 / 692

shrunk 17bp QoQ to 4.33%), steady fee income growth (+29% YoY) and

-5/0/11

controlled operating expenses. Asset quality remains healthy, with the GNPL

2103

ratio declining by 11bp QoQ to 2.47% and the coverage ratio by 260bp QoQ

69.9

25 October 2017

2QFY18 Results Update | Sector: Financials

CMP: INR1,010

TP: INR1,179(+17%)

Buy

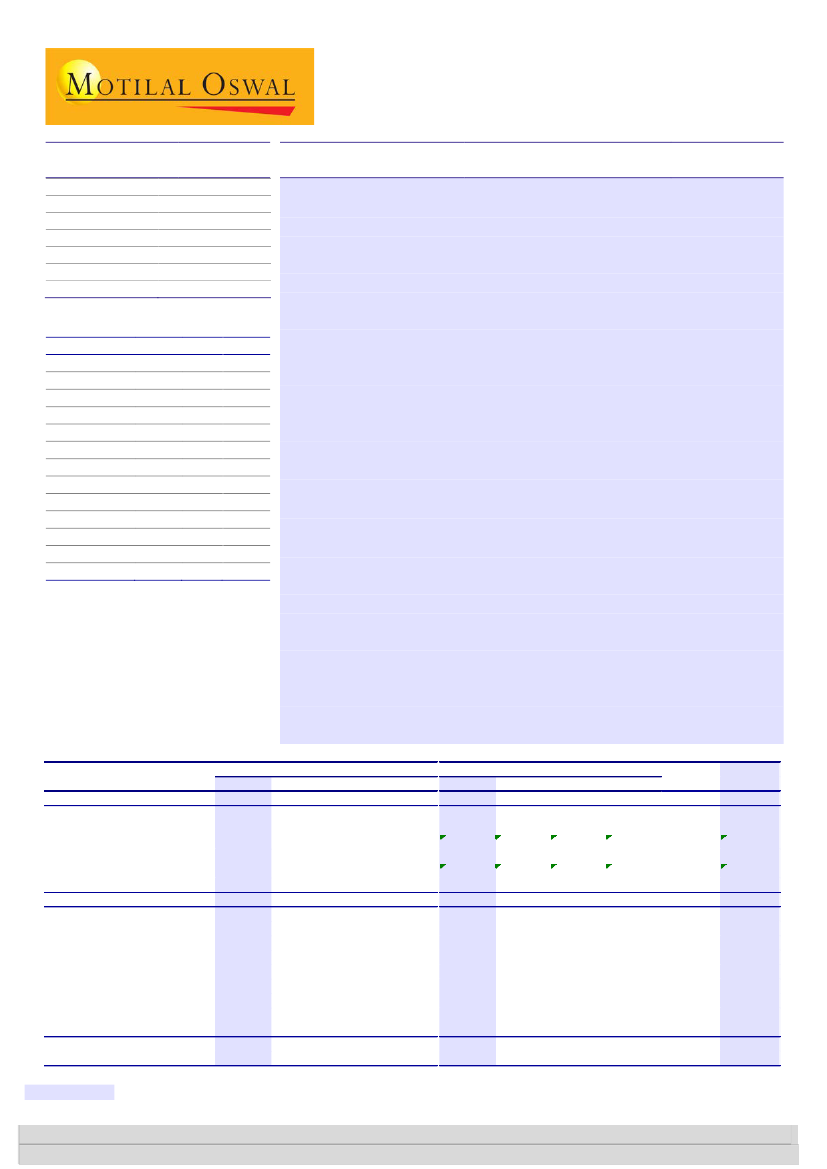

Financials & Valuations (INR b)

Y/E MARCH

2018E 2019E

NII

93.4 112.0

OP

71.3

90.4

Cons. NP

61.0

79.1

Cons. EPS (INR)

32.1

41.6

EPS Gr. (%)

19.4

29.7

Cons. BV. (INR)

232

272

Cons. RoE (%)

14.8

16.5

RoA (%)

1.8

1.9

Payout (%)

4.7

4.7

Valuations

P/E(X) (Cons.)

31.5

24.3

P/BV (X) (Cons.)

4.3

3.7

Div. Yield (%)

0.1

0.1

2020E

134.6

114.6

98.8

51.9

25.0

323

17.4

2.0

4.7

19.4

3.1

0.1

to 49.7%. The bank received RBI inspection report and no divergence was

reported as of March 2017.

Loan growth gained momentum, coming in at 21% YoY (+7% QoQ), led by

strong traction in CV, small business and personal banking segments.

Deposit growth stood at 17% YoY/1% QoQ.

Other highlights: a) CASA growth remained strong at 44% YoY (62% YoY

growth in SA deposits). CASA ratio thus increased 390bp QoQ to 47.8%. b)

SMA2 advances declined to 16bp of loans v/s 21bp in 1QFY18, while OSRL

declined to INR650m (4bp of loans).

Other businesses:

a) Profitability in the securities business improved to

INR1.18b, up 23% YoY, while Kotak Life Insurance also reported strong

earnings growth. b) K-Sec market share stood at 1.9% (stable QoQ). c) Asset

management business average AUM increased 9% QoQ (+57% YoY), led by

strong inflows in equity AUM (+102% YoY).

Valuation and view:

The bank’s share in consolidated profits now stands at

~69% (67.6% in 2QFY17), and we expect this to increase further as synergy

benefits show up fully in FY18. Among subsidiaries, KM Securities, KM Life

Insurance and Kotak AMC reported healthy earnings growth. We expect ~26%

earnings CAGR over FY17-19, led by a revival in loan growth and controlled opex.

Strong presence across geographies/products and healthy capitalization (Tier1 of

~19%) place the bank in a sweet spot to capitalize on growth opportunities and

gain market share. Comfort on asset quality remains high, with no SDR/5:25,

negligible SMA2 (16bp) and OSRL (4bp). At our SOTP based TP of INR1,179, KMB

will trade at 4.0x Sep19E consolidated BV.

Buy.

FY17

2Q

FY18E

2Q

23,127

15.9

17,248

19.8

9,943

22.3

FY17

3Q

23,530

14.8

18,501

21.1

10,554

20.0

4Q

24,334

12.6

19,613

15.2

11,715

20.0

1,619

811

250

1,333

295

507

0

1,041

-129

17,441

24.2

81,261

17.8

59,848

48.1

34,115

63.2

5,150

1,960

460

3,610

860

560

125

3,030

-385

49,485

43.0

93,445

15.0

71,316

19.2

41,340

21.2

6,014

2,461

490

5,002

1,032

1,163

0

4,091

-600

60,991

23.3

FY18E

Quarterly Performance

Y/E March

1Q

3Q

4Q

1Q

Kotak Bank (standalone)

Net Interest Income

19,191

19,954

20,503

21,614

22,456

% Cha nge (Y-o-Y)

20.1

18.9

16.1

16.4

17.0

Operating Profit

13,150

14,401

15,277

17,020

15,954

% Cha nge (Y-o-Y)

120.3

37.8

26.8

42.5

21.3

Net Profit

7,420

8,133

8,798

9,765

9,127

% Cha nge (Y-o-Y)

291.0

42.8

38.6

40.3

23.0

Other Businesses

Kota k Pri me

1,200

1,300

1,330

1,330

1,320

Kota k Ma h. Inves tments

400

530

480

560

450

Kota k Ma h. Ca pi ta l Co

230

50

70

110

50

Kota k Securi ti es

600

960

850

1,210

1,250

Interna ti ona l s ubs

130

310

220

210

170

Kota k Ma h. AMC & Trus tee Co.

190

70

160

130

150

Kota k Inves tment Advi s ors

110

10

0

0

0

Kota k OM Li fe Ins ura nce

710

630

680

1,010

1,030

Con.a dj a nd MI

-240

30

80

-280

-80

Conso. PAT

10,750

12,023

12,668

14,045

13,467

% Cha nge (Y-o-Y)

108.0

27.4

33.9

33.2

25.3

E: MOSL Es ti ma tes , Qua rterl y numbers va ry from ful l yea r number due to di fference

1,500

1,575

550

650

-10

200

1,180

1,239

280

287

230

276

0

0

1,000

1,020

-266

-125

14,407

15,676

19.8

23.7

i n reporti ng

Research Analyst: Nitin Aggarwal

(Nitin.Aggarwal@MotilalOswal.com); +91 22 3982 5540|Anirvan

Sarkar

(Anirvan.Sarkar@MotilalOswal.com); +91223982 5505

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

| Piran Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.