25 October 2017

2QFY18 Results Update | Sector: Financials

RBL Bank

Buy

BSE SENSEX

33,043

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg. Val, INR m

Free float (%)

S&P CNX

10,295

RBL IN

Strong growth with improving profitability and healthy asset quality

361.7

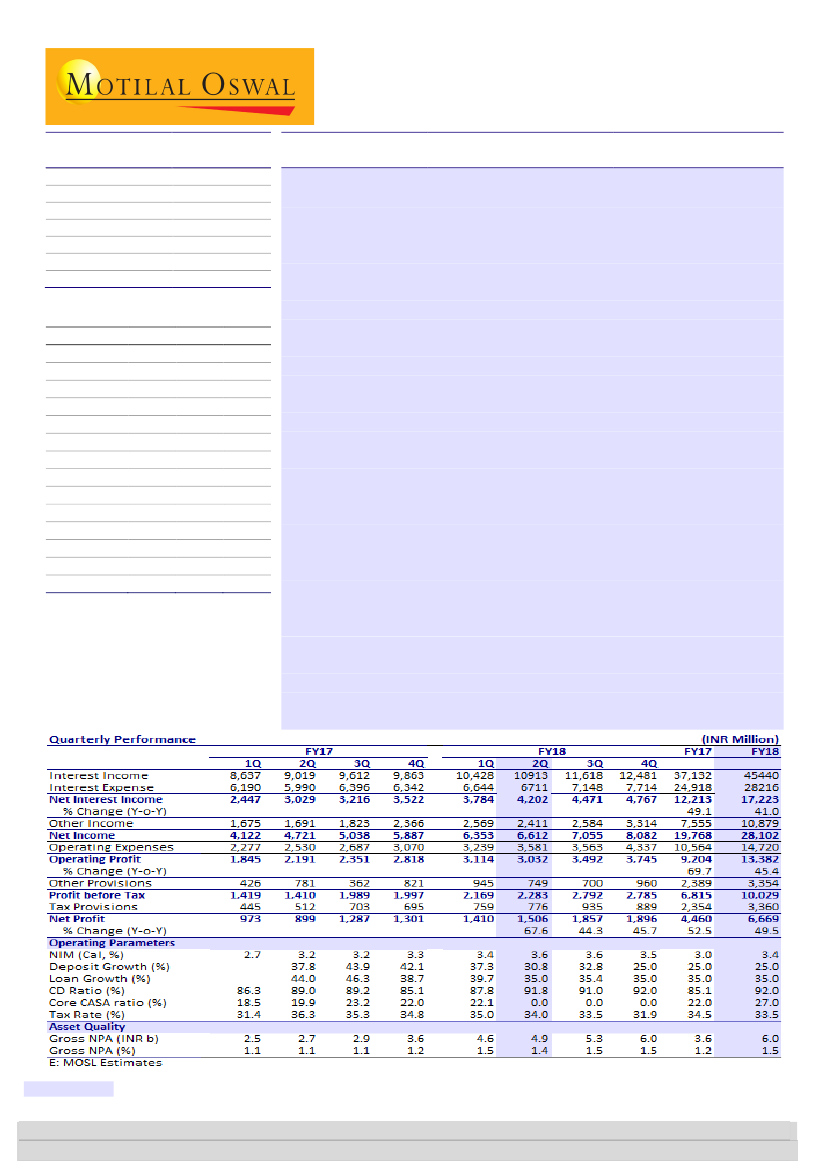

RBL’s 2QFY18 PAT increased 68% YoY (7% below estimate), mainly due to

1,33.1 /2.1

opex missing estimates by 5% (higher expansion costs), despite total income

600 / 320

(INR6.6b, +4%/+40% QoQ/YoY) being largely in line with estimates. Key

-2/-15/35

positives are: a) Loan growth of 8% QoQ and 35% YoY. b) Fee income growth

983

of 38% YoY, driven by a 150% increase in distribution/CC fees. c) Margin

100.0

CMP: INR524

TP: INR665 (+27%)

Financials & Valuations (INR b)

Y/E March

2018E 2019E

NII

17.2

21.8

OP

13.4

17.8

NP

6.7

9.4

NIM (%)

3.4

3.2

EPS (INR)

16.4

23.0

BV/Sh. (INR)

159.0

178.0

ABV/Sh. (INR)

154.3

171.7

RoE (%)

12.4

13.7

RoA (%)

1.2

1.3

Valuations

P/E(X)

32.1

22.8

P/BV (X)

3.3

2.9

P/ABV (X)

3.4

3.1

Div. Yield (%)

0.5

0.7

2020E

28.8

23.6

12.6

3.2

30.8

203.4

195.9

16.2

1.3

17.0

2.6

2.7

0.9

improvement of 20bp QoQ to 3.7%, driven partly by a reduction in cost of

funds from CASA inflows and partly by capital from QIP.

Absolute GNPAs increased 6% QoQ (+77% YoY) to 1.44% of loans (-2bp

QoQ). Sequential decline in asset quality was caused by a 30%/20% increase

in DB&FI/BBB portfolios, where GNPA ratios stood at 2.81%/1.49%

(+42bp/+8bp QoQ), while asset quality in Commercial Banking improved

with a decline in GNPA to 2% from 2.6% in the earlier quarter.

Loan growth was led by non-wholesale book growth of 41% YoY, increasing

the share of non-wholesale to 40.4% from 38.8% a year ago. Strong CASA

growth of 56% YoY (ahead of deposit growth of 31% YoY) led to CASA ratio

improving 380bp YoY (+160bp QoQ) to 23.7%.

Other highlights:

a) PAR>90 dpd in micro-banking stood at 4.68% (the bank

maintained PAR guidance of 5% and credit cost guidance of 2.5% on this

book). b) Post QIP in August 2017, Tier 1 ratio stood at 13.87%. c) Fees to

assets improved 10bp QoQ to 1.6%. d) Cost to core income ratio stood at

57% v/s 58% in 1Q.

Valuation view:

With a diverse product portfolio, no legacy issues, highly

capable management and low market share, we expect RBL to report industry-

leading loan CAGR of ~35% over FY17-20. We expect stable/improving margins

due to a changing loan mix toward high-yielding loans, a sharp fall in cost of bulk

deposits and an improvement in the CD ratio. Strong balance sheet growth is

expected to drive operating leverage. We cut FY18E PAT by ~5% to account for

continued high expansion costs, and maintain

Buy

with a TP of INR665 based on

3.5x Sept-19E BV.

Research Analyst: Nitin Aggarwal

(Nitin.Aggarwal@MotilalOswal.com); +91 22 3982 5540|Anirvan

Sarkar

(Anirvan.Sarkar@MotilalOswal.com); +91223982 5505

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

| Piran Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.