Divi's Laboratories

BSE SENSEX

33,600

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

10,441

DIVI IN

Regulatory issues impact revenues

265

Revenue declined 10% YoY (~4% miss), while EBITDA of INR2.8b was ~8%

244.3 / 3.8

below our estimate. Apart from loss of sales due to the import alert, lower

1,319 / 533

volumes due to batch-by-batch testing at Unit-2 (for exempted product list)

0/35/-49

1,759.05

contributed to muted revenue performance. EBITDA margin contracted

47.9

~600bp YoY to 31.1% due to lower turnover, and remediation expense of

1 November 2017

Q2FY18 Results Update | Sector: Healthcare

CMP: INR920

TP: INR800 (-13%)

Neutral

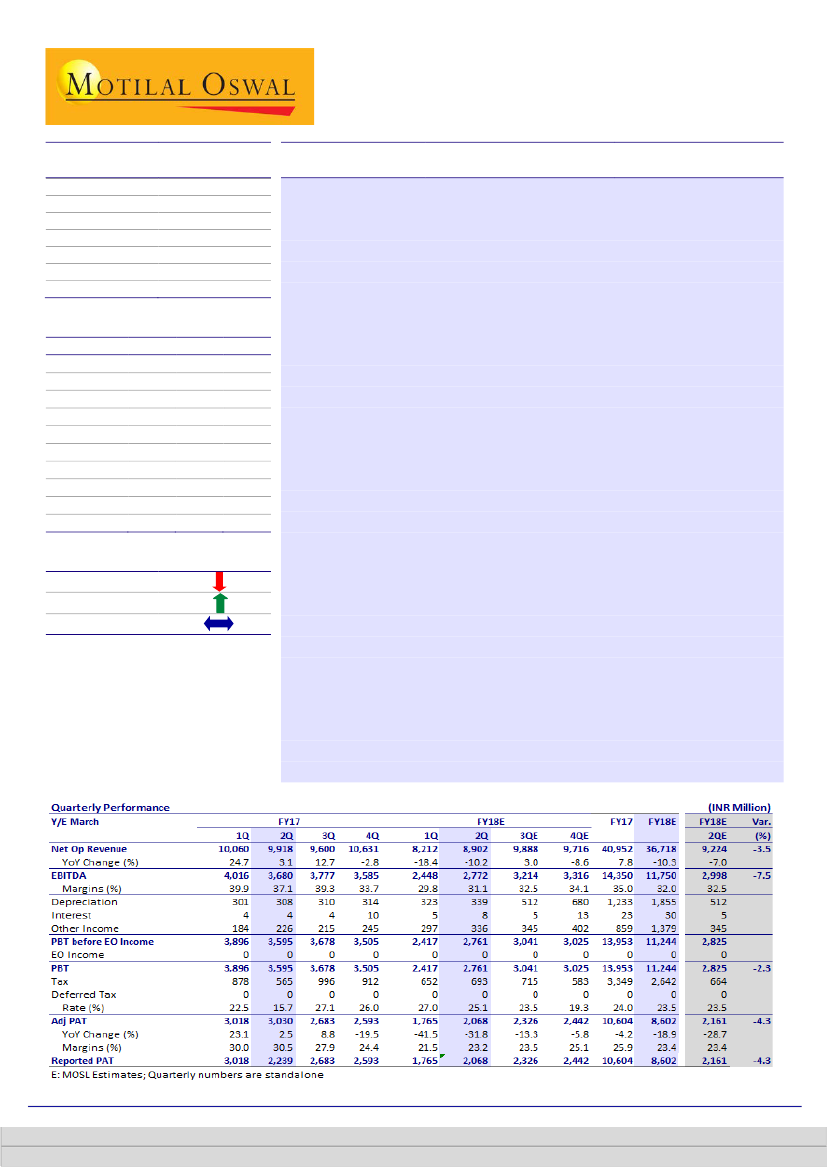

Financials & Valuations (INR b)

2017 2018E

Y/E Mar

Net Sales

41.0

36.7

EBITDA

14.3

11.7

PAT

10.6

8.6

EPS (INR)

39.9

32.4

Gr. (%)

-5.8

-18.9

BV/Sh (INR)

201.8

194.8

RoE (%)

22.0

16.3

RoCE (%)

21.8

16.3

P/E (x)

23.0

28.4

P/BV (x)

4.6

4.7

2019E

42.9

15.0

10.7

40.3

24.4

217.0

19.6

19.5

22.8

4.2

Estimate change

TP change

Rating change

~INR170m related to the import alert at Unit II. PAT of INR2.1b (down ~32%

YoY) was ~4% below our estimate.

Remediation over at Unit-2:

DIVI has already completed remediation for

observations highlighted by the USFDA in a re-inspection. Management too

has met the USFDA in late Oct-17. The company believes that till the import

alert resolution does not happen, the sales run-rate will remain at 2Q levels.

Capex plan:

DIVI spent ~INR4.5b as capital work in progress till end-FY17 to

expand capacity at Unit-1 and 2. The company plans to spend ~INR3.65b in

FY18 (~INR1.6b already spent in 1H) for capacity expansion. This expanded

capacity will be ready for commercial use in FY19.

Unit-1 USFDA inspection is due:

Unit-1 accounts for 35% of total revenue,

and its US exposure stands at ~11% of total revenues. This plant was last

inspected in June 2014, and an inspection is due over the coming few days.

It will be critical for the company to come out clear in the USFDA inspection

(particularly since the FDA had cited data integrity issues at Unit-2).

Buyback/special dividend could be near-term trigger:

DIVI has cash of

~INR17b. There is a possibility of a buyback/special dividend (like DRRD) in

the near term, which could provide near-term support to the stock price.

Things moving on right track, but resolution timeline still uncertain:

Although an early re-inspection of Unit-2 is a positive surprise, we will wait

to review the 483s. We maintain

Neutral

with a target price of INR800 @

18x FY19E PER (v/s INR720 @ 18x FY19E PER). We have cut our FY18E EPS

due to a weak 1H performance and slower ramp-up of sales in 2H as well.

Kumar Saurabh – Research analyst

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Ankeet Pandya – Research analyst

(Ankeet.Pandya@MotilalOswal.com )

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.