7 November 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

33,731

0.1

Nifty-50

10,452

0.0

Nifty-M 100

19,808

0.1

Equities-Global

Close

Chg .%

S&P 500

2,591

0.1

Nasdaq

6,786

0.3

FTSE 100

7,562

0.0

DAX

13,469

-0.1

Hang Seng

11,525

-0.7

Nikkei 225

22,548

0.0

Commodities

Close

Chg .%

Brent (US$/Bbl)

64

3.4

Gold ($/OZ)

1,272

-0.3

Cu (US$/MT)

6,937

1.1

Almn (US$/MT)

2,151

-0.7

Currency

Close

Chg .%

USD/INR

64.7

0.2

USD/EUR

1.2

-0.3

USD/JPY

114.1

0.0

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.9

0.0

10 Yrs AAA Corp

7.7

0.0

Flows (USD b)

6-Nov

MTD

0.1

0.6

FIIs

DIIs

0.0

-0.3

Volumes (INRb)

6-Nov

MTD*

Cash

406

430

F&O

4,005

6,356

Note: YTD is calendar year, *Avg

YTD.%

26.7

27.7

38.0

YTD.%

15.7

26.1

5.9

17.3

22.7

18.0

YTD.%

15.7

9.7

25.6

26.2

YTD.%

-4.7

10.1

-2.6

YTDchg

0.4

0.1

YTD

6.1

11.1

YTD*

301

5,548

Today’s top research theme

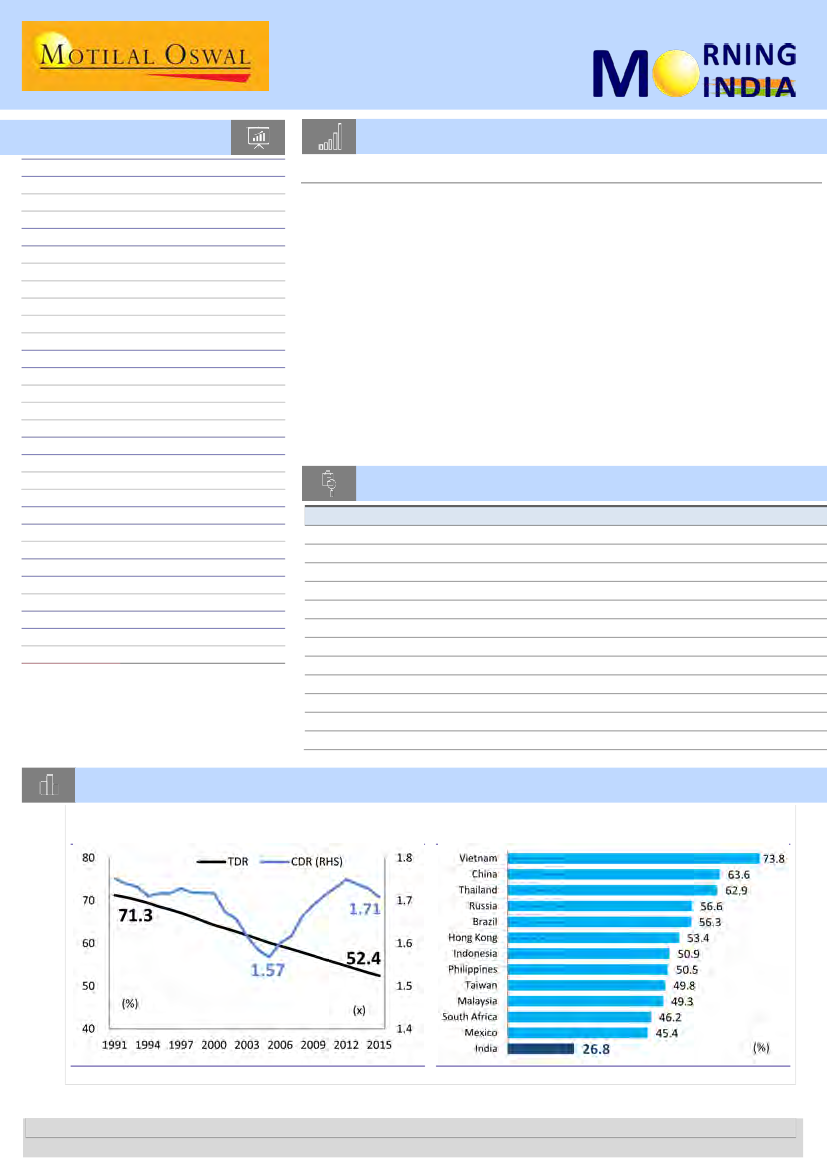

Economy (FoE): How can India reap its demographic dividends?

v

At a time when other major economies are experiencing an aging population, the

opportunity for India to increase its foothold in the global economy is immense, if

it is able to exploit its demographic dividends. India’s total dependency ratio – a

measure to gauge demographic dividends – has fallen from ~68% in mid-1990s to

~52% in 2015 and is expected to bottom at ~46% by 2040.

v

While a larger working-age population might be necessary, it is not sufficient to

reap demographic dividends. The share of working-age population looking for

work holds the key. During the past decade, while India’s working-age population

has grown at 1.9% per year, its labor force has grown at just 0.9%.

v

Over the next two decades, larger working-age population must be

complemented by a recovery in the labor force participation ratio (LFPR).

Nevertheless, higher LFPR will bring with it the challenge of providing sufficient

good-quality employment opportunities, without which India will not be able to

reap demographic dividends.

Labor force participation ratio holds the key

Research covered

Cos/Sector

Economy

Transport Corporation

Indian Bank

Gujarat Gas

L & T Infotech

GE T&D India

K E C Intl

Zensar Tech

Parag Milk Foods

Siti Networks

Metals Weekly

Results Expectation

Key Highlights

FoE: How can India reap its demographic dividends?

Corner Office — Healthy volume growth led by restocking post GST

Strong operational performance with asset quality improvement

Roller coaster continues

Beat on revenue growth despite ramp-down in India business

Operating performance above expectations

Operating performance above expectations led by margins beat

Waiting for the big guns to start firing

Subdued top-line growth again

Phase 3/4 monetization to boost revenue

Chinese export HRC prices see some weakness

ALPM | BHEL | CSTRL | CIPLA | DBEL | SKB | JYL | TEAM

Chart of the Day: Economy (FoE) – How can India reap its demographic dividends?

India’s TDR and CDR moved in opposite direction during

the last decade

Female labor force participation ratio (FLFPR) in India is

half the world’s average

Source: ILO, MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.