9 November 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

33,219

-0.5

Nifty-50

10,303

-0.5

Nifty-M 100

19,363

-0.6

Equities-Global

Close

Chg .%

S&P 500

2,594

0.1

Nasdaq

6,789

0.3

FTSE 100

7,530

0.2

DAX

13,382

0.0

Hang Seng

11,576

-0.6

Nikkei 225

22,914

-0.1

Commodities

Close

Chg .%

Brent (US$/Bbl)

63

-0.3

Gold ($/OZ)

1,281

0.3

Cu (US$/MT)

6,826

0.5

Almn (US$/MT)

2,090

-1.1

Currency

Close

Chg .%

USD/INR

65.0

0.0

USD/EUR

1.2

0.3

USD/JPY

113.8

-0.4

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.9

0.0

10 Yrs AAA Corp

7.7

0.0

Flows (USD b)

8-Nov

MTD

FIIs

-0.6

0.1

DIIs

0.5

0.4

Volumes (INRb)

8-Nov

MTD*

Cash

527

451

F&O

8,009

6,713

Note: YTD is calendar year, *Avg

YTD.%

24.8

25.9

34.9

YTD.%

15.9

26.1

5.4

16.6

23.2

19.9

YTD.%

14.5

10.5

23.6

22.7

YTD.%

-4.2

10.0

-2.8

YTDchg

0.4

0.2

YTD

5.6

11.8

YTD*

303

5,565

Today’s top research theme

GST: Rate recalibration likely

Consumers, light electrical and home building may benefit

v

The GST Council in its 23rd meeting, which is scheduled to commence on 10th

November 2017, is likely to make sweeping changes to the GST framework, with

an aim to (i) ease the compliance burden for small businesses and (b) recalibrate

the tax rates on many common-use goods that fall under the 28% slab.

v

We believe that the Council might look to lower rates for items in the consumer,

light electrical and home building sectors.

v

In our view, this should positively impact companies like HUL, GCPL, Nestle, Asian

Paints, Berger Paints, Kansai Nerolac, Titan, Bata, Havells, Crompton Consumer,

Finolex, V Guard, Kajaria Ceramics, Somany Ceramics, Century Ply, and VIP

industries, among others.

Research covered

Cos/Sector

GST

United Spirits (ART)

Shree Cement

Petronet LNG

Pidilite Inds.

Ashok Leyland

Bharat Forge

United Breweries

Dalmia Bharat

GSK Consumer

Castrol India

Muthoot Finance

Other Results

Results Expectation

Key Highlights

Rate recalibration likely; Consumers

Earnings to cash conversion improves

EBITDA beat led by better realization and lower other expenses

EBTIDA significantly above est.; PAT boosted by higher OI

Good margins performance

EBITDA margin 50bp below estimate of 10.6% due to RM inflation

Above est.; strong growth in non-autos drives EBITDA margin

Quarter characterized by multi-year-high double-digit volume growth

In-line quarter; Net debt reduction program on track

Market share continues to decline, schemes impact gross margins

EBITDA beat led by higher volumes and realization

Strong quarter; Asset quality worsens

CESC | ARVND | TMX | RINDL | IRB | JKLC | NELI | VATW | TEAM

AGLL | AMRJ | ARBP | CGPOWER | ENDU | GDPL | HPCL | ICEM | IGL |

JAGP | JSP | PAG | SAIL | SRF | TTMT

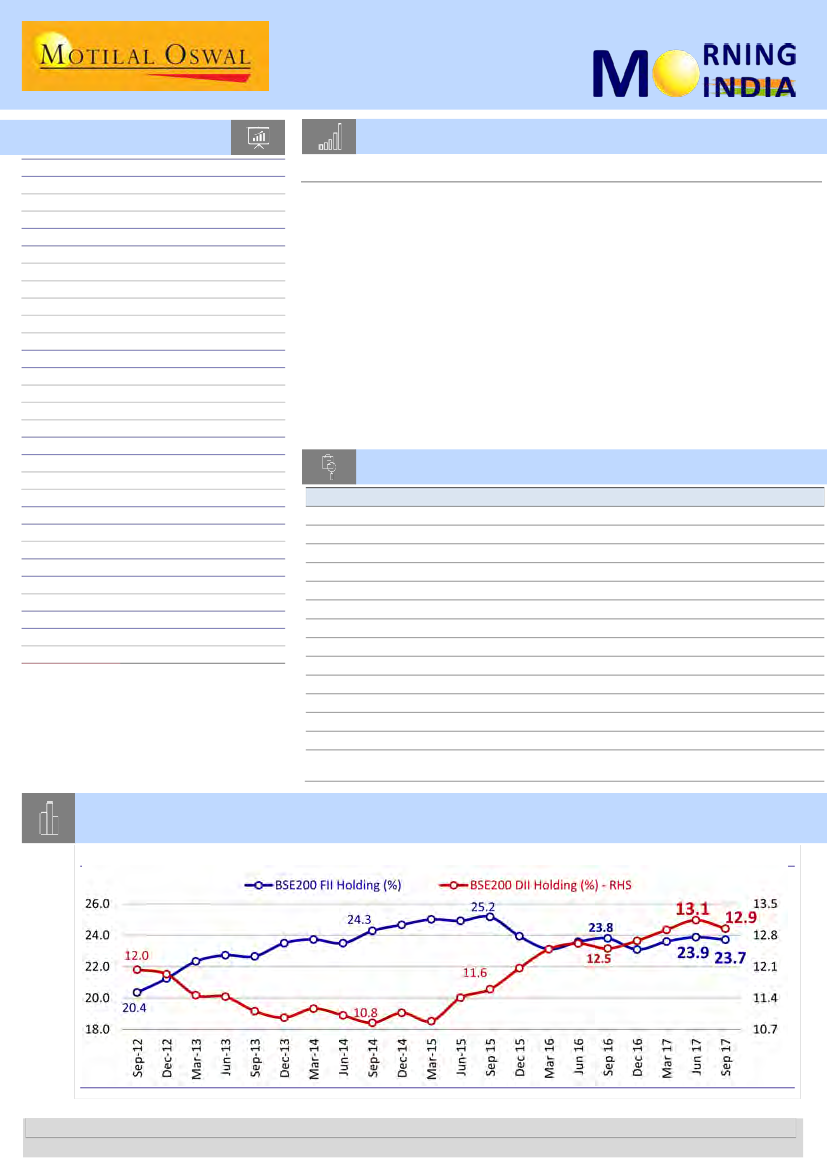

Chart of the Day: Institution holding in BSE-200 companies moderates by 20bp QoQ in

2QFY18

Trend in BSE-200 FII & DII Holding (%)

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.