8 November 2017

Q2FY18 Results Update | Sector: Textiles

Arvind

Neutral

BSE SENSEX

33,219

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

10,303

ARVND IN

Demerger of brands and retail business to create long-term

258.2

117.5 / 1.8

value

462 / 322

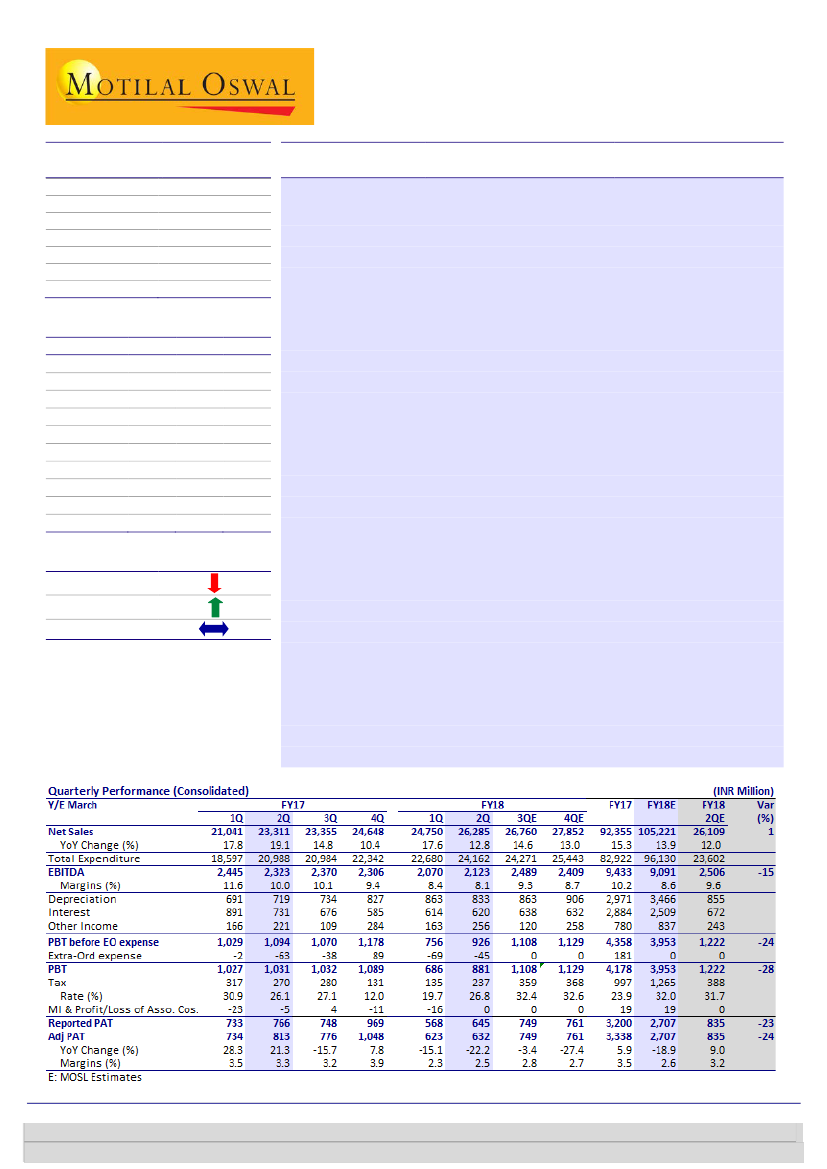

GST transition, coupled with high cotton prices, impacts margins:

ARVIND’s

3/-8/-18

revenue grew 12% YoY to INR26.3b (est. of INR26.1b) in 2QFY18. Brands and

645.7

Retail grew 34% YoY to INR10.3b, while Textiles grew 1% YoY to INR14.4b.

57.1

CMP: INR414

TP: INR425(+3%)

Financials & Valuations (INR b)

2017 2018E

Y/E Mar

Net Sales

92.4

105.2

EBITDA

9.4

9.1

PAT

3.2

2.7

EPS (INR)

12.4

10.5

Gr. (%)

1.2

-15.0

BV/Sh (INR)

138.1

145.0

RoE (%)

10.3

7.4

RoCE (%)

8.8

6.8

P/E (x)

30.9

36.3

P/BV (x)

2.8

2.6

2019E

121.2

11.5

4.3

16.5

56.5

156.7

10.9

8.8

23.2

2.4

Estimate change

TP change

Rating change

EBITDA declined 9% YoY to INR2,123m (est. of INR2,506m), with the margin

contracting 190bp to 8.1% (est. of 9.6%) on account of higher raw material

costs (+300bp to 48.7% of net sales). Adjusted PAT stood at INR632m (est. of

INR835m) v/s INR813m in 2QFY17.

Branded Apparel and Engineering businesses to demerge:

The board has

approved the demerger of (i) Branded Apparel from the parent company to

Arvind Fashions and (ii) Engineering undertaking to Anup Engineering.

Shareholders will be entitled for one equity share of Arvind Fashions for

every five shares of ARVIND, and for one equity share of Anup Engineering

for 27 shares of ARVIND. It is important to note that this is a mirror image

being created, as the number of shares for Arvind Fashions stands at 52m

v/s listed ARVIND at 258.4m shares. Hence, the ratio stands at one new

share of Arvind Fashion for five shares of ARVIND. We believe the demerger

is positive for minority shareholders over the medium-to-long term.

Valuation and view:

We cut FY18/FY19E EBITDA by 10%/8% and

consequently FY18E/FY19E PAT by 18%/12% to factor in lower margins in

Textiles and higher growth in Brands and Retail, which is a lower-margin

business compared to Textiles. While we have cut our margin estimate for

Textiles and value it at 6x FY19E EV/EBITDA, we have increased our multiple

on Brands and Retail to 24x FY19 EV/EBITDA, which we believe is where

Arvind Fashions would trade post its listing, given its strong unique

positioning, future ready portfolio and increasing size of scale. Maintain

Neutral

with a TP of INR425.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Niket Shah – Research analyst

(Niket.Shah@MotilalOswal.com); +91 22 6129 1535

Aksh Vashishth – Research analyst

(Aksh.Vashishth@motilaloswal.com); +91 22 6129 1553