Alkem Laboratories

BSE SENSEX

33,315

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

10,322

ALKEM IN

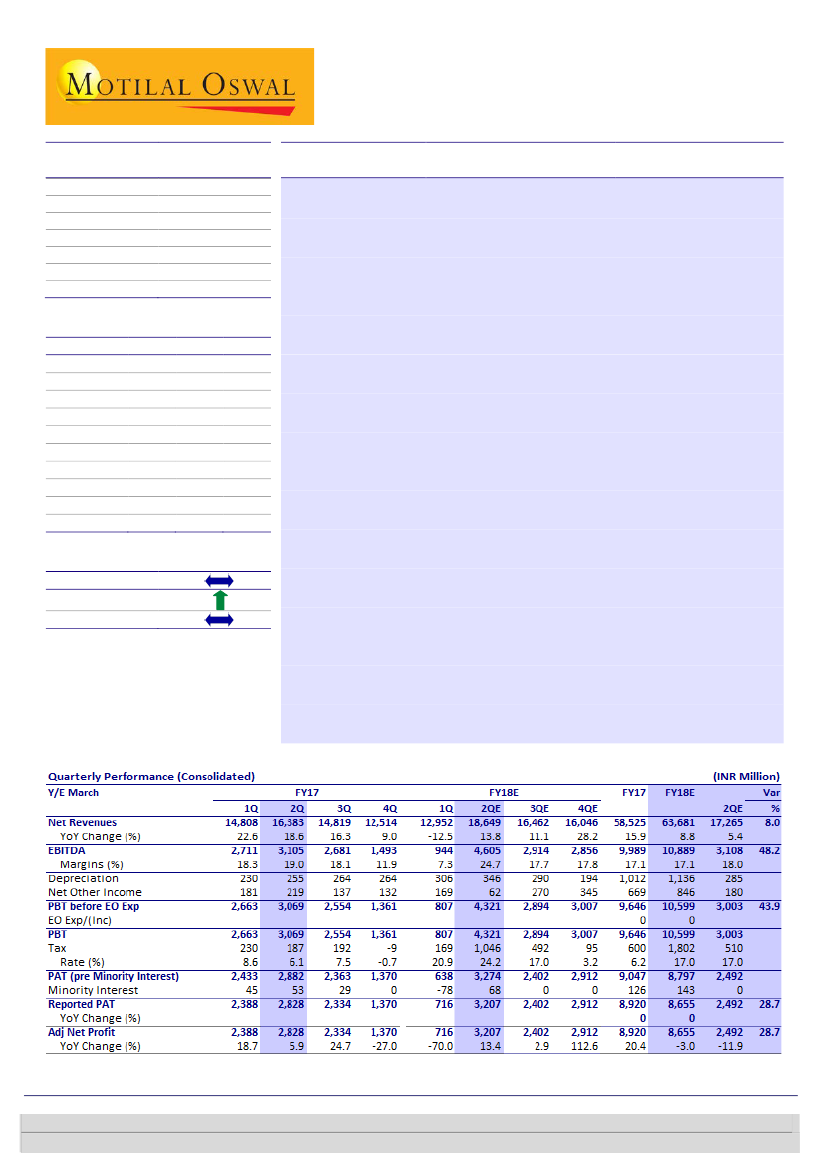

Strong numbers; operating leverage impact visible

120

Revenue increased ~14% YoY to INR18.6b (8% beat; adjusted for GST,

231.5 / 3.6

revenue growth stands at ~20%). EBITDA rose 48% YoY to INR4.6b (48%

2238 / 1535

beat), with the margin at ~24.7% (+570bp YoY and 1740bp QoQ), as other

0/-8/-3

expense declined ~500bp YoY (as % of sales). R&D expense stood at

87

INR901m (4.8% of sales). PAT increased ~13% YoY to INR3.2b (29% beat).

33.0

Strong domestic business growth; expect better growth in 2H:

Alkem’s

11 November 2017

2QFY18 Results Update | Sector: Healthcare

CMP: INR1,937 TP: INR1,950(+1%)

Neutral

Financials & Valuations (INR b)

2017

2018E

Y/E Mar

Net Sales

58.5

63.7

EBITDA

10.0

10.9

PAT

8.9

8.2

EPS (INR)

74.6

68.8

Gr. (%)

6.0

-7.7

BV/Sh (INR)

373.7

427.1

RoE (%)

21.9

17.2

RoCE (%)

20.1

16.0

P/E (x)

26.0

28.1

P/BV (x)

5.2

4.5

2019E

74.6

13.5

10.8

90.7

31.8

497.4

19.6

21.8

21.3

3.9

Estimate change

TP change

Rating change

domestic business grew robustly by 15% YoY to INR14.1b, led by channel

refilling post GST. The company is expanding its presence in the domestic

business via new product launches and expanding into new therapies. Alkem

maintained its guidance for mid-teens growth in FY18; with channel refilling

post GST, it is confident to achieve this target. Inventory levels are at ~30

days post GST, up from 17 days in 1QFY18; the company expects this to

improve, going forward.

Key launches to drive US business:

US sales came in at USD47.5m. We

expect ramp-up in the US business in the coming quarters, led by the

expected launch of 8-10 products in FY18. Also, 2H is expected to improve

on the back of seasonally strong quarter for Benzonatate and the launch of

Nexium/Prasugrel.

Key concall takeaways:

a) Price erosion is in single-digit for Alkem. b)

Company is entering OTC business and expects to break-even in 2-3 years. c)

Expects higher than market growth rate going ahead. d) Planning to file 12-

15 ANDAs in FY18. e) Expects in-licensing opportunities in (i) acute segment

in anti-infectives therapy and (ii) chronic in the diabetic segment.

Maintain Neutral:

We continue believing that Alkem is the best way to play

the domestic growth story (>70% of revenue and >85% of EBITDA came from

India in FY17). Having said that, at current valuations, the stock provides

limited room for upside. Our target price of INR1,950 for Alkem is based on

20x 1HFY20E PER (v/s INR1,830 @ 20x FY19E PER).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Kumar Saurabh-Research analyst

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Ankeet Pandya-Research analyst

(Ankeet.Pandya@MotilalOswal.com)