Ipca Laboratories

BSE SENSEX

32,942

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

10,187

IPCA IN

Strong recovery in margins

126

2QFY18 revenue was flat YoY at INR8.6b (~3% below est.). Domestic

67.6 / 1.0

business was up 3% YoY. Gross margin expanded to 65.9% from 62.5% in

656 / 400

2QFY17. EBITDA rose ~16% YoY to INR1.5b (+5% beat), with the margin

6/-9/-27

128

improving to 17.2% (+260bp YoY). EBITDA margin saw a negative impact of

53.9

~300bp from GST rollout. PAT rose 105% YoY to INR966m (+27% beat).

14 November 2017

2QFY18 Results Update | Sector: Healthcare

CMP: INR536

TP: INR550(+3%)

Neutral

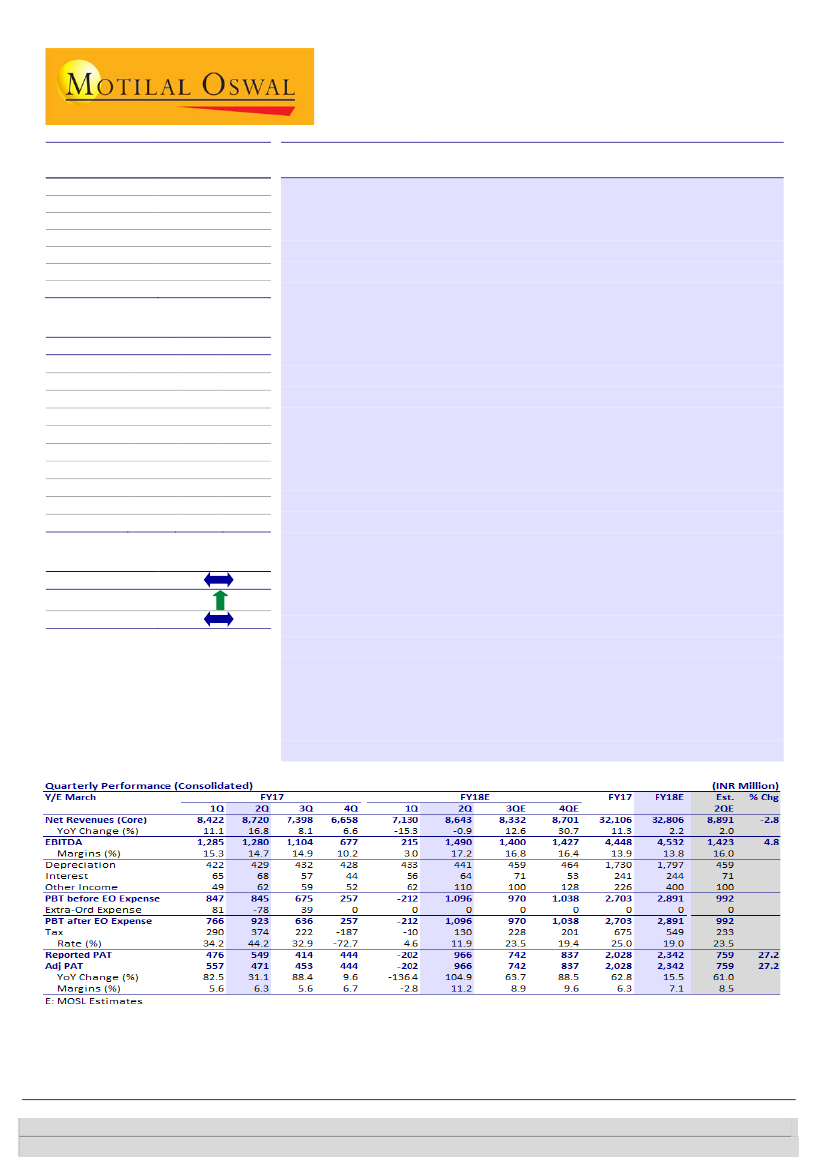

Financials & Valuations (INR b)

2017 2018E

Y/E Mar

Net Sales

32.1

32.8

EBITDA

4.4

4.5

PAT

2.0

2.3

EPS (INR)

16.1

18.6

Gr. (%)

52.8

15.5

BV/Sh (INR)

194.6

210.3

RoE (%)

8.6

9.2

RoCE (%)

7.5

8.2

P/E (x)

33.3

28.9

P/BV (x)

2.8

2.5

2019E

37.0

6.0

3.4

26.5

43.1

232.9

12.0

10.5

20.2

2.3

Estimate change

TP change

Rating change

Domestic business (ex anti-malaria) delivers strong growth:

India

formulation sales grew 5% YoY to ~INR4.2b. According to management,

domestic branded business (ex anti-malaria) grew ~23-24% YoY. IPCA lost

~INR350-400m of sales v/s 2QFY17 due to lower Malaria-related sales.

Management expects growth to bounce back to low-to-mid-teens in coming

quarters, led by channel re-filling. International generic revenue fell ~18%

YoY, mainly on weak UK/flat US business. Institutional business reported

revenue of INR220m, as ~INR150 of sales got deferred to 3QFY18.

Pick-up in institutional business from CY18E:

IPCA announced that Global

Funds has selected the company as its panel supplier. At peak, institutional

biz revenue was ~INR4b. Adjusted for price deflation, peak business should

be ~INR2.5b (v/s IPCA’s current run-rate of ~INR1.2-1.3b). IPCA expects to

reach peak sales in FY19. Two more approvals in anti-malaria are expected

in FY19, which could add ~INR1.5b to top-line in two years.

Update on regulatory resolution:

IPCA has already invited USFDA for

Piparia/Pithampur plants inspection. Currently, >90% of ANDAs are linked to

API from Ratlam. IPCA plans to invite the USFDA for re-inspection at Ratlam

plant by CY17 end/CY18 beginning. We do not expect a pick-up in US

business in FY19 as resolution at these plants can take at least 6-12 months.

Resolution of regulatory issues is key:

Reiterate

Neutral

with a TP of INR550

@ 18x 1HFY20E PER (v/s INR430 @ 16x FY19E). We have increased our

target multiple on the back of the improved business outlook.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Kumar Saurabh-Research analyst

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Ankeet Pandya-Research analyst

(Ankeet.Pandya@MotilalOswal.com)