20 November 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

33,343

0.7

Nifty-50

10,284

0.7

Nifty-M 100

19,643

1.0

Equities-Global

Close

Chg .%

S&P 500

2,579

-0.3

Nasdaq

6,783

-0.2

FTSE 100

7,381

-0.1

DAX

12,994

-0.4

Hang Seng

11,609

0.6

Nikkei 225

22,397

0.2

Commodities

Close

Chg .%

Brent (US$/Bbl)

62

2.1

Gold ($/OZ)

1,294

1.2

Cu (US$/MT)

6,744

0.6

Almn (US$/MT)

2,087

0.1

Currency

Close

Chg .%

USD/INR

65.0

-0.5

USD/EUR

1.2

0.2

USD/JPY

112.1

-0.8

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.0

0.0

10 Yrs AAA Corp

7.8

0.0

Flows (USD b)

17-Nov

MTD

FIIs

0.2

2.4

DIIs

0.2

0.9

Volumes (INRb)

17-Nov

MTD*

Cash

415

409

F&O

5,338

6,860

Note: YTD is calendar year, *Avg

YTD.%

25.2

25.6

36.9

YTD.%

15.2

26.0

3.3

13.2

23.6

17.2

YTD.%

12.5

12.3

22.1

22.4

YTD.%

-4.3

12.1

-4.2

YTDchg

0.5

0.2

YTD

7.9

12.3

YTD*

305

5,611

Today’s top research idea

HDFC Standard Life

(Initiating Coverage):

Another 'compounder'

Quality franchise; attractive valuations

HDFC SL has reported strong growth trends, which has enabled it to

consistently rank among India’s top three private insurers. It has steadily

improved the share of high-margin protection products to 26.4% as at Sep-17,

which has helped it to deliver best-in-class new business margins.

We estimate the company to deliver 25% CAGR in new business APE over FY17-

20E, aided by its increasing bancassurance tie-ups, improvement in agency

channel and higher direct sales.

We estimate HDFCSL to deliver average RoEV of ~19% over FY17-20E, while

new business margins are likely to improve further to 23%. We value HDFCSL at

3.5x Mar-20E EV at INR370/sh (implied new business multiple of 28x).

Research covered

Cos/Sector

HDFC Standard Life

Strides Shasun

Cement (Petcoke Ban

Update)

EcoScope

EcoScope

Healthcare

Cement

Key Highlights

Another 'compounder'; Quality franchise; attractive valuations

Divestment to focus on profitable businesses

Environment ministry prohibits usage of petcoke in U.P, Rajasthan &

Haryana

Fears of fiscal deficit slippage are exaggerated

Moody’s upgrades India to highest sovereign rating post liberalization

IPM – early signs of revival

Prices largely flattish; Hikes likely in south markets

Piping hot news

India up one place on Per Capita GDP terms to 126, Qatar No 1: IMF report

India has moved up one position to 126th in terms of per capita GDP of

countries while Qatar remains the world’s richest on this parameter, as per

IMF data. The data, which forms part of the latest World Economic Outlook

report of the International Monetary Fund (IMF),…

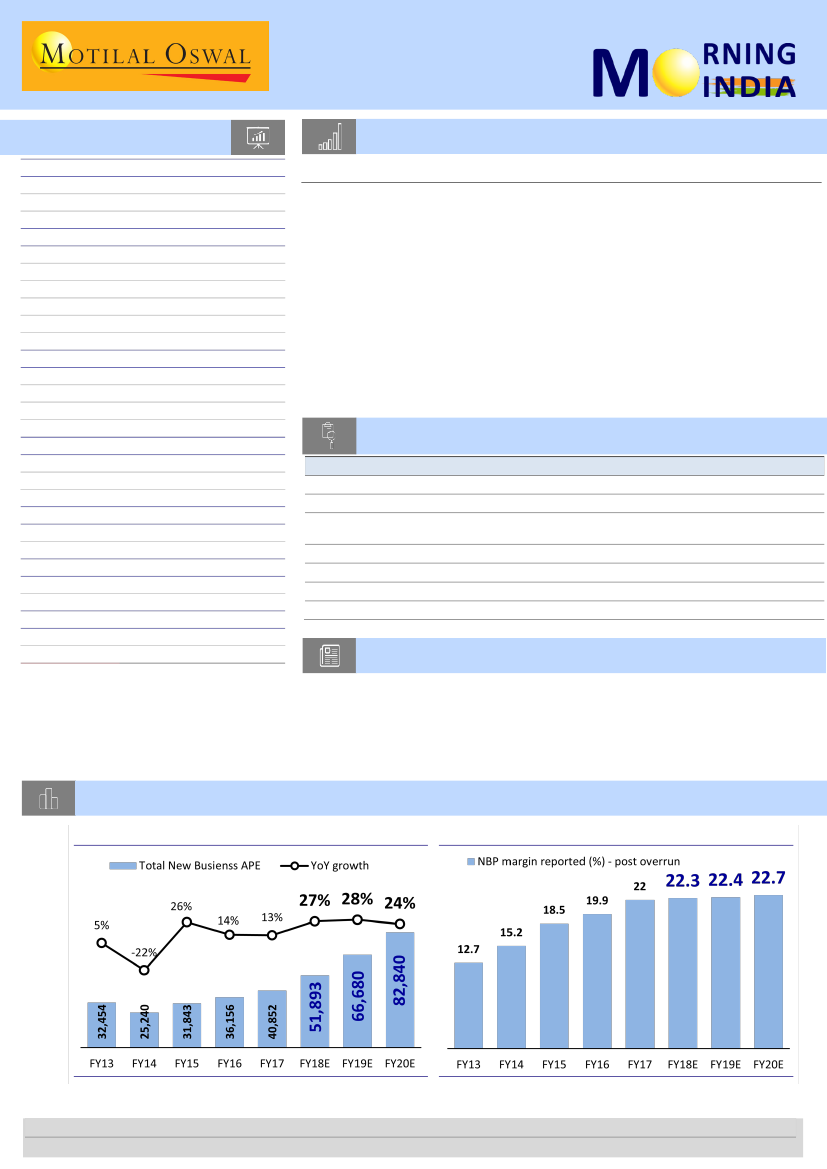

Chart of the Day: HDFC Standard Life – Another 'compounder'; Quality franchise; attractive valuations

Trend in APE premium and growth

Trend in new business margin

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.