E

CO

S

COPE

Moody’s upgrades India to highest sovereign rating post liberalization

Further upgrades from Moody’s unlikely, but other agencies could follow suit

17 November 2017

The Economy Observer

Moody's upgraded India's sovereign credit rating to Baa2 from Baa3, the highest rating that the country has received

from the global ratings agency post liberalization. Outlook on the rating is also changed to stable from positive.

Notably, Moody's has upgraded India's rating after nearly 14 years (last in January 2004).

The ratings agency attributed the upgrade to a host of economic and institutional reforms (such as GST, better

monetary policy framework, bank recapitalization, demonetization and DBT), which are expected to drive a gradual

improvement in India’s fiscal metrics. India’s real GDP growth is also expected to improve from 6.7% in FY18 to 7.5% in

FY19, and then remain high in the ensuing years.

Although the upgrade has no impact on the country’s fundamentals, it is a sentiment booster and largely reflects the

governments’ past and ongoing actions.

Moody’s clarified that further upgrades will depend on a

material

improvement in fiscal metrics, along with a

strong

and durable recovery

of the investment cycle. On the contrary, a material deterioration in fiscal metrics/health of the

banking system could prompt a downgrade. Overall, we do not expect any further rating change from Moody’s in the

near future; however, an upgrade from other rating agencies (Standard & Poor’s and Fitch) is long due, in our view.

Moody’s – one of the three major global ratings agencies – upgraded the

Government of India’s local and foreign currency issuer ratings by one notch to Baa2

from Baa3. The outlook on the rating was also changed to stable from positive. The

global ratings agency has upgraded India’s rating after nearly 14 years (last in

January 2004; Exhibit 1). This is India’s highest credit rating by Moody’s post

liberalization.

Reasons for the upgrade

Moody’s took note of the Indian government’s wide range of economic and

institutional reforms, such as the GST (would promote productivity by removing

barriers to inter-state trade), improvement in the monetary policy framework,

measures to address the overhang of non-performing loans (NPL) in the banking

system, demonetization, and Aadhar and the Direct Benefit Transfer (DBT) system

for targeted delivery of benefits. The rating agency expects India’s GDP growth to

accelerate to 7.5% in FY19 from 6.7% in FY18; it sees “similarly robust levels” of

growth in the ensuing years. Moody’s also highlighted that India has stronger long-

term growth potential than most other Baa-rated sovereigns.

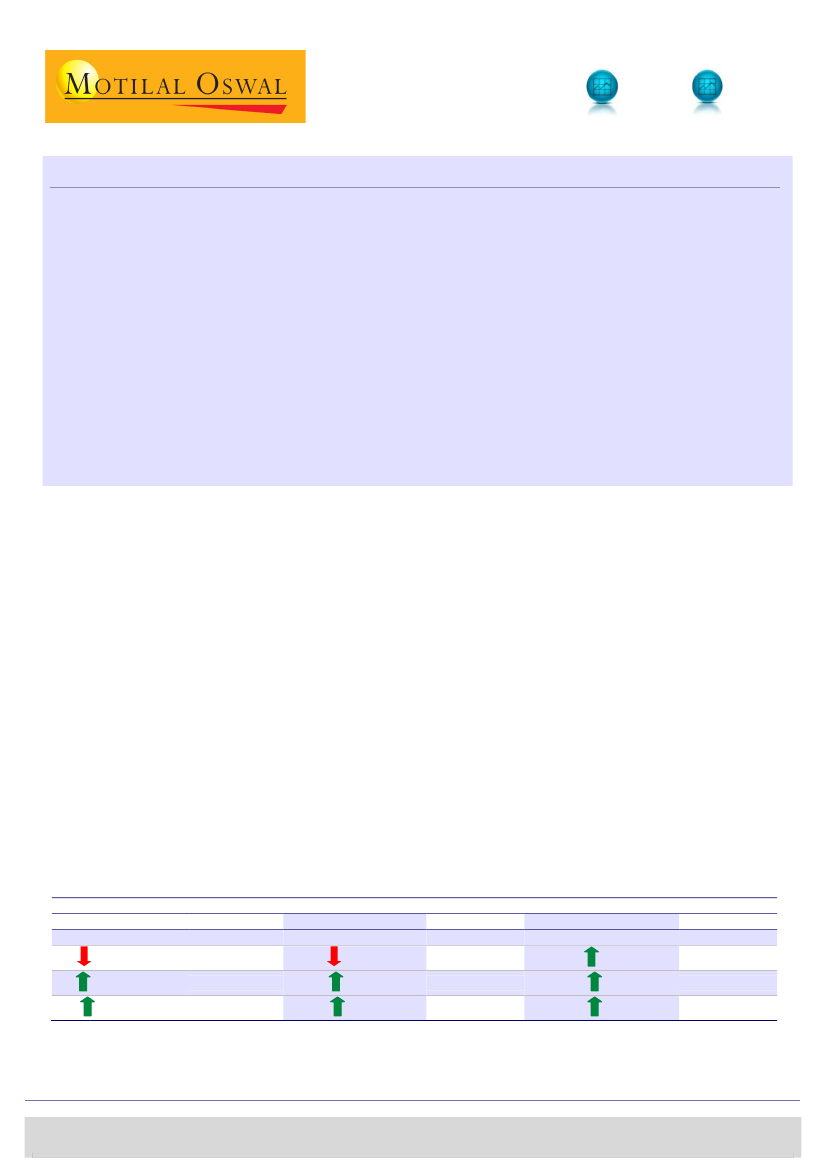

Exhibit 1: Movements in India’s ratings by three major rating agencies

BB+

BB

BB+

Standard & Poor's (S&P)

Rating

Date

7-Dec-92

(Lowest)

22-Oct-98

2-Feb-05

Fitch

Rating

BB+

BB

BB+

(Highest)

(Lowest)

Date

8-Mar-00

21-Nov-01

21-Jan-04

1-Aug-06

Rating

Ba2

(Lowest)

Ba1

Baa3

Baa2

Moody's

Date

28-Jul-99

3-Feb-03

22-Jan-04

16-Nov-17

(Highest)

Source: Bloomberg, MOSL

30-Jan-07

BBB-

(Highest)

BBB-

The table doesn’t include change in ratings’ outlook

Nikhil Gupta – Research analyst

(Nikhil.Gupta@MotilalOswal.com); +91 22 3982 5405

Rahul Agrawal

– Research analyst

(Rahul.Agrawal@motilaloswal.com); +91 22 3982 5445

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.