7 December 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

32,597

-0.6

Nifty-50

10,044

-0.7

Nifty-M 100

19,552

-1.0

Equities-Global

Close

Chg .%

S&P 500

2,629

0.0

Nasdaq

6,776

0.2

FTSE 100

7,348

0.3

DAX

12,999

-0.4

Hang Seng

11,163

-2.8

Nikkei 225

22,177

-2.0

Commodities

Close

Chg .%

Brent (US$/Bbl)

61

-2.1

Gold ($/OZ)

1,263

-0.2

Cu (US$/MT)

6,518

0.1

Almn (US$/MT)

2,002

-1.6

Currency

Close

Chg .%

USD/INR

64.5

0.2

USD/EUR

1.2

-0.1

USD/JPY

112.2

-0.4

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.0

-0.03

10 Yrs AAA Corp

7.7

-0.03

Flows (USD b)

6-Dec

MTD

FIIs

-0.2

-0.4

DIIs

0.2

0.6

Volumes (INRb)

6-Dec

MTD*

Cash

289

300

F&O

6,774

5,039

Note: YTD is calendar year, *Avg

YTD.%

22.4

22.7

36.2

YTD.%

17.4

25.9

2.9

13.2

18.8

16.0

YTD.%

10.6

9.6

18.0

17.5

YTD.%

-5.0

12.1

-4.0

YTDchg

0.5

0.2

YTD

8.0

13.4

YTD*

307

5,665

Today’s top research Idea

Havells: Expanding share in electricals sector

Upgrade to Buy

Continuously entering new categories to drive growth:

HAVL has consistently

identified and entered new product categories over the years. Key categories

where it has made a successful entry include lighting in 2003, premium fans in

2005, water heaters in 2010, REO Switches in 2012, air coolers in 2014, re-

launch of the Standard brand in 2016 (target of INR10b by FY20) and entry into

EHV cables.

GST rate cuts to accelerate market share gains from unorganized sector:

The

government has cut GST rates across electrical categories from 28% to 18%,

and this should accelerate the shift toward the organized sector, especially in

categories like cables/wires, fans, switches and lighting, where the share of the

unorganized segment is high.

EESL threat recedes:

Our recent meeting with EESL indicates that its focus has

now shifted to electric vehicles, smart meters and solar rooftops from fans and

lighting. This should benefit electrical players like Havells.

Research covered

Cos/Sector

EcoScope

Havells India

TVS Motor Co.

Granules India

Key Highlights

RBI keeps rates unchanged; maintains neutral stance

Expanding share in electricals sector

Apache RR310: First BMW partnership product launched

Gearing up for next phase of growth

Piping hot news

RBI raises inflation forecast, leaves interest rate unchanged

The Reserve Bank of India’s (RBI) monetary policy committee (MPC) kept the

key interest rate unchanged on Wednesday, noting risks to inflation, but

expressed optimism that the slowdown in economic growth had bottomed out

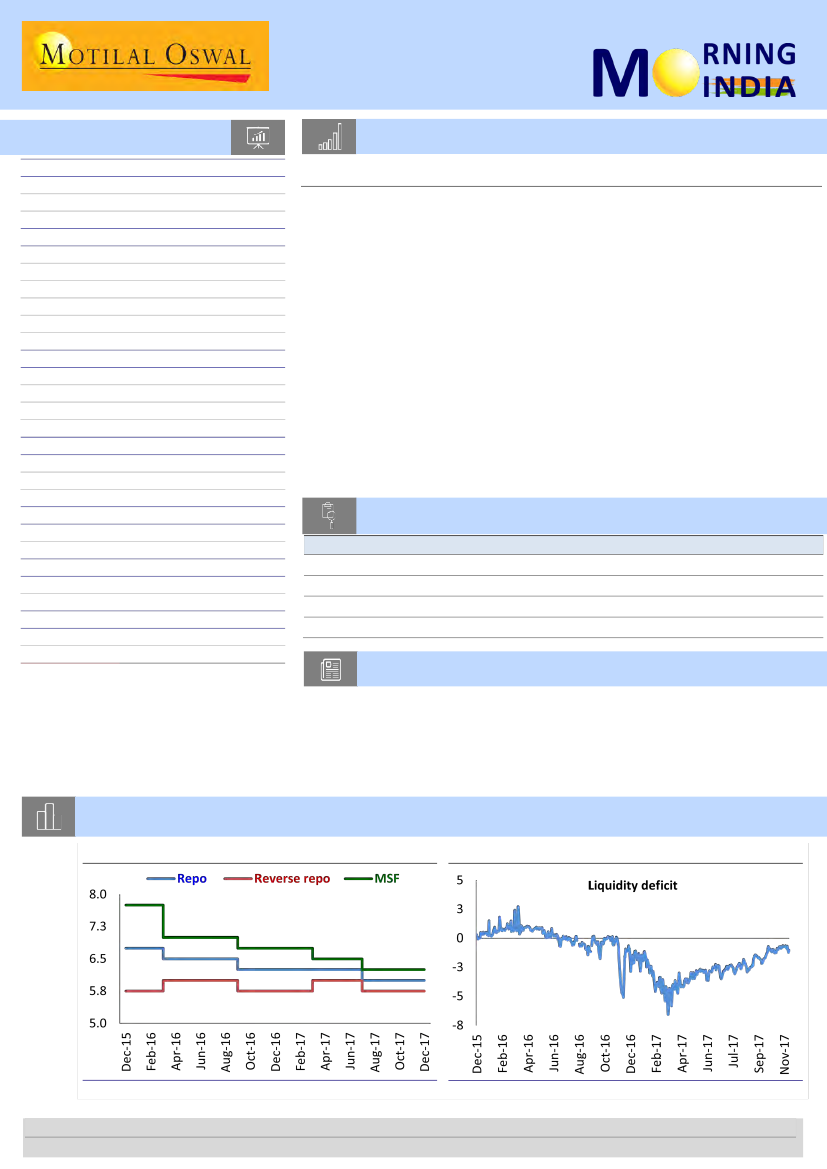

Chart of the Day: EcoScope – RBI keeps rates unchanged; maintains neutral stance

RBI keeps policy rates unchanged

Liquidity surplus continues to decline (% of NDTL)

Source: RBI

Source: RBI

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.