27 December 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

34,011

0.2

Nifty-50

10,532

0.4

Nifty-M 100

21,005

0.8

Equities-Global

Close

Chg .%

S&P 500

2,683

0.0

Nasdaq

6,960

-0.1

FTSE 100

7,593

-0.1

DAX

13,073

-0.3

Hang Seng

11,653

0.5

Nikkei 225

22,893

0.0

Commodities

Close

Chg .%

Brent (US$/Bbl)

66

2.6

Gold ($/OZ)

1,283

0.6

Cu (US$/MT)

7,085

0.6

Almn (US$/MT)

2,181

2.2

Currency

Close

Chg .%

USD/INR

64.1

0.1

USD/EUR

1.2

0.0

USD/JPY

113.2

-0.1

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.3

0.00

10 Yrs AAA Corp

8.0

0.01

Flows (USD b)

26-Dec

MTD

FIIs

0.0

-1.2

DIIs

0.1

1.4

Volumes (INRb)

26-Dec

MTD*

Cash

341

335

F&O

5,192

6,570

Note: YTD is calendar year, *Avg

YTD.%

27.7

28.7

46.4

YTD.%

19.9

29.3

6.3

13.9

24.0

19.8

YTD.%

19.8

11.3

28.3

28.0

YTD.%

-5.7

12.8

-3.2

YTDchg

0.8

0.4

YTD

7.2

14.2

YTD*

309

5,738

Today’s top research idea

Sanghi Industries: Ready for the next leap

Diversification into new markets to bring in scale and margin expansion

SIL, a Gujarat-based cement company, has capacity of 4.1mt and sells ~90% of

volumes in Gujarat. It owns a 63MW captive power plant and a port.

SIL is one of the lowest cost cement producers due to its quality limestone,

locational advantage and strong integration across manufacturing value chain.

We expect SIL’s margin to expand by 8.4pp over FY17-20, led by (i)

commissioning of a waste heat recovery system (WHRS), (ii) focusing on coastal

mode of transportation by way of acquisition of ships and (iii) favorable

revenue mix with higher proportion of Portland Pozzolana Cement (PPC).

Increase in capacity to 8.2mt over next 30 months and diversification into new

higher-priced markets should result in capacity-led re-rating.

Expect PAT CAGR of 61% to INR2.63b over FY17-20; RoE to increase by 11pp to

16.8% in FY20, led by sharp uptick in profitability.

We initiate coverage on SIL with Buy and TP of INR157 (23% upside; valuing its

present capacity of 4.1mt at USD120 EV/tonne; incremental capacity of 4.1mt

at USD78/t).

Research covered

Cos/Sector

Key Highlights

Sanghi Industries (Initiating Coverage) Ready for the next leap

India Strategy

Contrarian Investing: Exploring two sub-themes

Bharat Forge (ART)

High capital intensity keeps return ratios subdued

Piping hot news

RCom finalizes Rs39,000 crore debt resolution plan

Reliance Communications Ltd (RCom) has finalized a debt resolution plan that

involves the sale of its assets and does not require lenders and bond holders to

write off their dues or convert it into equity. The company has also exited the

strategic debt restructuring process (SDR), RCom said on Tuesday…

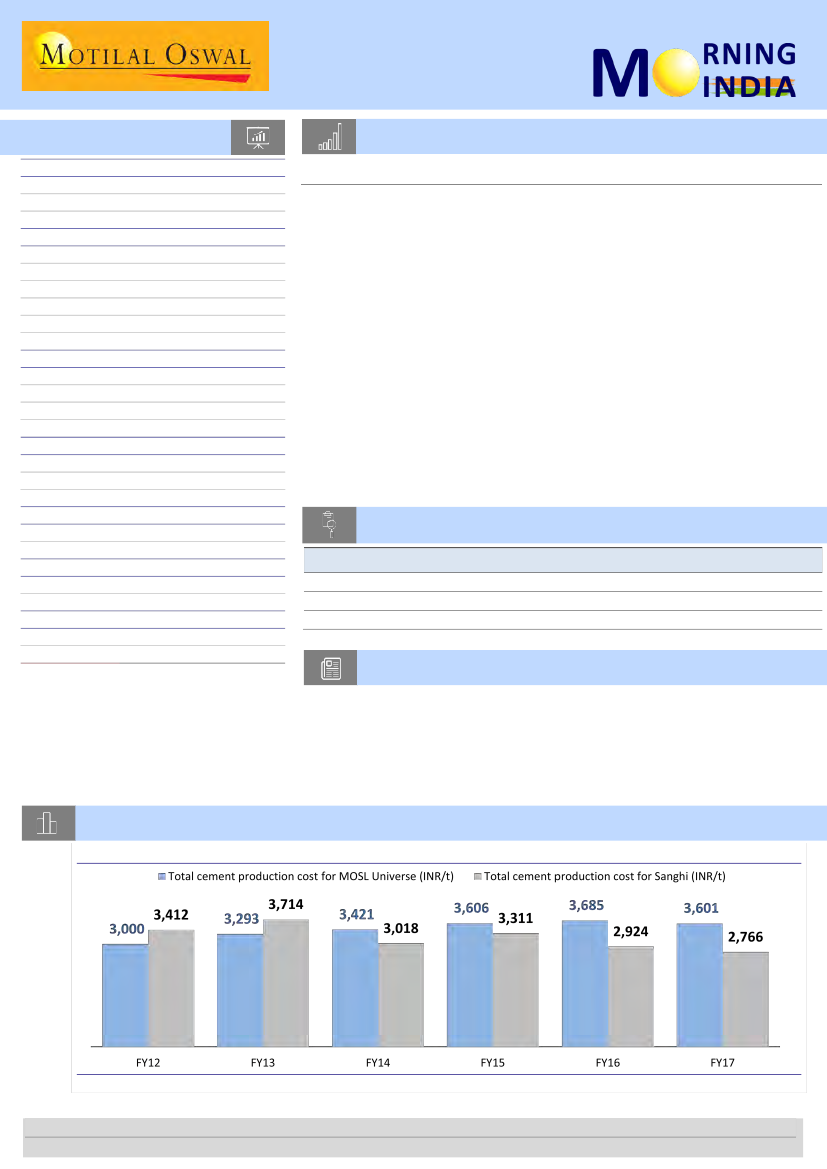

Chart of the Day: Sanghi Industries—Ready for the next leap

SIL’s cement production cost has remained lower than industry average over the years

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.