1 January 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

34,057

0.6

Nifty-50

10,531

0.5

Nifty-M 100

21,134

0.7

Equities-Global

Close

Chg .%

S&P 500

2,674

-0.5

Nasdaq

6,903

-0.7

FTSE 100

7,688

0.9

DAX

12,918

-0.5

Hang Seng

11,709

0.2

Nikkei 225

22,765

-0.1

Commodities

Close

Chg .%

Brent (US$/Bbl)

67

0.6

Gold ($/OZ)

1,297

0.4

Cu (US$/MT)

7,207

-0.6

Almn (US$/MT)

2,256

-0.8

Currency

Close

Chg .%

USD/INR

63.8

-0.4

USD/EUR

1.2

0.4

USD/JPY

112.6

-0.2

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.3

-0.07

10 Yrs AAA Corp

8.0

-0.11

Flows (USD b)

29-Dec

MTD

FIIs

0.1

-0.7

DIIs

0.1

1.3

Volumes (INRb)

29-Dec

MTD*

Cash

394

347

F&O

2,777

6,854

Note: YTD is calendar year, *Avg

YTD.%

27.9

28.6

47.3

YTD.%

19.4

28.2

7.6

12.5

24.6

19.1

YTD.%

20.6

11.9

30.5

32.4

YTD.%

-6.0

13.6

-3.9

YTDchg

0.8

0.5

YTD

7.7

14.0

YTD*

310

5,771

Today’s top research idea

Motherson Sumi: Magical times ahead!

MSS is in a sweet spot to benefit from the evolving disruptive global

automotive trends, which would drive its next wave of growth. MSS is now

entrenched in the virtuous cycle of 'scale begets scale', as it would significantly

benefit from OEMs' focus on vendor consolidation.

MSS has strong organic growth opportunities in both international and

domestic markets, driven by an increase in content per vehicle, a strong order

book and its entry in new markets/segments.

Over the next 12-15 months, with bulk of SMP plants ramping up, we expect

~19% revenue CAGR to EUR5b by FY20 and EBITDA margin expansion of 450bp

to ~11%.

PKC would benefit from a) strong tailwind in US Class 8 trucks, b) ramp-up in

China Truck and c) ramp-up in rolling stock, driving revenue CAGR of 15%

(FY17-20E) and ~400bp EBITDA margin expansion to ~10.9% by FY20E.

For MSS, we estimate consolidated revenue/EBITDA/PAT CAGR of

22%/30%/33.5% over FY17-20E. We initiate coverage with a Buy rating and a

target price of INR458.

Supportive global trends | Strong growth visibility | Financial discipline

Research covered

Cos/Sector

Motherson Sumi (Initiating Coverage)

Automobiles

Key Highlights

Magical times ahead!

Strong wholesales on low base of previous year; Rural

sentiment remains positive

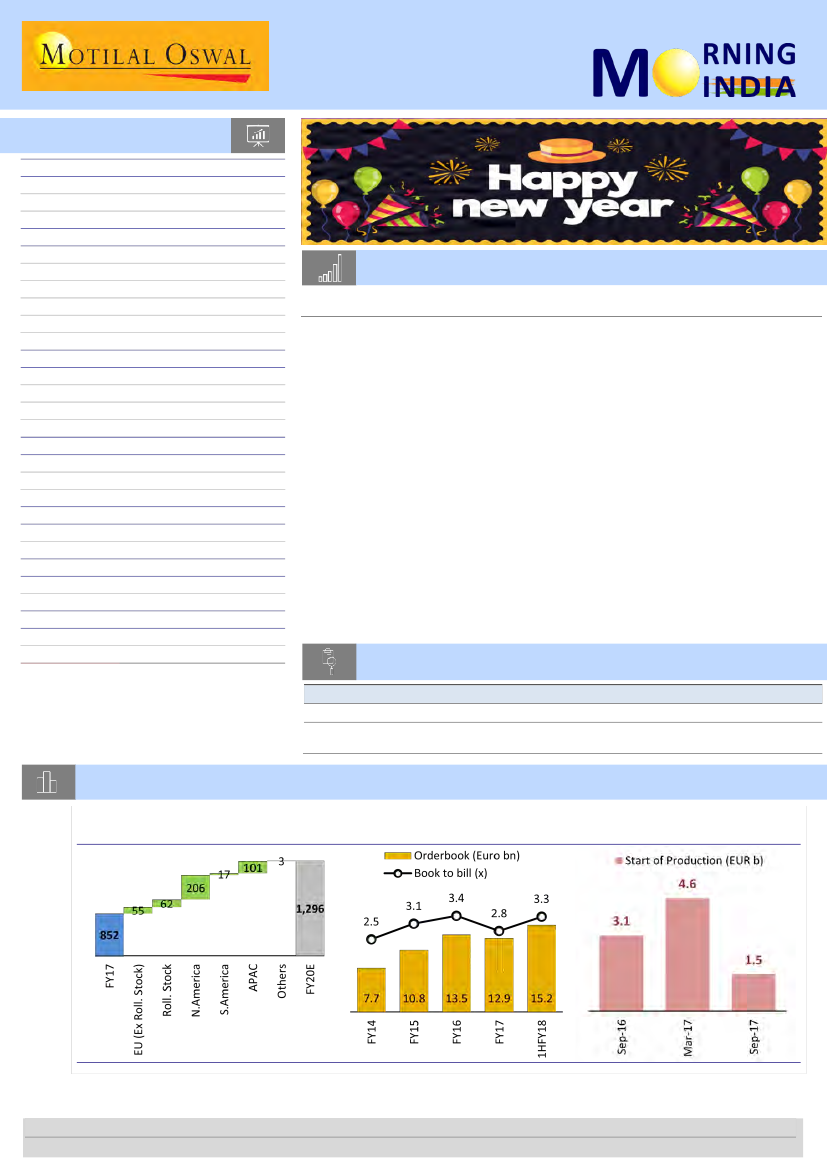

Chart of the Day: Motherson Sumi – Magical times ahead!

We estimate 15% CAGR in PKC’s revenue

driven by US class 8 trucks and APAC

SMRPBV has strong order book

resulting in high growth visibility

SMRPBV has started execution of

EUR9.2b orders in last 12 months

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.