3 January 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

33,812

0.0

Nifty-50

10,442

0.1

Nifty-M 100

20,960

-0.7

Equities-Global

Close

Chg .%

S&P 500

2,696

0.8

Nasdaq

7,007

1.5

FTSE 100

7,648

-0.5

DAX

12,871

-0.4

Hang Seng

12,069

3.1

Nikkei 225

22,765

0.0

Commodities

Close

Chg .%

Brent (US$/Bbl)

67

-0.1

Gold ($/OZ)

1,312

0.7

Cu (US$/MT)

7,161

-0.6

Almn (US$/MT)

2,252

-0.2

Currency

Close

Chg .%

USD/INR

63.5

-0.4

USD/EUR

1.2

0.6

USD/JPY

112.8

0.2

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.4

0.05

10 Yrs AAA Corp

8.0

0.02

Flows (USD b)

2-Jan

MTD

FIIs

0.1

0.1

DIIs

0.0

-0.2

Volumes (INRb)

2-Jan

MTD*

Cash

370

346

F&O

5,251

4,098

Note: YTD is calendar year, *Avg

CY17%

27.0

27.5

47.1

CY17%

19.4

28.2

7.6

12.5

24.6

19.1

CY17%

20.5

12.3

30.5

32.4

CY17%

-6.2

13.8

-3.9

CY17%

0.8

0.4

CY17

7.7

14.0

YTD*

346

4,098

Today’s top research idea

Titan Industries: Healthy jewellery retail growth led by

festive demand

Jewellery division witnessed a good festive season, with retail sales growing in

double-digits. If not for PMLA, then growth would have been even better,

despite a high base. However, suspension of PMLA in early Oct’17 helped boost

sales further over the rest of the festive season.

TTAN mentioned that Jewellery retail growth in 3QFY18 was healthy and met

management’s internal expectations. We, however, note that primary growth

for 3QFY18 was lower due to upstocking by franchisees in 2QFY18 (to the

extent of INR2.5b due to early onset of festive season and as PMLA was

effective last quarter). Market share gain for Jewellery continued in 3QFY18.

Recent aggression to capitalize on opportunities across divisions is heartening.

Earnings CAGR is likely to be a massive 36% over FY17-20. The sheer scale of

top-line opportunity demands premium valuations. We thus maintain Buy with

revised a TP of INR975 (valued at 49x Dec’19E EPS).

Research covered

Cos/Sector

Titan Industries

Sustainability Meter

Bulls & Bears

Automobile

Capital Goods

Key Highlights

Healthy jewellery retail growth led by festive demand

Larsen & Toubro: Green portfolio contribution rising

India Valuations Handbook — A stellar finish to the year

Volumes Nos: 1. BJAUT; 2. HMCL; 3. TTMT; 4. AL; 5. EIM; 6. MM

Capex tracker: New project announcements decline sharply in 3QFY18

Piping hot news

Rupee climbs to fresh 2-1/2 year high on sliding dollar

The rupee shot up to end at a nearly 2-1/2 year high of 63.48, surging by 20

paise against the US dollar as the bullish momentum continued strongly for the

fourth-straight day driven by upbeat hopes on macro front.

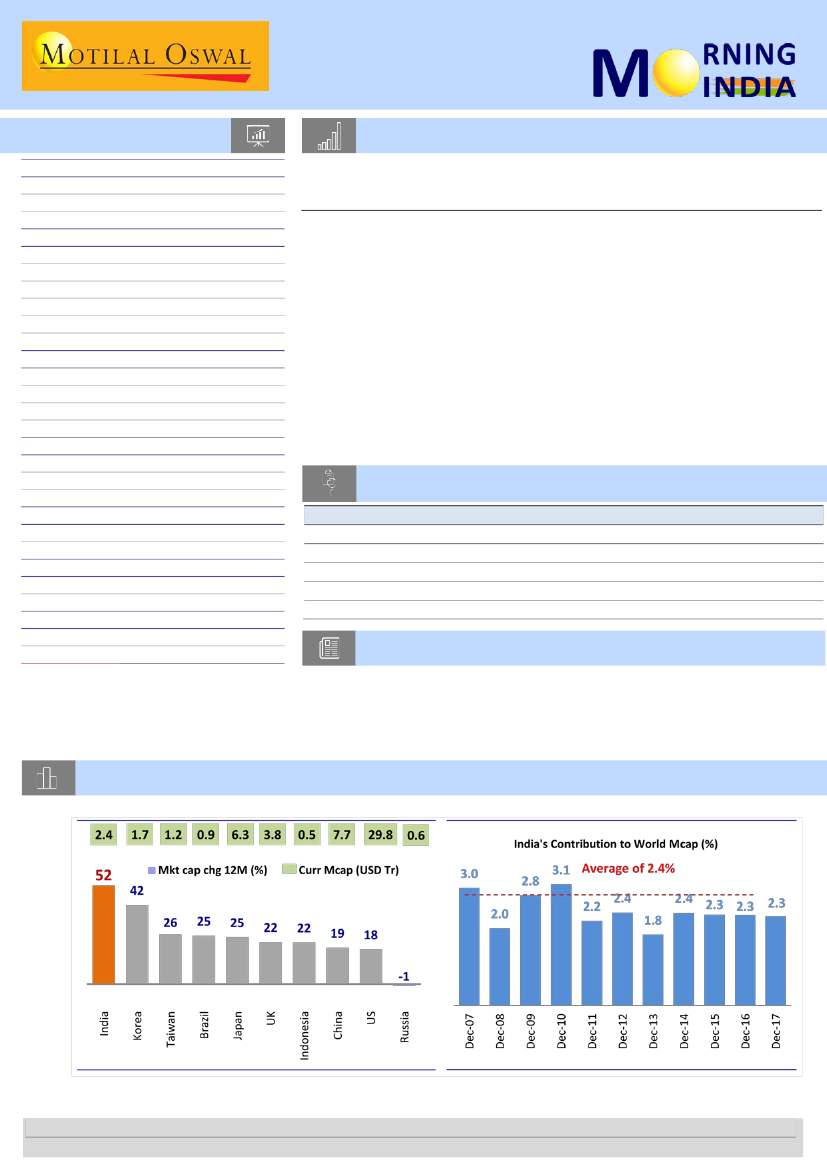

Chart of the Day: India’s share in world market cap marginally below historical average

Over the last 12 months, world market cap has increased 53.5% (USD35.7t), while India’s market cap is up 52%

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.