F

UEL

R

E

NGINES

5 January 2018

F

RIEND

O

F

T

HE

E

CONOMY

What does RBI’s consumer confidence survey suggest?

Adjustments to widening divergences key to future growth

Inflationary expectations, as reflected by the households survey conducted by Reserve Bank of India (RBI), has always

been an important variable taken into consideration during the monetary policy meetings. However, the consumer

confidence survey (CCS) for November 2017, which is conducted among households across various cities, has revealed

some conflicting trends.

According to the results of the recent survey, while households’ one-year-ahead expectations of income and

employment are at the lowest level in four years, an overwhelming majority of respondents (second highest on record)

expects spending to improve next year. Moreover, while the current perception (vis-à-vis a year ago) on income and

employment is the worst on record (more respondents expect a decrease than increase), a record-high proportion of

respondents has reported higher spending.

Such widening divergence (i) between current situation and households’ expectations of income/employment and (ii)

between consumption spending and income/employment is unsustainable. The adjustments to these divergences will

determine the future trajectory of economic growth. If the outlook on income/employment does not alter positively,

consumers will most likely revise down their spending outlook, creating more risks to real GDP growth.

Over the past few years,

while consumers have

grown more wary of the

current situation, they have

remained optimistic about

the future

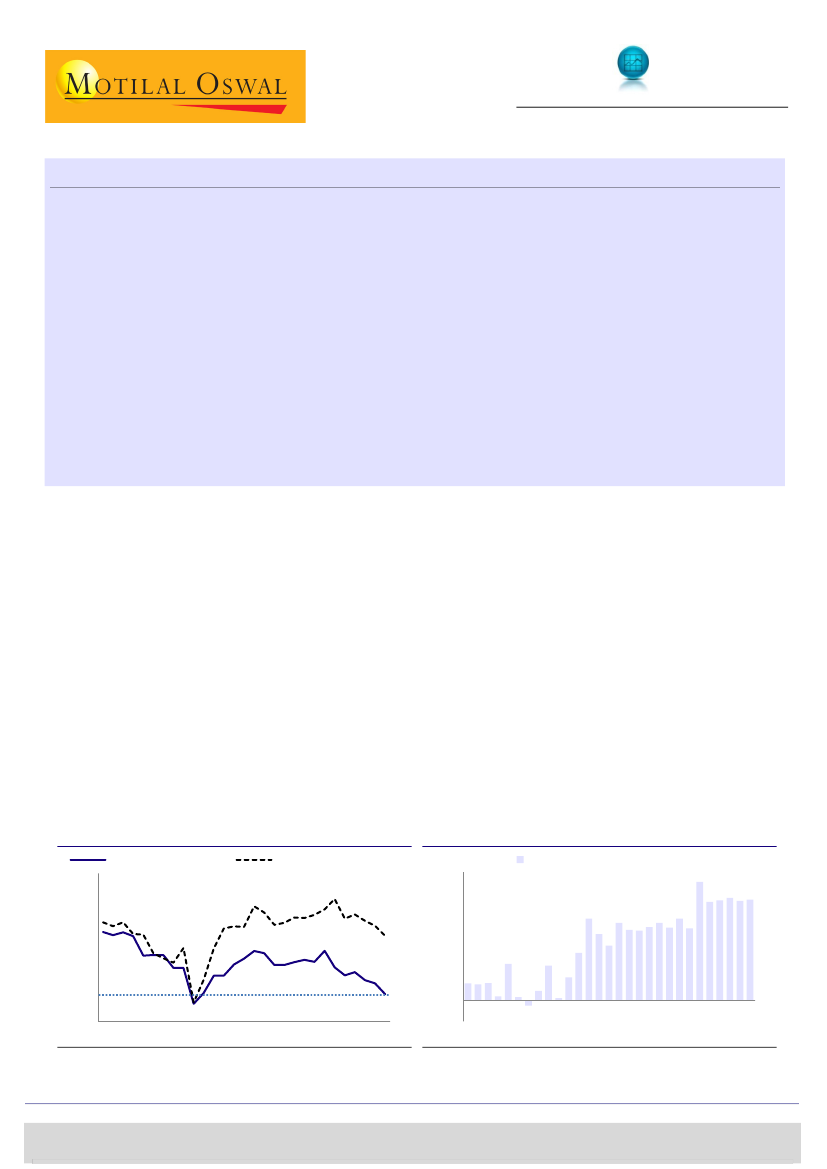

Consumer confidence at second lowest level in seven years:

According to the

results of the recent round of the RBI’s consumer confidence survey (CCS)

conducted in November 2017, the current situation index (CSI) fell from 95.5 in the

previous survey to 91.1

(Exhibit 1).

This is the lowest reading in four years and the

second lowest level on record (data available since 3QFY11 or quarter-ending

December 2010). Likewise, the future expectations index (FEI) has also fallen to a

four-year lowest level; however, it remains better than the level seen in 2012-2013.

Over the past few years, while consumers have grown more wary of the current

condition, they have remained optimistic about the future, as reflected in the

growing difference between FEI and CSI. While the two indices were very close to

each other until 2013, consumers have turned more confident about future from

2014. The present condition, however, started deteriorating after some

improvement seen in FY15. The difference between FEI and CSI was 23.6 points in

the recent survey, one of the highest since the record began in FY11

(Exhibit 2).

Exhibit 2: …and the divergence with future expectations

index (FEI) is among the highest

30

25

20

15

10

5

0

(5)

Difference between FEI and CSI

Exhibit 1: Consumers’ current situation index (CSI) is among

the lowest on record, according to CCS

140

Current Situation index

Future expectation index

120

100

80

Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 Mar-17 Nov-17

Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 Mar-17 Nov-17

Source: Reserve Bank of India (RBI), MOSL

Nikhil Gupta

– Research analyst

(Nikhil.Gupta@MotilalOswal.com); +91 22 3982 5405

Rahul Agrawal

– Research analyst

(Rahul.Agrawal@motilaloswal.com); +91 22 3982 5445

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.