12 January 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

34,503

0.2

Nifty-50

10,651

0.2

Nifty-M 100

21,719

0.3

Equities-Global

Close

Chg .%

S&P 500

2,768

0.7

Nasdaq

7,212

0.8

FTSE 100

7,763

0.2

DAX

13,203

-0.6

Hang Seng

12,296

0.1

Nikkei 225

23,710

-0.3

Commodities

Close

Chg .%

Brent (US$/Bbl)

69

0.1

Gold ($/OZ)

1,322

0.4

Cu (US$/MT)

7,103

-0.1

Almn (US$/MT)

2,165

-0.1

Currency

Close

Chg .%

USD/INR

63.7

0.1

USD/EUR

1.2

0.7

USD/JPY

111.3

-0.2

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.3

0.00

10 Yrs AAA Corp

7.6

-0.02

Flows (USD b)

11-Jan

MTD

FIIs

-0.1

0.2

DIIs

0.1

0.2

Volumes (INRb)

11-Jan

MTD*

Cash

406

403

F&O

10,203

5,861

Note: YTD is calendar year, *Avg

CY17%

29.3

29.9

50.9

CY17%

22.8

32.9

8.5

15.7

30.8

24.5

CY17%

25.1

14.3

28.8

27.2

CY17%

-6.4

13.6

-4.7

CY17%

0.7

0.1

CY17

7.7

14.0

YTD*

403

5,861

Today’s top research idea

MAS Financial (Initiating Coverage): Grassroots financier

An efficient player in high growth product segment

Run by first-generation entrepreneurs since 1995, MAS Financial Services

(MASFIN) is an NBFC operating out of six states, primarily Gujarat and

Maharashtra. A quintessential NBFC, it targets the middle and low income

customer segments.

Over the past five years, MASFIN’s AUM grew at a robust 35% CAGR to reach

INR37b. Growth was driven by their flagship product (MEL loans) and new

product such as SME loans. The company has impeccable track record of 39%

PAT CAGR over FY12-17 with consistent ROA (on AUM) of 2%+. At the same

time, the company has always maintained GNPL ratio & credit costs both close

to ~1% - among the best in our NBFC coverage.

Given a favorable backdrop, we expect the company to deliver 25% AUM CAGR

and 25% EPS CAGR over FY17-20E.

Research covered

Cos/Sector

MAS Financials

TCS

IndusInd Bank

Shree Cement

Hindustan Media

Results Expectation

Key Highlights

Grassroots financier

Recovery in Retail offset by muted BFS outlook and margin risks

Strong core operating performance, asset quality deteriorates slightly

Low-cost acquisition in the UAE aligns well with long-term strategy

Lackluster growth, but outlook improving

HT Media | Infosys

Piping hot news

SEBI ban on PW may hit audit of 77 firms, including Tata Steel, Hindalco

SEBI’s order banning the Price Waterhouse network of audit firms (PW firms)

from auditing listed clients for two years will affect 77 NSE-listed firms,

according to data compiled by Prime Database…

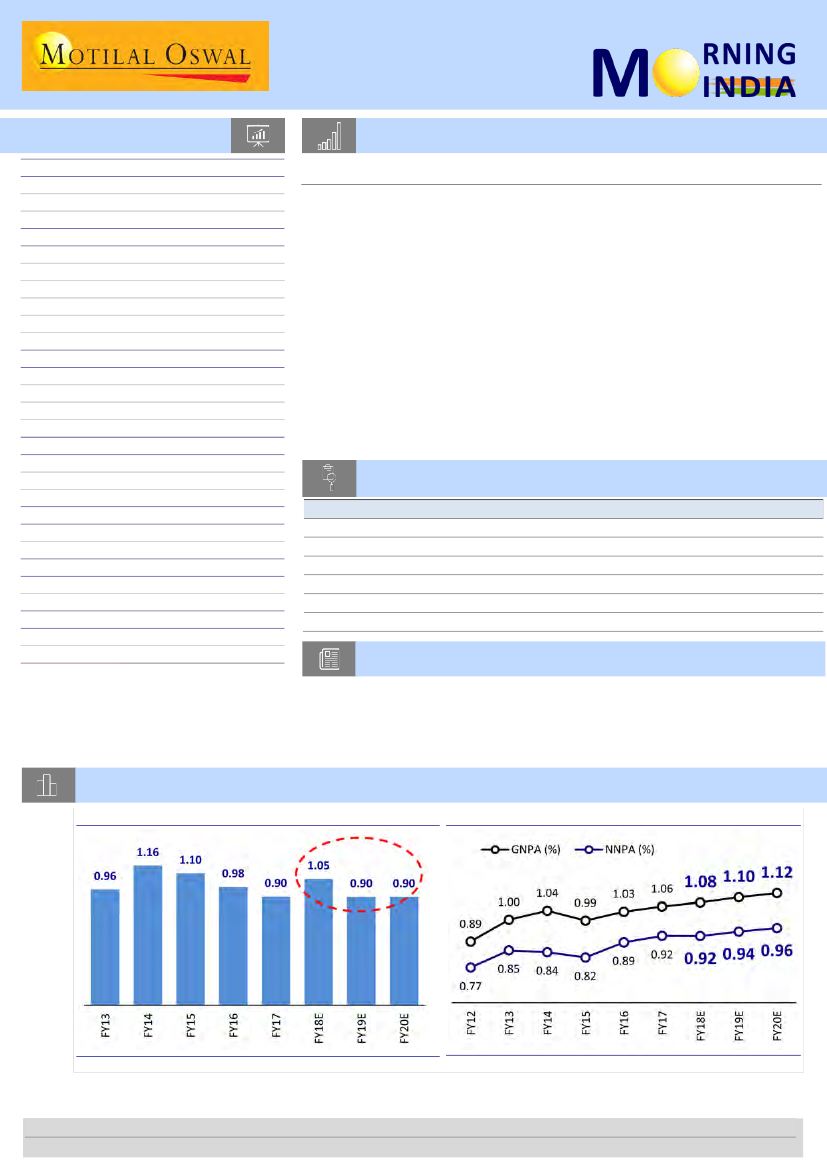

Chart of the Day: MAS Financial (Initiating Coverage)—Grassroots financier

We bake in stable credit costs through FY18-20

GNPA remains in the range of 1-1.2%

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.