11 January 2018

3QFY18 Results Update | Sector: Technology

TCS

BSE SENSEX

34,503

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

10,651

TCS IN

1,914

5,337.8 / 83.8

2820 / 2154

2/8/-7

2929

26.4

CMP: INR2,788 TP: INR2,700(-3%)

Neutral

Recovery in Retail offset by muted BFS outlook and margin risks

Counterbalancing forces keep us subdued:

After declining for three quarters

(YoY CC), Retail recovered with 3% YoY CC growth, and TCS expects this to

reach double-digits in FY19, a key positive from its 3Q earnings. However,

1.5% QoQ CC decline in BFSI (flat YoY CC), and limited likelihood of this

rebounding in the next few quarters offset the strength in Retail. Add to that

profitability risk that current levels of INR-USD bear, and the overhang to

earnings from potentially greater taxation liability arising out of BEAT, we

remain subdued on the near-to-medium-term triggers for TCS.

In-line operational performance:

TCS’ 3QFY18 CC revenue growth was 1.3%

QoQ, marginally ahead of our estimate of +0.9%. 9M YoY CC growth stands at

6.4%, compared to 6.2% in this quarter. EBIT margin expanded 10bp QoQ to

25.2%, as against our estimate of a 20bp contraction. PAT increased 1.3%

QoQ, but fell 3.6% YoY to INR65.3b (2% beat).

Deals getting larger in Digital:

Digital remained the key growth driver, up

39.6% YoY CC compared to overall company’s 6.2%. TCS announced its first-

ever USD50m+ deal in Digital, an indicator of the gradually increasing deal

sizes within the segment. While 39.6% CC growth of the current quarter may

not be tenable, TCS continues to witness deepening of Digital adoption

across Enterprises.

Valuation view:

Our numbers are largely unchanged post the earnings, as

Retail recovery was offset by continued expectation of a soft BFS.

Management cited that momentum pick-up in Retail leaves it with only BFS

as the segment where recovery is still WIP. We believe intermittent risks to

TCS’ valuations maybe three-fold: [1] BFS softness, [2] margin headwinds

from a strong INR and [3] likelihood of additional taxation burden under the

new US tax regime. Our price target of INR2,700 (3% downside to CMP),

based 17x forward earnings, keeps us

Neutral.

Financials & Valuations (INR b)

2017

2018E

Y/E Mar

1,179.7 1,222.7

Net Sales

323.1

323.1

EBITDA

262.9

255.3

PAT

133.4

130.6

EPS (INR)

8.3

-2.1

Gr. (%)

448.3

417.0

BV/Sh (INR)

32.6

30.4

RoE (%)

32.4

26.5

RoCE (%)

20.9

21.4

P/E (x)

6.2

6.7

P/BV (x)

2019E

1,358.2

358.8

282.0

147.3

12.8

481.0

32.9

25.3

18.9

5.8

Estimate change

TP change

Rating change

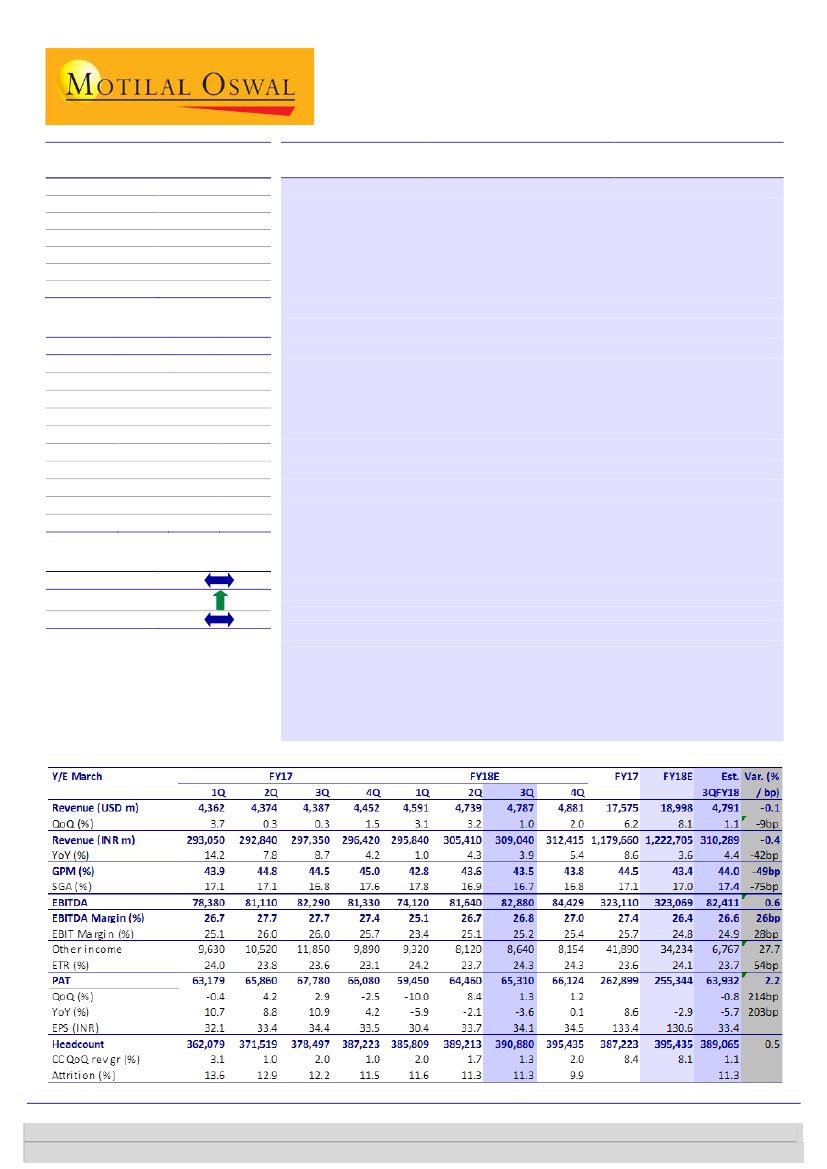

Quarterly Performance (Consolidated)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Ashish Chopra

– Research analyst

(Ashish.Chopra@MotilalOswal.com); +91 22 6129 1530

Sagar Lele

– Research analyst

(Sagar.Lele@MotilalOswal.com); +91 22 6129 1531