18 January 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

35,082

0.9

Nifty-50

10,789

0.8

Nifty-M 100

21,516

1.0

Equities-Global

Close

Chg .%

S&P 500

2,803

0.9

Nasdaq

7,298

1.0

FTSE 100

7,725

-0.4

DAX

13,184

-0.5

Hang Seng

12,869

0.6

Nikkei 225

23,868

-0.3

Commodities

Close

Chg .%

Brent (US$/Bbl)

69

0.1

Gold ($/OZ)

1,327

-0.8

Cu (US$/MT)

6,994

-0.6

Almn (US$/MT)

2,193

0.6

Currency

Close

Chg .%

USD/INR

63.9

-0.2

USD/EUR

1.2

-0.6

USD/JPY

111.3

0.8

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.2

-0.16

10 Yrs AAA Corp

7.9

-0.17

Flows (USD b)

17-Jan

MTD

FIIs

0.1

0.5

DIIs

0.0

0.2

Volumes (INRb)

17-Jan

MTD*

Cash

450

413

F&O

9,107

6,097

Note: YTD is calendar year, *Avg

CY17%

30.6

30.7

48.4

CY17%

24.0

34.2

8.6

15.4

36.1

25.3

CY17%

25.1

16.2

27.4

27.9

CY17%

-5.7

16.6

-5.6

CY17%

0.9

0.5

CY17

7.7

14.0

YTD*

413

6,097

Today’s top research idea

Hindustan Unilever: Impressive volumes

Strong margin expansion despite high adspend

HUVR’s 3QFY18 net sales rose 11.5% YoY to INR85.9b. Domestic consumer

business grew 17% YoY, with 11% underlying volume growth. EBITDA increased

by 23.9% YoY to INR16.8b (est. of INR16b) and PAT (bei) by 30.2% YoY to

INR12b (est. of INR10.9b).

We believe that four key trends are particularly relevant for HUL, which should

lead to an elevation in its earnings growth trajectory compared to the past – (i)

rapidly improving adaptability to market requirements, (ii) recognition of

Naturals as a key sub-segment across categories, (iii) continuing strong trend

toward premiumization and (iv) extensive plans to employ technology.

On a target multiple of 50x Dec’19 EPS (well-deserved 15% premium to three-

year average due to significantly improved business fundamentals), we get a

revised target price of INR1,585. Maintain

Buy.

Research covered

Cos/Sector

Hindustan Unilever

Larsen & Toubro

Bharti Infratel

Zee Entertainment

Jubilant Life

Mindtree

Delta Corp

Jyothy Labs

DCB Bank

S H Kelkar

Healthcare

Results Expectation

Key Highlights

Impressive volumes, strong margin expansion despite high adspend

The Monitorable Troika

Tenancy declines 3% QoQ, keeping rental revenue flat; EBITDA up 1% QoQ

Better growth to drive valuation

Life Science Ingredients segment drives earnings

Back in the game with 3Q beat and sanguine outlook

Robust performance; earnings drivers intact

Mixed performance; Growth outlook maintained

Income beat offset by elevated opex; advances growth picks up

Volume recovery leads to a strong quarter

IPM – growth picks up on higher volumes

ADSEZ | BHARTI | CYL | DBCL | HZ | UTCEM | YES | ZENT

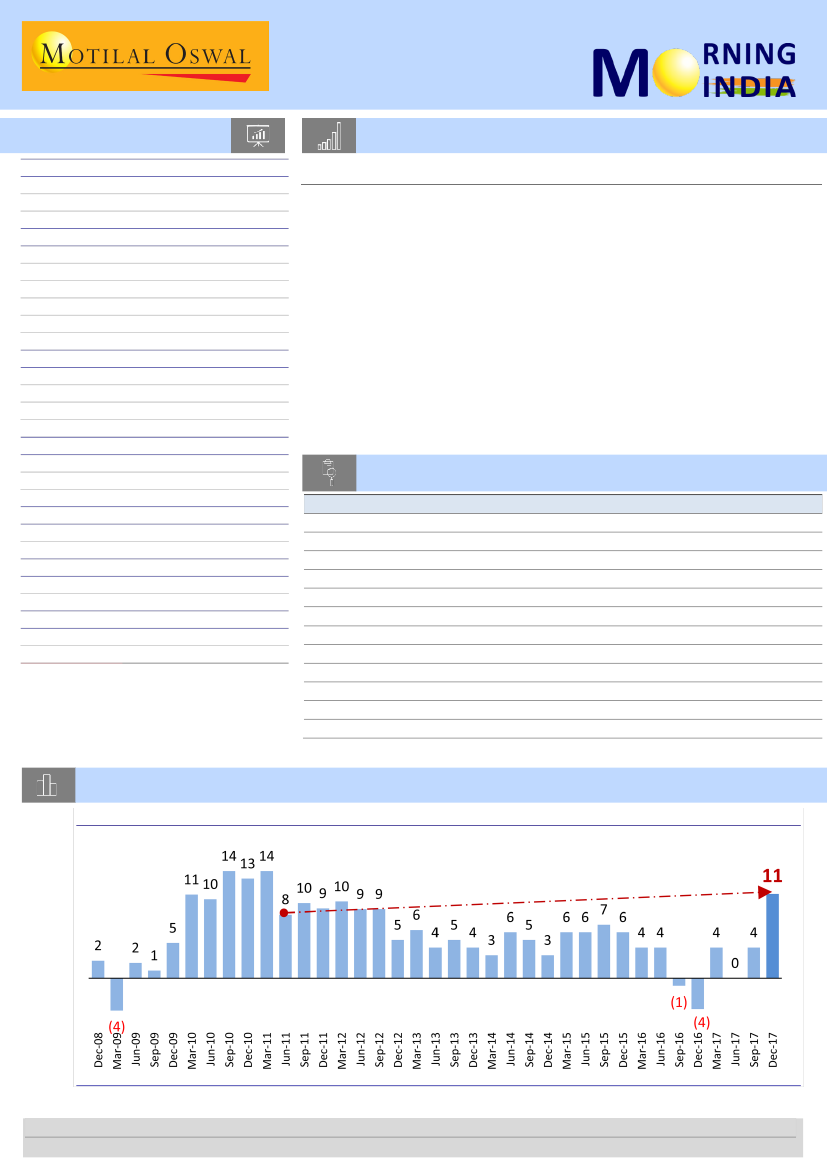

Chart of the Day: Hindustan Unilever – Impressive volumes

Underlying volumes grew 11% YoY in 3QFY18; highest in last 27 quarters

Research Team (Gautam.Duggad@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.