Sector Update |

Update| Healthcare

Sector

17 January 2018

Healthcare

Performance of top

companies: Dec-17, %)

Company

IPM

Sun Pharma

Abbott India

Cipla

Zydus Cadila

Mankind

Alkem

Lupin

Torrent Pharma

Pfizer

Glenmark

Pharma

Sanofi

Dr Reddy Labs

GSK Pharma

Alembic Pharma

Ipca Labs

Natco

Ajanta Pharma

Merck

Biocon

MAT gr Dec-17

5.5

7.8

7.6

8.1

7.4

7.1

3.2

10.2

9.5

8.6

5.4

19.9

3.7

12.4

7.9

12.7

5.9

1.6

(3.5)

(0.6)

9.3

9.2

3.9

7.6

(1.7)

(4.4)

(7.4)

9.1

5.0

10.6

10.5

8.6

7.0

9.3

(2.0)

(4.3)

14.8

8.5

(0.3)

11.4

IPM – growth picks up on higher volumes

Indian pharmaceutical market's (IPM) secondary sales continued to grow at a

healthy rate in December, led by strong volume growth, while price growth

continued its downtrend during the month. IPM grew by 7.8% YoY in December

2017 and 7.2% YoY in 3QFY18.

After declining trend in YoY quarterly growth till 2QFY18, industry volumes grew

by 5.9% in 3QFY18. Growth in new products was 2.8% in 3QFY18, as compared

to 2.7% in 2QFY18. After declining 2.1% in 2QFY18, prices further reduced YoY in

3QFY18 as well (-1.5%).

Moving annual total (MAT) growth for December was 5.5% as against 5.6% YoY

in November.

Natco’s secondary sales (+24.5%) posted robust growth for 3QFY18 YoY,

followed by Mankind (+14.1%) and Alkem (+13.1%). More than 65% of the

companies posted improvement in YoY growth in 3QFY18 compared to previous

three quarters.

Exceptionally, IPCA’ secondary sales continued to decline (-7.1%) in 3QFY18 YoY,

followed by Pfizer, which declined 3.4% during the quarter.

Ophthal & Vaccines (1.9% each of IPM) posted robust growth of 13.2% YoY in

3QFY18, followed by Respiratory (+12.3%; 7.5% of IPM) and Derma (+11.5%;

6.4% of IPM). Although all therapies reported growth in December, ~40% of

them underperformed the IPMs.

In value terms, secondary sales of DPCO-listed products increased by 3% YoY

and non-DPCO products by 8.7% YoY.

FDC-banned drugs (~2.4% of IPM) grew 4% in December, while non-banned

drugs grew by 8.7% YoY. Secondary sales for Indian companies increased 8.2%

YoY, while those of MNC companies grew by 6.3% YoY.

Natco, Mankind and Alkem witness highest YoY growth for the quarter

Ophthal & Vaccine, Respiratory and Derma lead among therapies

DPCO v/s non-DPCO market (December-17)

FDC ban impact (December-17)

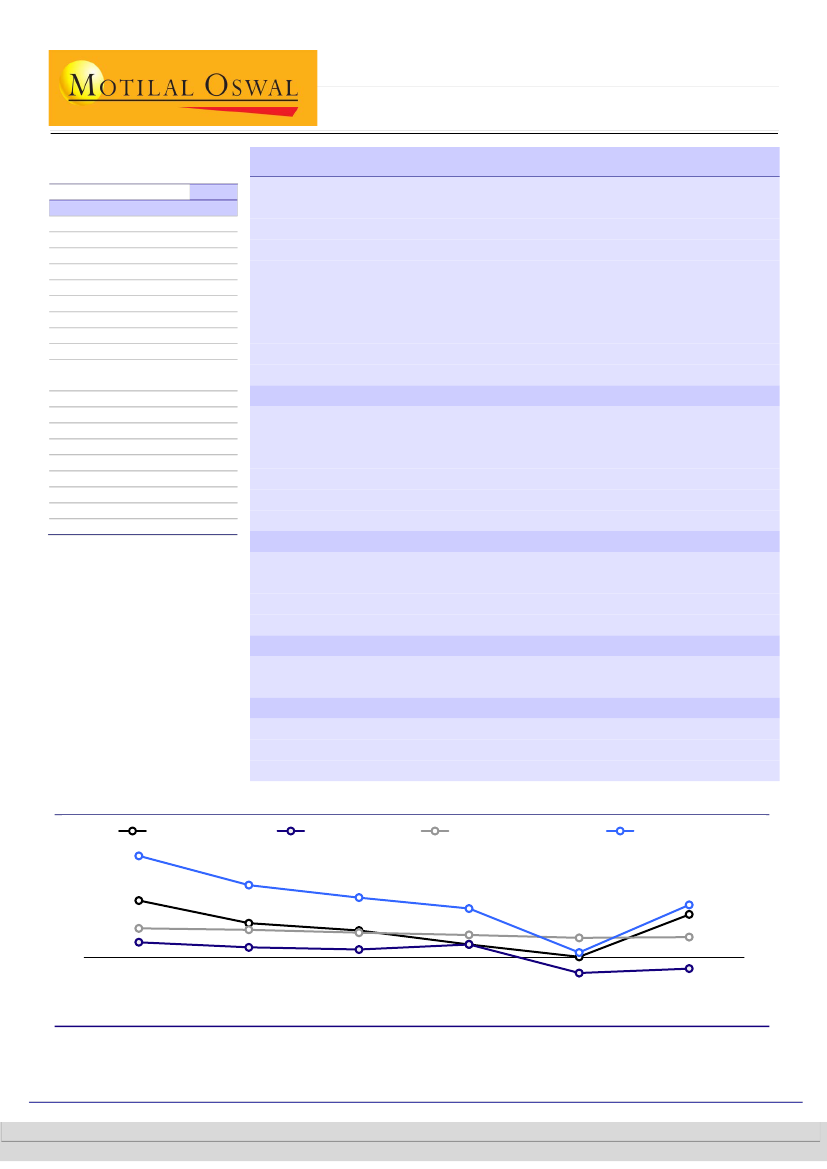

Exhibit 1: Volume-led high industry growth

13.9

Volume Growth (%)

9.9

7.8

4

2.1

4.7

3.8

1.4

Price Growth (%)

New Product Growth (%)

Total Growth (%)

8.2

3.7

3.4

1.1

6.7

3.1

1.8

1.8

1QFY18

0.7

0.1

-2.1

2QFY18

2.7

7.2

5.9

2.8

-1.5

3QFY18

Source: AIOCD, MOSL

2QFY17

3QFY17

4QFY17

Kumar Saurabh – Research analyst

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Ankeet Pandya – Research analyst

(Ankeet.Pandya@MotilalOswal.com)

18 August 2017

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

1