Sector Update | 22 January 2018

Aviation

Aviation

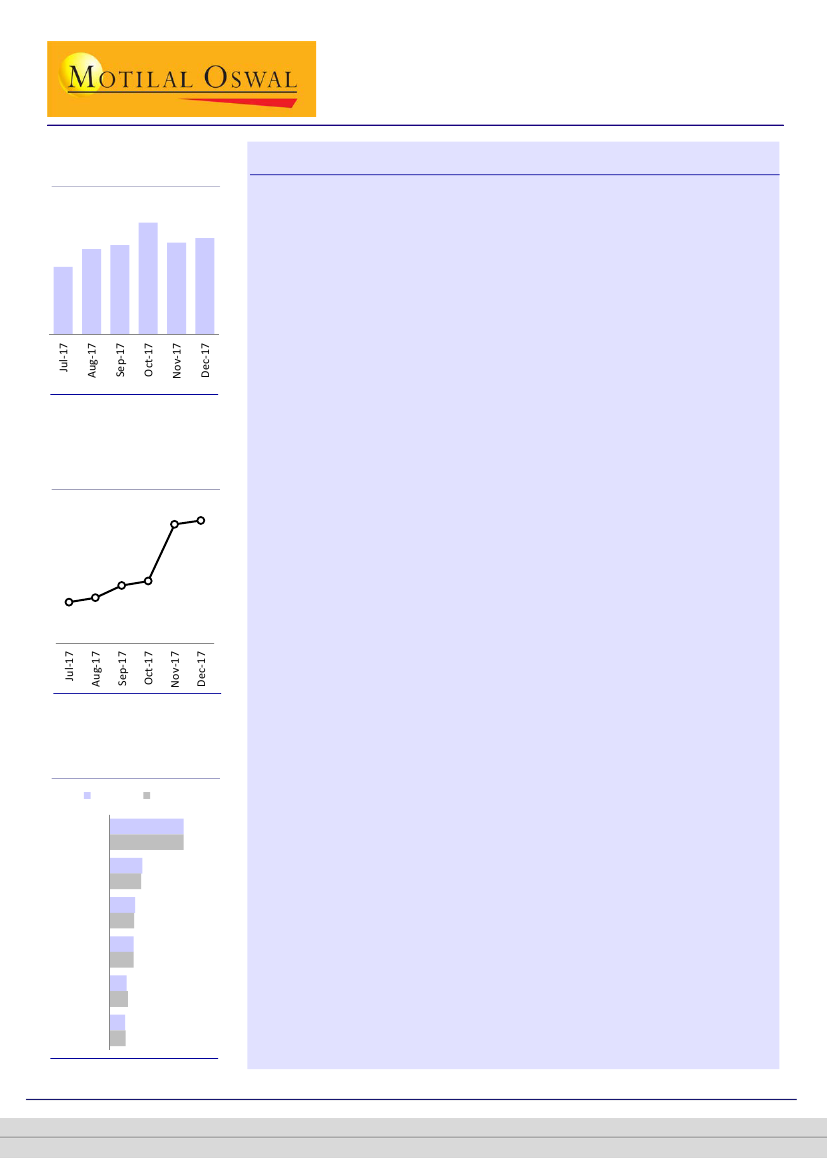

Domestic passenger growth

(YoY; %)

20.6

15.7 16.5

12.5

Domestic air passengers increase 17.8% in December

Domestic PLF at a record high of 89.5% led by strong festive demand

16.9 17.8

Domestic air passengers in India grew 17.8% YoY to 11.2m in Dec-17 and 18.4% YoY in

3QFY18 (v/s +15% YoY in 2QFY18). Passenger growth has been in double-digits for the

last 41 months.

Domestic ASK grew 16.5% YoY in Dec-17 and 14.2% YoY in 3QFY18 (v/s +14% YoY in

2QFY18). RPK rose 17.5% YoY in Dec-17 and 18.3% YoY in 3QFY18 (v/s +15% YoY in

2QFY18).

IndiGo’s domestic ASK/RPK grew at 12.6/12% in Dec-17, after recording muted growth

th

over the last six months due to engine issues. IndiGo received seven NEOs post 17

November 2017, which accelerated capacity addition in Dec-17.

Domestic industry load factor stood at a record high of 89.5% in Dec-17 and 87.8% in

3QFY18 (v/s 83.7% in 2QFY18). IndiGo’s load factor also increased to 90.8% in Dec-17

and 89.6% in 3QFY18 (v/s 84.1% in 2QFY18).

Domestic air passengers up 17.8% YoY to 11.2m in December

Industry load factor (%)

89.2 89.5

83.2 83.5

84.5 84.8

India's domestic air passengers grew 17.8% YoY to 11.2m in December 2017.

Passenger growth has been in double-digits for the last 41 months.

IndiGo’s passengers grew 15% YoY in Dec-17 and 12% YoY in 3QFY18 (v/s 10%

YoY in 2QFY18).

GoAir’s passengers rose 38.4% YoY in Dec-17 and 34% in 3QFY18 (v/s 12% YoY in

2QFY18).

SpiceJet’s domestic passenger volumes grew 23% YoY in Dec-17 and 18% in

3QFY18 (v/s 31% YoY in 2QFY18).

Passenger volume growth for the other airlines was as follows: Jet Airways:

+11% YoY (+16% YoY in 3QFY18) and Air India: +11% YoY (+19% YoY in 3QFY18).

IndiGo’s passenger market share stood at 39.5% in Dec-17 and 39.6% in 3QFY18

(v/s 38.4% in 2QFY18).

SpiceJet’s market share stood at 12.7% in Dec-17 and 12.8% in 3QFY18 (v/s 14%

in 2QFY18).

GoAir’s market share stood at 9.6% in Dec-17 and 9.2% in 3QFY18 (v/s 8.1% in

2QFY18); it seems to have stabilized in the 8-9% range. Jet Airways’ market

share remained below 20% for the 21

st

consecutive month at 16.7%. Prior to

that, it had a market share of above 20% since July 2014.

Air India’s market share stood at 13% in Dec-17 (v/s 13.3% in 2QFY18).

IndiGo’s domestic ASK increased 12.6% YoY in Dec-17 and 7.2% YoY in 3QFY18

(v/s 6% YoY in 2QFY18); its domestic ASK share was the highest at 40.2%.

SpiceJet’s domestic ASK grew 15.7% YoY in Dec-17 and 17.5% YoY in 3QFY18 (v/s

31.4% YoY in 2QFY18).

Domestic ASK grew 38% YoY in Dec-17 and 32.2% YoY in 3QFY18 (v/s 20% YoY in

2QFY18) for GoAir, and 10.5% YoY in Dec-17 and 13.1% YoY in 3QFY18 (v/s 14%

YoY bin 2QFY18) for Jet Airways.

IndiGo’s PAX market share stays highest; Go Air’s share inches up

Passenger market share (%)

Nov-17

IndiGo

Jet

AI

SpiceJet

GoAir

Others

17.4

16.7

13.5

13.0

12.6

12.7

8.9

9.6

8.1

8.4

Dec-17

39.5

39.5

Domestic ASK grows 16.5% YoY in Dec-17 (+14.2% YoY in 3QFY18)

Swarnendu Bhushan – Research Analyst

(Swarnendu.Bhushan@MotilalOswal.com); +91 22 6129 1529

Abhinil Dahiwale – Research Analyst

(Abhinil.Dahiwale@MotilalOswal.com); +91 22 3980 4309

22 January

1

Investors

2018

advised to refer through important disclosures made at the last page of the Research Report.

are

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.