5 February 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

35,067

-2.3

Nifty-50

10,761

-2.3

Nifty-M 100

19,760

-4.3

Equities-Global

Close

Chg .%

S&P 500

2,762

-2.1

Nasdaq

7,241

-2.0

FTSE 100

7,443

-0.6

DAX

12,785

-1.7

Hang Seng

13,539

0.8

Nikkei 225

23,275

-0.9

Commodities

Close

Chg .%

Brent (US$/Bbl)

68

-2.5

Gold ($/OZ)

1,333

-1.2

Cu (US$/MT)

7,004

-1.0

Almn (US$/MT)

2,210

-0.7

Currency

Close

Chg .%

USD/INR

64.1

0.1

USD/EUR

1.2

-0.4

USD/JPY

110.2

0.7

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.6

-0.04

10 Yrs AAA Corp

8.2

-0.15

Flows (USD b)

2-Feb

MTD

FIIs

0.1

2.2

DIIs

-0.1

0.0

Volumes (INRb)

2-Feb

MTD*

Cash

534

504

F&O

7,244

11,166

Note: YTD is calendar year, *Avg

YTD.%

3.0

2.2

-6.5

YTD.%

3.3

4.9

-3.2

-1.0

15.6

2.2

YTD.%

1.8

2.3

-2.8

-2.1

YTD.%

0.3

3.8

-2.2

YTDchg

0.2

0.3

YTD

2.2

-0.1

YTD*

433

7,601

Today’s top research idea

Bajaj Finance: Growth outlook remains healthy; Pressure on

LAP continues

Bajaj Finance (BAF) had a strong quarter with 35% YoY AUM growth, modest

margin uptick (due to higher capital), and stable asset quality.

From a customer base of 25m currently, management targets to reach 75m

over the next five years. BAF already has a database of 30m people who are

mass affluent but not yet customers of the company – management would like

to tap around half of them. Tie up with RBL is showing strong traction and it has

already issued 0.25m cards and target to end with 1m cards by end of CY18.

Management has infused INR12b in the HFC subsidiary, taking its net-worth to

INR15.5b. Over the next 5 years, this could be an INR600-700b balance sheet,

as per management.

Research covered

Cos/Sector

Bulls & Bears

Bajaj Auto

Bajaj Finance

Hindalco Inds

Ashok Leyland

United Breweries

Cummins India

MRPL

GSK Pharma

Other Results

Automobiles

Results Expectation

Key Highlights

India Valuations Handbook — Markets extend stellar gains of CY17

Revenue in-line; lower other income, higher tax dents PAT

Growth outlook remains healthy; Pressure on LAP continues

Stable performance in India; Novelis getting stronger

Product mix, operating leverage and higher exports drive margins

Multi-year high-double-digit volume growth

Operational performance disappoints

EBITDA significantly above estimate; core GRM at USD6.8/bbl

Pick-up seen in Recruitment and 99acres

INFOE | GUJGA | UNBK | JKCE | CEAT | JKLC | BSE | JKBK

Bajaj Auto | Hero MotoCorp

BOS | CLGT | ENIL | TTMT

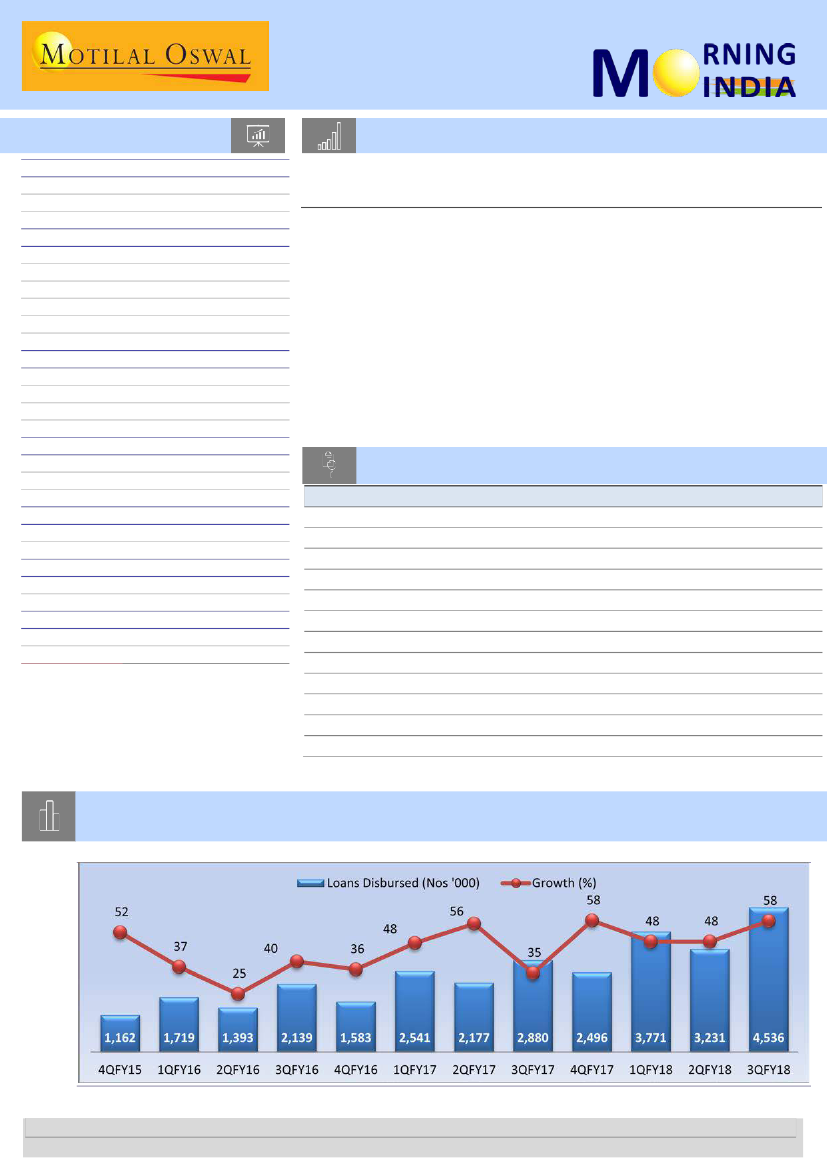

Chart of the Day: Bajaj Finance: Growth outlook remains healthy; Pressure on LAP

continues

No. of loan disb. grew at healthy 58% YoY

Research Team (Gautam.Duggad@MotilalOswal.com)

Source:

MOSL, Company

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.