12 February 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

34,006

-1.2

Nifty-50

10,455

-1.2

Nifty-M 100

19,872

0.2

Equities-Global

Close

Chg .%

S&P 500

2,620

1.5

Nasdaq

6,874

1.4

FTSE 100

7,092

-1.1

DAX

12,107

-1.2

Hang Seng

11,902

-3.9

Nikkei 225

21,383

-2.3

Commodities

Close

Chg .%

Brent (US$/Bbl)

62

-2.6

Gold ($/OZ)

1,316

-0.2

Cu (US$/MT)

6,712

-1.4

Almn (US$/MT)

2,121

-2.5

Currency

Close

Chg .%

USD/INR

64.4

0.2

USD/EUR

1.2

0.0

USD/JPY

108.8

0.1

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.5

0.02

10 Yrs AAA Corp

8.1

0.02

Flows (USD b)

9-Feb

MTD

FIIs

-0.2

-0.8

DIIs

0.1

0.9

Volumes (INRb)

9-Feb

MTD*

Cash

356

431

F&O

5,281

9,213

Note: YTD is calendar year, *Avg

YTD.%

-0.1

-0.7

-6.0

YTD.%

-2.0

-0.4

-7.7

-6.3

1.6

-6.1

YTD.%

-6.6

1.0

-6.9

-6.0

YTD.%

0.8

2.1

-3.5

YTDchg

0.2

0.2

YTD

1.5

0.9

YTD*

427

7,744

Today’s top research idea

State Bank of India - Asset quality disappoints

Expect gradual recovery over FY19E

SBIN reported a weak quarter with net slippages spiking up to INR267.8b

(adversely impacted by divergence). Provisioning increased to INR188.8b,

resulting in a loss of INR24.2b. On the positive side, 89% of corporate slippages

came from stressed assets, resulting in a decline in net stressed assets to 8.4%

of total loans. Core PPoP held stable led by modest growth in core other

income while NII growth stood flat on sequential basis. While the core portfolio

performance remains healthy, cleanup of residual stressed assets will remain

an overhang in near term. We cut our FY18E/19E/20E earnings by

75%/20%/22% respectively and build in capital infusion of INR88b as

announced by the government. We revise our PT to INR375 (1.4x FY20E ABV for

bank) and maintain our BUY rating.

Research covered

Cos/Sector

Automobile

State Bank of India

ONGC

Coal India

Hindustan Zinc

BPCL

M&M

Tata Steel

HPCL

Sun TV Network

Aditya Birla Cap

Bank of Baroda

Key Highlights

Auto Expo 2018: Action in 125cc scooters and EVs

Asset quality disappoints; Expect gradual recovery over FY19E

EBITDA below estimate; gas production up 4% YoY

In-line; e-auction offset drag of power sector priority

Getting more aggressive on volume growth

EBITDA significantly below estimate; core GRM at USD6.5/bbl

Operating performance miss led by higher other expense

Lower cost of production driving EBITDA beat

EBITDA significantly below estimate; core GRM at USD6.1/bbl

Ad growth revives; digitization-led subscription revenue to witness robust gr.

Robust growth and healthy asset quality intact

Strong operational performance; stressed assets declining rapidly

SAIL | ABB | OINL | ALKEM | JSP | VOLT | TCOM | MUTH | GNP | NACL |

Other Results

AMRJ | GETD | MAHCL | BCORP | STR | ICEM | KSCL | VATW | GRAN | TTMT

Results Expectation BOI | BRIT | CGPOWER | GAIL | SKB | INBK | NHPC | SADE

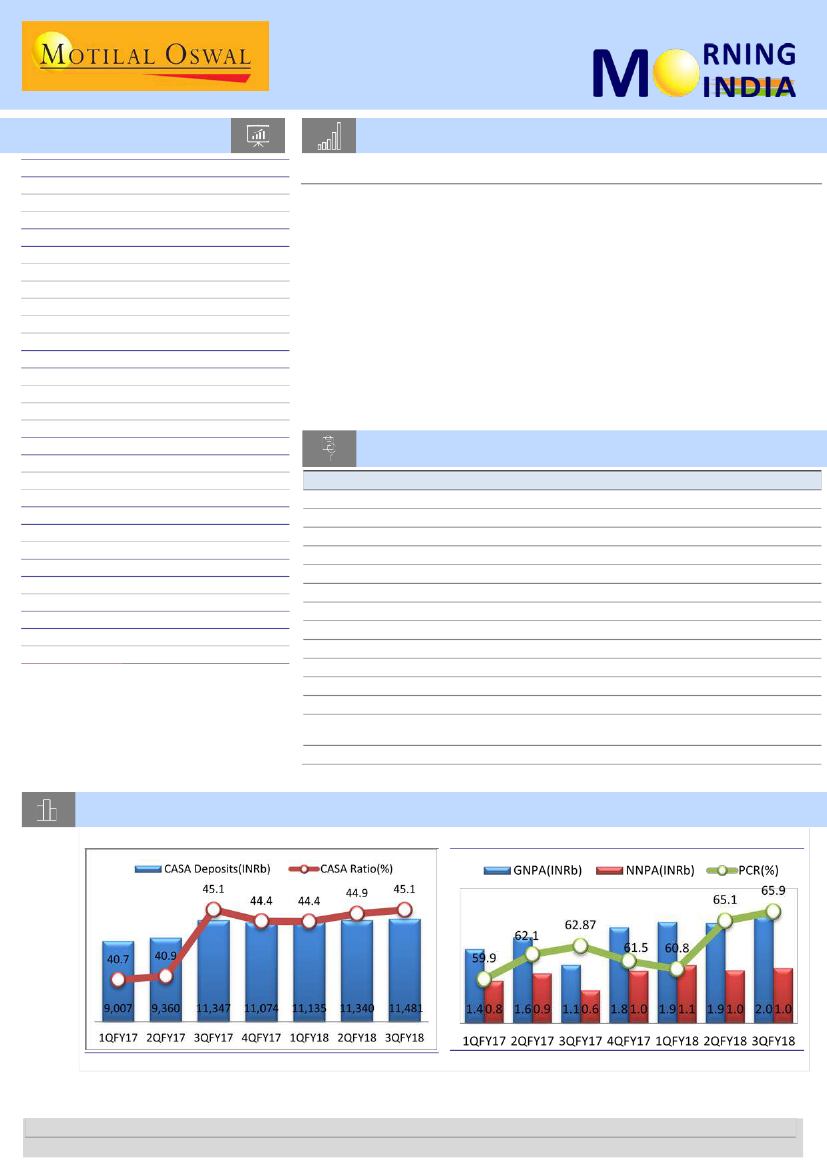

Chart of the Day:

State Bank of India - Asset quality disappoints; Expect gradual recovery over FY19E

CASA ratio improved marginally to 45.1%

PCR improved by 80bp sequentially

Source: MOSL, Company

Source: MOSL, Company

Research Team (Gautam.Duggad@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.