13 March 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

33,918

1.8

Nifty-50

10,421

1.9

Nifty-M 100

18,961

1.0

Equities-Global

Close

Chg .%

S&P 500

2,783

-0.1

Nasdaq

7,588

0.4

FTSE 100

7,215

-0.1

DAX

12,418

0.6

Hang Seng

12,697

2.1

Nikkei 225

21,824

1.7

Commodities

Close

Chg .%

Brent (US$/Bbl)

65

-0.8

Gold ($/OZ)

1,317

-0.2

Cu (US$/MT)

6,876

-0.9

Almn (US$/MT)

2,069

-1.5

Currency

Close

Chg .%

USD/INR

65.0

-0.2

USD/EUR

1.2

0.1

USD/JPY

106.6

-0.2

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.6

-0.04

10 Yrs AAA Corp

8.3

-0.04

Flows (USD b)

12-Mar

MTD

FIIs

0.1

0.4

DIIs

-0.1

-0.1

Volumes (INRb)

12-Mar

MTD*

Cash

312

324

F&O

5,507

8,704

Note: YTD is calendar year, *Avg

YTD.%

-0.4

-1.0

-10.3

YTD.%

4.1

9.9

-6.2

-3.9

8.4

-4.1

YTD.%

-3.1

1.5

-4.6

-8.3

YTD.%

1.9

2.8

-5.4

YTDchg

0.3

0.4

YTD

0.4

2.8

YTD*

393

7,944

Today’s top research idea

Future Consumer (Initiating Coverage) - Company of the “Future”

Future Consumer (FCL) is the best play on the huge window of opportunity for

brands using modern retail methods of distribution.

Improving mix and operating leverage through rapid sales growth are expected

to drive significant margin expansion over the next five years.

We initiate coverage on FCL with a Buy rating. The company is expected to be

PAT positive on consolidated level only in FY19 rendering near term P/E

valuations meaningless. We, thus, value FCL on EV/sales basis, assigning a

multiple of 2.2x (60% discount to EV/sales of coverage consumer universe). This

results in a target price of INR76, implying ~50% upside. As soon as FCL

demonstrates profitability at the net level, we will move our valuation on P/E

basis.

Research covered

Cos/Sector

Future Consumer

(Initiating Coverage)

Ecoscope

Metals Weekly

Key Highlights

Company of the “Future”; Long runway of growth justifies

expensive near-term valuations; Buy with TP of INR76, 50% Upside

Retail inflation eases to a four-month low in February 2018

Iron ore (china cfr) prices down 10% WoW; Base metals weak

Piping hot news

Tata Sons to sell TCS stake worth $1.25 billion to pay debt

Tata Sons Ltd, India’s biggest business group, plans to sell $1.25 billion of its

stake in Tata Consultancy Services (TCS), according to terms of the transaction.

Tata Sons will sell 28.27 million shares of Asia’s largest software developer, or

about 1.48% stake, according to the terms…

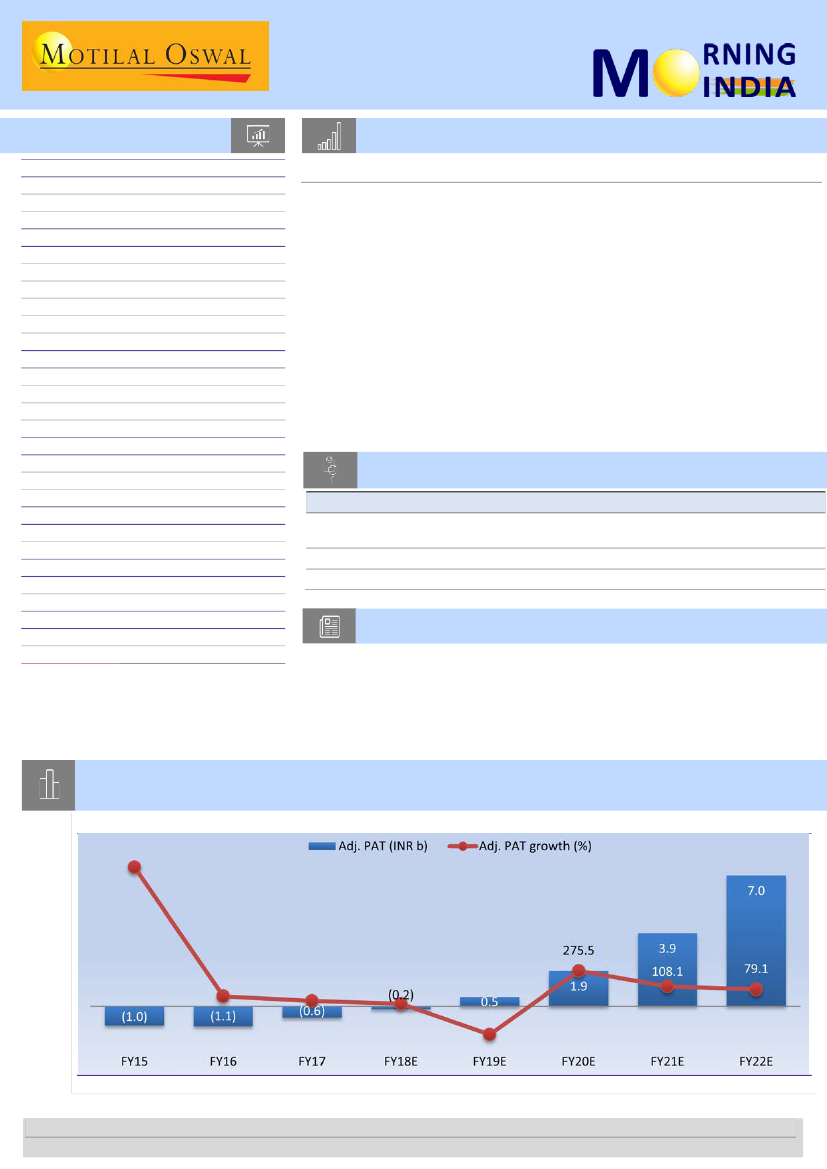

Chart of the Day: Future Consumer (Initiating Coverage) - Company of the “Future”; Long

runway of growth justifies expensive near-term valuations

Adj. PAT to turn positive by FY19 and touch INR7b by FY22

Source: Company, MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.