India Strategy

|

Get on track please !

Thematic

|

20 March 2018

Automobiles

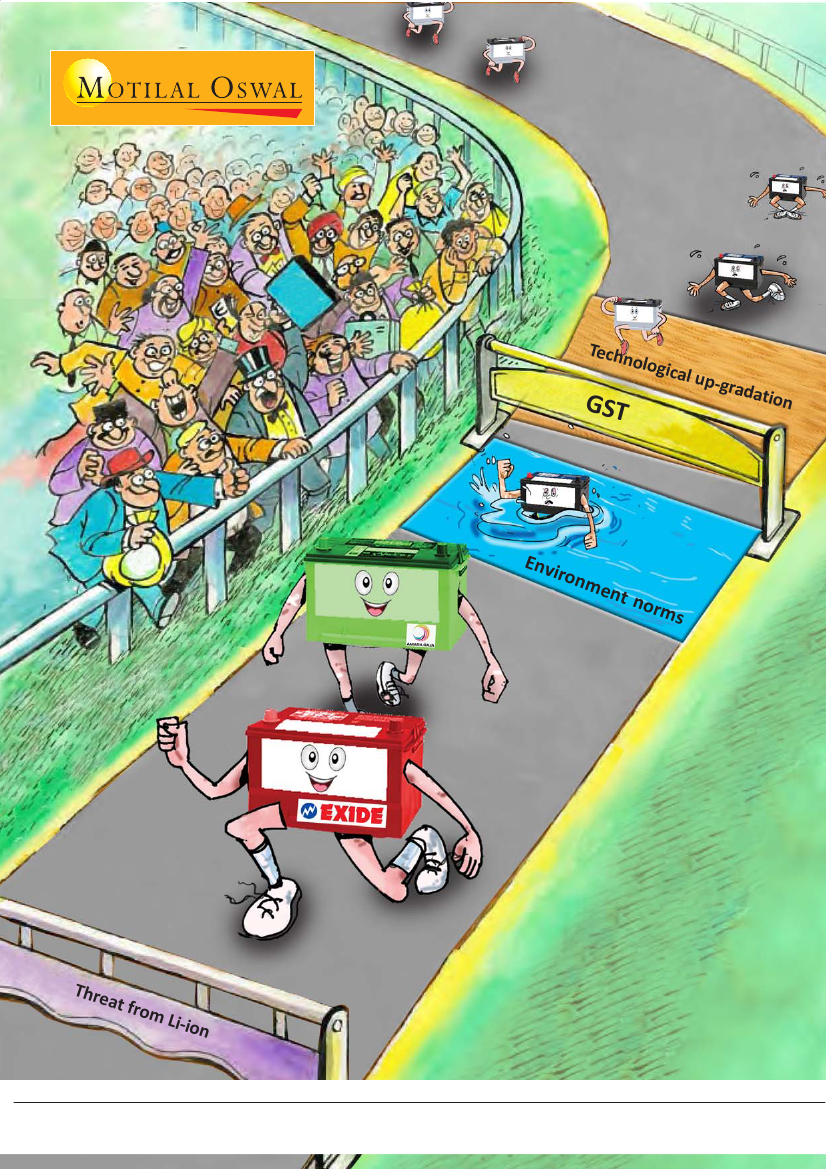

Batteries:

Huge opportunities,

but challenges too

Jinesh Gandhi - Research Analyst

(Jinesh@MotilalOswal.com); +91 22 6129 1524

Deep A Shah - Research Analyst

(Deep.S@MotilalOswal.com);

Suneeta Kamath - Research Analyst

(Suneeta.Kamath@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.