May 14th, 2018

Currency Futures (NSE)

Currency

USDINR

EURINR

GBPINR

JPYINR

Spot

67.36

80.59

91.42

61.63

Expiry

April

May

May

May

Open

67.30

80.24

91.07

61.48

High

67.50

80.62

91.62

61.78

Low

67.22

80.17

90.99

61.46

Option Monitor

Call

IV

6.64

5.94

5.88

6.00

6.01

6.69

% Chg in OI

0%

2%

5%

14%

18%

9%

OI

104251

69890

189930

85671

29879

29679

Volume

4164

14702

118945

49178

52549

19568

Premium

0.99

0.77

0.58

0.44

0.21

0.07

Strike

66.50

66.75

67.00

67.25

67.75

68.50

Premium

0.06

0.09

0.16

0.25

0.55

1.18

Volume

154834

41564

188046

84533

35546

60

Put

OI

142401

85120

155380

47099

12328

2543

% Chg in OI

-8%

3%

16%

18%

165%

-2%

Close

67.44

80.58

91.59

61.75

% chg

0.00%

0.43%

0.25%

0.33%

OI

2439814

94923

50451

23152

% Chg in OI

-0.3%

-2.3%

4.4%

1.6%

Trade Sheet

Sell USDJPY May

Buy EURUSD May

USDINR May Sell 66.75PE / Sell 68.50 CE

FII Activity

Action

IV

5.53

5.26

5.28

5.33

5.81

6.97

BUY

SELL

NET

Rs. (Crs)

3911.49

4236.93

-325.44

$ (Mil)

585.90

634.65

-48.75

-203.16

-25.4

-1891.64

15

Daily Debt($) Flows

Daily Equity($) Flows

MTD Flows($ mln)

Days to Expriy

10 Yr Bonds Yields

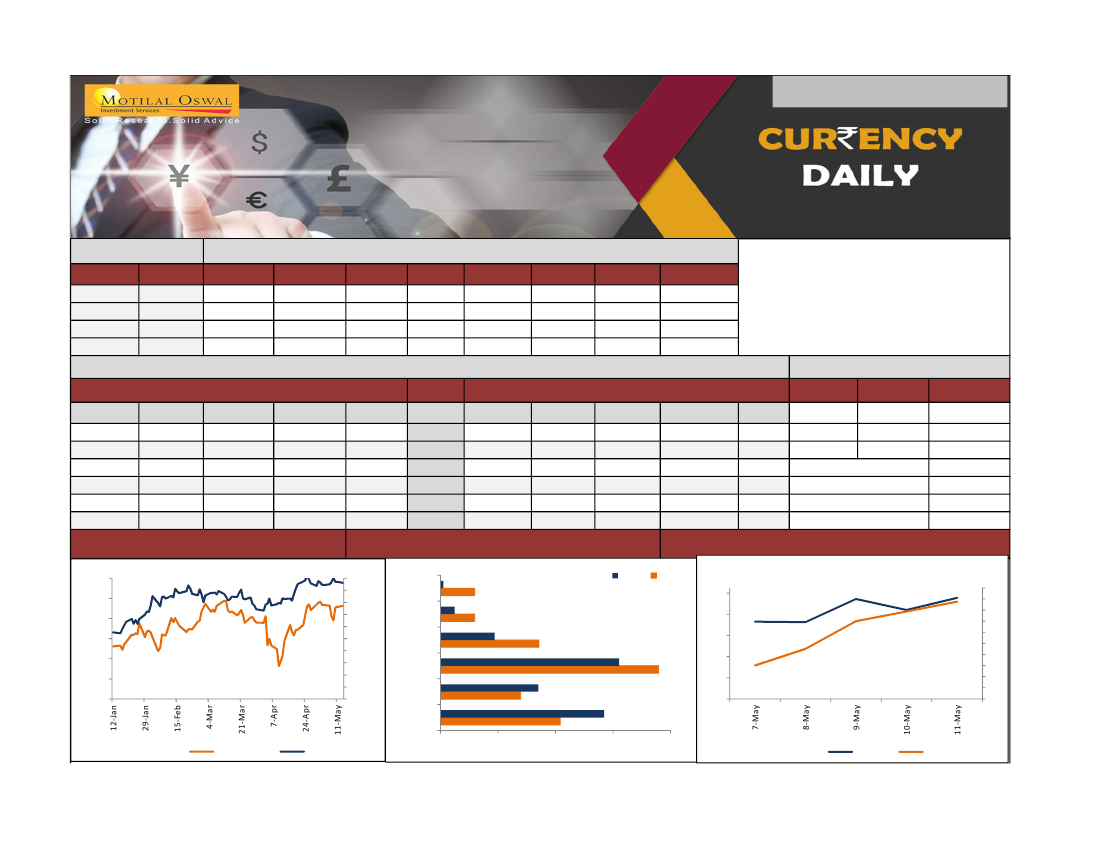

Open Interest Distribution

Put

68.50

67.75

67.25

67.00

Call

Correlation Between USDINR v/s USDINR 1 year FWD

USINR V/S USD INR 1yr FWD

67.4

67.2

67

66.8

66.6

274

272

270

268

266

264

262

260

258

256

254

8

7.8

7.6

7.4

7.2

7

6.8

3

2.9

2.8

2.7

2.6

2.5

2.4

2.3

2.2

2.1

2

66.75

66.50

0

Source: Reuters

66.4

Source: Reuters

India

US (RHS)

50000

100000

150000

200000

Source: Reuters

USDINR

USDINR 1yr FWD