15 May 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

35,557

0.1

Nifty-50

10,807

0.0

Nifty-M 100

19,275

-1.2

Equities-Global

Close

Chg .%

S&P 500

2,730

0.1

Nasdaq

7,411

0.1

FTSE 100

7,711

-0.2

DAX

12,978

-0.2

Hang Seng

12,545

1.6

Nikkei 225

22,866

0.5

Commodities

Close

Chg .%

Brent (US$/Bbl)

78

1.6

Gold ($/OZ)

1,314

-0.4

Cu (US$/MT)

6,856

-0.8

Almn (US$/MT)

2,316

1.7

Currency

Close

Chg .%

USD/INR

67.5

0.3

USD/EUR

1.2

-0.1

USD/JPY

109.7

0.2

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.8

0.10

10 Yrs AAA Corp

8.5

0.10

Flows (USD b)

14-May

MTD

FIIs

0.1

-0.8

DIIs

0.1

1.4

Volumes (INRb)

14-May

MTD*

Cash

305

337

F&O

4,044

6,375

Note: YTD is calendar year, *Avg

YTD.%

4.4

2.6

-8.8

YTD.%

2.1

7.4

0.3

0.5

7.1

0.4

YTD.%

16.4

0.8

-4.9

2.7

YTD.%

5.7

-0.6

-2.7

YTDchg

0.5

0.6

YTD

1.2

5.1

YTD*

372

7,872

Today’s top research theme

Value Migration – Digging deeper, exploring more themes

Pace of migration accelerating in BFSI and Jewelry

"Value Migration" is defined as a flow of economic and shareholder value away

from obsolete business models to new, more effective designs that are better

able to satisfy customers' most important priorities.

Value Migration happens in three stages-Value Inflow, Stability and Value

Outflow. In our Theme Report on Value Migration published in January 2017,

we had highlighted 26 case studies in which value migration is either prevalent

or will drive changes in future.

In this sequel, we look at the progress/updates on some of the cases already

highlighted and also dwell on two interesting new themes of Value Migration

Information Technology - staring at Phase-3 of Value Migration? After basking

in glory of low cost-talent, we are now witnessing value outflow towards

models built on the combination of automation, cloud and digital technologies.

Green metamorphosis - Value Migration from Oil to Gas. In the last few years,

rising pollution has been at the forefront of the policy making and judicial

activism in India with the focus on increasing penetration of gas.

Consumer: Jewelry - massive Value Migration unfolding from unorganized to

organized space. Titan the only pan-national branded jewelry player is at the

forefront to capture this long-term opportunity. In addition to it, pace of Value

Migration is accelerating in BFSI space from PSU Banks to Private Banks.

Research covered

Key Highlights

Digging deeper, exploring more themes

April CPI higher than expected but not alarming enough

Impressive volume growth; superior execution, good monsoon

HUL

make the growth story even more compelling

Titan Company

A gem that’s getting even more lustrous

KEC International Results exceed expectations led by strong execution

Solar Industries

Results exceed expectations led by robust overseas performance

Blue Star

Margins miss our estimates, but exceed consensus

South Indian Bank Loan growth picks up; asset quality deteriorates marginally

Healthcare

Volumes remain the key, while prices continue to drag growth

Metals Weekly

Zinc and lead prices increase 3-4% WoW

Results Expectation BRIT | CROMPTON | ENDU | LPC | MRPL | PI | PNB

Cos/Sector

Value Migration

Ecoscope

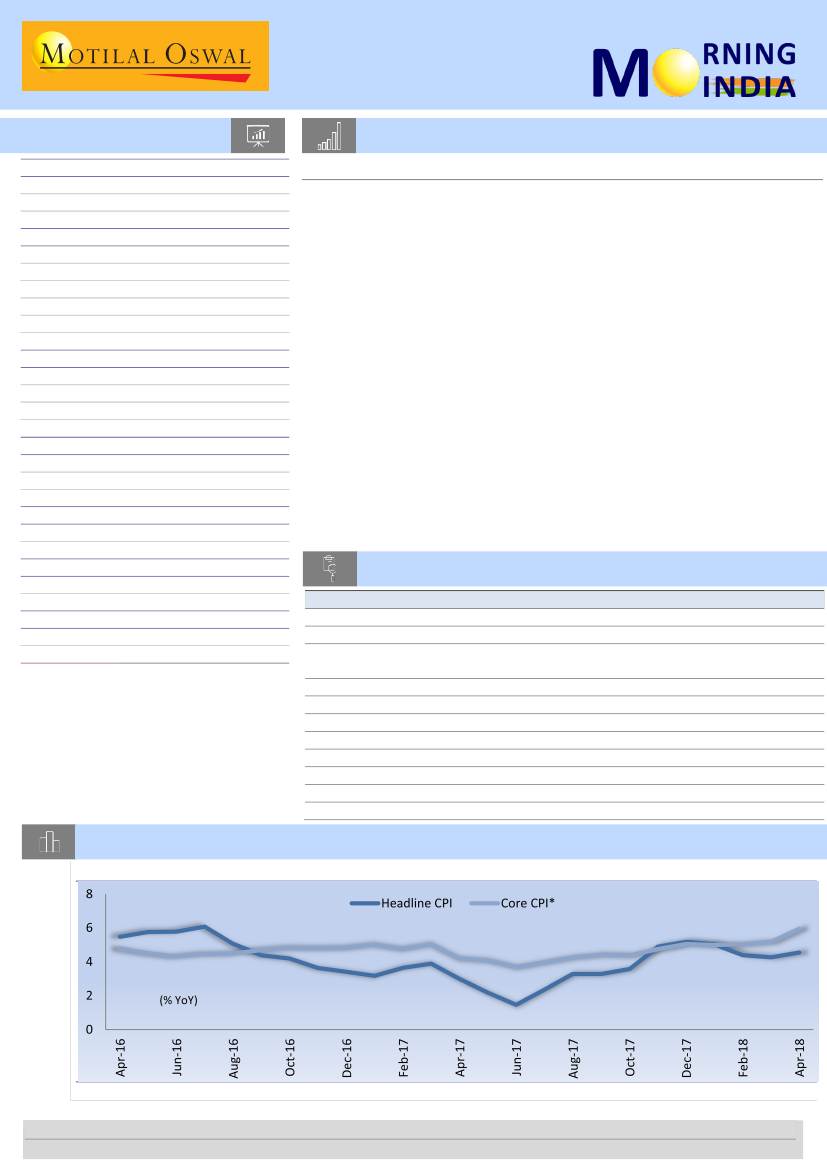

Chart of the Day: Ecoscope – April CPI higher than expected but not alarming enough to prompt a hike rate

Retail inflation rises to 4.6% in April 2018

* Excluding F&B and F&L

Source: Central Statistics Office (CSO), MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.