18 May 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

35,149

-0.7

Nifty-50

10,683

-0.5

Nifty-M 100

19,153

0.4

Equities-Global

Close

Chg .%

S&P 500

2,720

-0.1

Nasdaq

7,382

-0.2

FTSE 100

7,788

0.7

DAX

13,115

0.9

Hang Seng

12,278

-1.3

Nikkei 225

22,838

0.5

Commodities

Close

Chg .%

Brent (US$/Bbl)

79

0.5

Gold ($/OZ)

1,291

0.0

Cu (US$/MT)

6,857

0.9

Almn (US$/MT)

2,303

-1.4

Currency

Close

Chg .%

USD/INR

67.7

-0.1

USD/EUR

1.2

-0.1

USD/JPY

110.8

0.3

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.9

-0.02

10 Yrs AAA Corp

8.6

-0.02

Flows (USD b)

17-May

MTD

FIIs

-0.1

-0.6

DIIs

0.1

1.1

Volumes (INRb)

17-May

MTD*

Cash

343

341

F&O

14,328

7,840

Note: YTD is calendar year, *Avg

YTD.%

3.2

1.4

-9.4

YTD.%

1.7

6.9

1.3

1.5

4.9

0.3

YTD.%

18.0

-0.9

-4.9

2.1

YTD.%

6.0

-1.7

-1.7

YTDchg

0.6

0.7

YTD

0.7

6.2

YTD*

371

8,013

Today’s top research idea

Eicher Motors: All set for next leg of growth

Driven by high-potential, under represented BIMARU states

We see high growth potential in key motorcycling markets like BIMARU (Bihar,

MP, Rajasthan and UP). These under-penetrated 2W markets offer higher

scope for aspirational products like RE. RE's market share in these states is

currently 3-4% (v/s 6% for pan-India).

Our state-wise demand model indicates 20% CAGR in domestic volumes over

FY18-20. However, considering capacity constraints we model ~16% volume

CAGR.

RE is focused on creating a mark in developing markets like LatAm and South

East Asia. We believe that export markets can be a meaningful contributor to

volumes in five years, but ramp-up would be back-ended.

We expect EPS to grow 30% CAGR over FY18-20E.

Buy

with TP of INR35,572

(FY20E).

Research covered

Cos/Sector

India Strategy

Eicher Motors

Bajaj Finance

Britannia Inds

Voltas

Muthoot Finance

Quess Corp

SRF

Escorts

TeamLease Services

Results Expectation

Key Highlights

Contrarian Investing: Consensus Upgrade Analysis

All set for next leg of growth…

Growth outlook positive, improving asset quality

Robust volume and margin outlook; Maintain Buy

Results impacted by below-expected UCP performance

PAT misses estimate as growth remains tepid

Robust growth in Staffing leads to revenue beat; In-line margins

Strong beat on all fronts

Healthy progress across segments, upgrade to Neutral

Margin story playing out better than expectations

AMRJ | AL | BJAUT | DBEL | STR | TMX

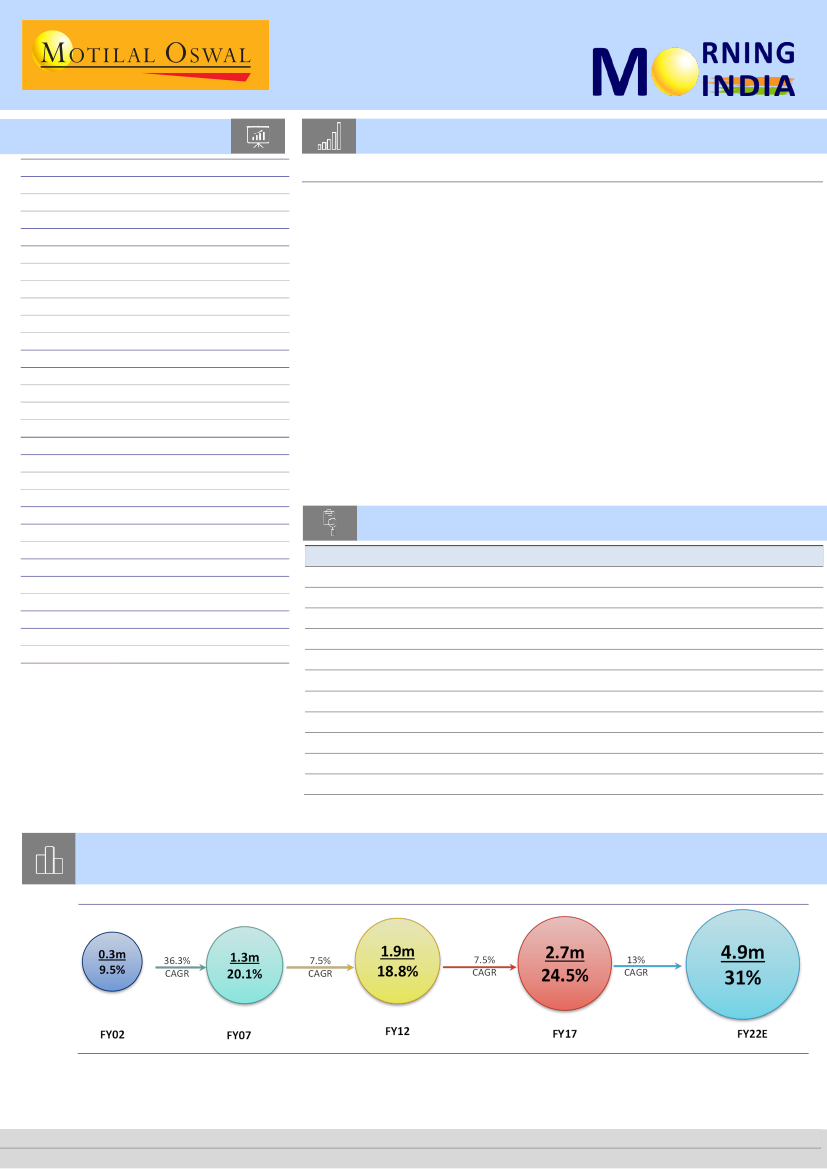

Chart of the Day: Eicher Motors – All set for next leg of growth; driven by high-potential,

under represented BIMARU states

Share of Premium (>150cc) motorcycles to expand to ~31% of motorcycles by FY22E

Note: % in circle represents share of premium segment in motorcycle

Source: MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.