22 May 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

34,616

-0.7

Nifty-50

10,517

-0.8

Nifty-M 100

18,571

-1.7

Equities-Global

Close

Chg .%

S&P 500

2,733

0.7

Nasdaq

7,394

0.5

FTSE 100

7,859

1.0

DAX

13,078

-0.3

Hang Seng

12,350

0.0

Nikkei 225

23,002

0.3

Commodities

Close

Chg .%

Brent (US$/Bbl)

79

1.1

Gold ($/OZ)

1,293

0.0

Cu (US$/MT)

6,844

0.3

Almn (US$/MT)

2,276

0.4

Currency

Close

Chg .%

USD/INR

68.1

0.2

USD/EUR

1.2

0.2

USD/JPY

111.1

0.2

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.8

-0.03

10 Yrs AAA Corp

8.5

0.00

Flows (USD b)

21-May

MTD

FIIs

-0.1

-0.7

DIIs

0.2

1.4

Volumes (INRb)

21-May

MTD*

Cash

338

342

F&O

6,355

7,554

Note: YTD is calendar year, *Avg

YTD.%

1.6

-0.1

-12.1

YTD.%

2.2

7.1

2.2

1.2

5.5

1.0

YTD.%

18.2

-0.8

-5.0

0.9

YTD.%

6.7

-1.8

-1.5

YTDchg

0.5

0.6

YTD

0.6

6.4

YTD*

371

7,967

Today’s top research idea

Ultratech Cement: Ultratech to acquire Century Textiles’

cement assets

Acquisition bodes well for Ultratech

Ultratech’s (UTCEM’s) board has approved the acquisition of cement division of

Century textiles Industries Limited (CTIL) which has total grinding capacity of

13.4mt with 11.4mt of integrated capacity and grinding unit of 2mt.

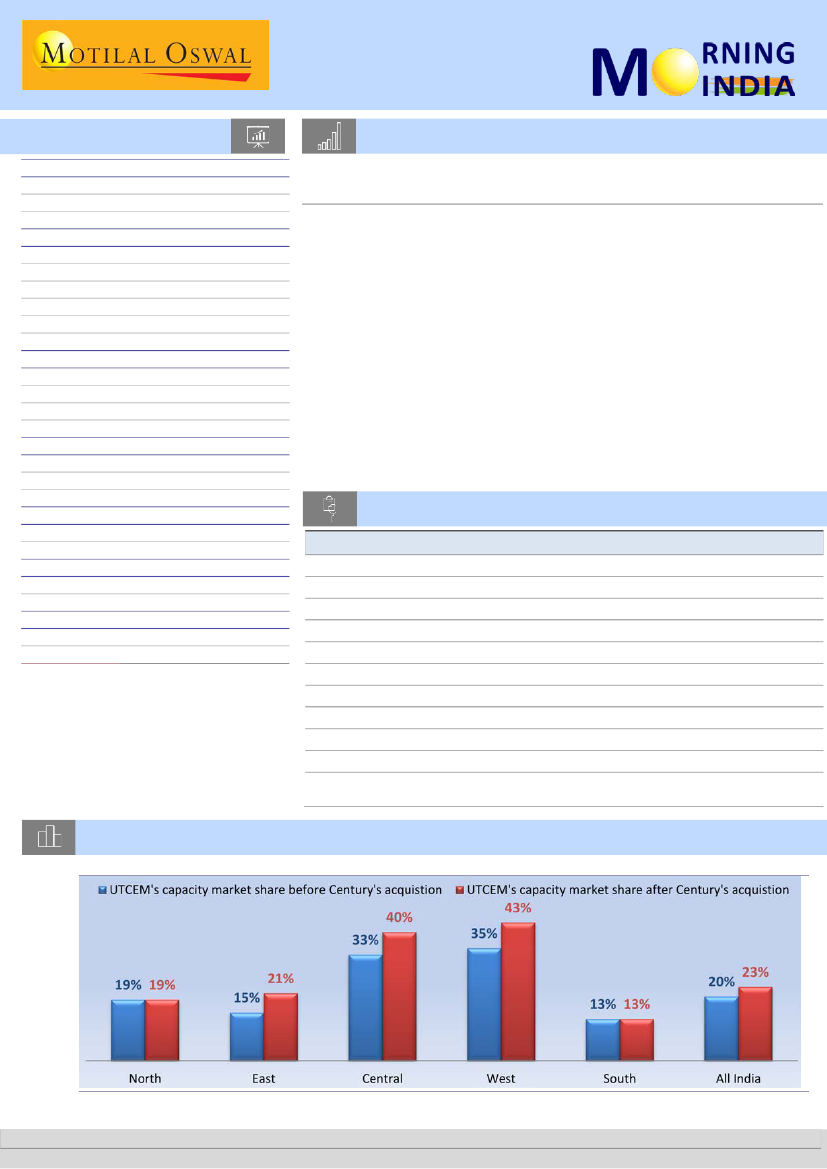

We believe the acquisition of CTIL’s integrated cement capacity of 13.4mt at

USD106/t is positive for UTCEM as it will help in increasing UTCEM’s domestic

capacity to 106mt and capacity market share by ~3pp to 23% by FY19 end. The

acquisition cost is ~7-8% lower than the cost of JPA’s acquired assets about 2

years back. Additionally, the acquisition is earnings accretive from 1st year of

operations vs 2 years in case of JPA.

UTCEM by way of this acquisition has ensured higher market share with zero

lead time for asset creation and at valuation largely in line with greenfield

expansions which we believe is positive for UTCEM.

Research covered

Cos/Sector

UltraTech Cement

Bajaj Auto

Petronet LNG

Colgate-Palmolive

Dalmia Bharat

Thermax

Guj.St.Petronet

Mahanagar Gas

Sanghi Inds

Metals Weekly

Key Highlights

Ultratech to acquire Century Textiles’ cement assets

Operating performance in-line, higher other income boosts PAT

In-line EBITDA; Dahej utilization at 109%

Mixed bag – volumes disappoint but margins expand sharply

Healthy volume growth, realization drive profitability

Miss led by weak execution, pressure on margins

EBITDA below estimate; strong transmission volumes

EBITDA below estimate; volume growth strong

Cost push impacts margins, shutdown hurts volumes

Thermal coal prices continue to rise

AGLL | BHFC | BOS | CIPLA | DRRD | FCON | HPCL | IOCL |

Results Expectation

RADIOCIT | SBIN

Chart of the Day: Ultratech Cement – Ultratech to acquire Century Textiles’ cement assets

UTCEM’s all-India capacity market share to increase by ~3pp

Research Team (Gautam.Duggad@MotilalOswal.com)

Source: MOSL, Company

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.