11 June 2018

Motilal Oswal values your support in the

Asiamoney Brokers Poll 2018 for India

Research, Sales and Trading team.

We

request your ballot.

Today’s top research theme

Consumer: Consumption demand set to pick up in FY19

HUVR, TTAN, BRIT, PAG remain our top picks

4QFY18 results for Consumer/retail companies under coverage were largely in

line with expectations. The outstanding performers for the quarter were HUVR,

PAGE, TITAN and UBBL. Visibility on growth is also high for these companies

going forward.

Disappointment (albeit marginal) on earnings in 4QFY18 came from Marico,

Emami (HMN), Future Consumer (FCL) and P&GHH. BRIT reported in line

numbers and outlook remains robust. Two themes are emerging in the

Consumer space (a) outlook on rural is improving quarter after quarter which

augurs very well for companies with high rural exposure or incrementally high

rural growth and (b) Titan and Pidilite are emerging as early and likely

significant beneficiaries of GST implementation.

Our top picks taking all of these factors into account are HUVR, Titan, BRIT and

PAGE.

Market snapshot

Equities - India

Close

Chg .%

Sensex

35,444

-0.1

Nifty-50

10,768

0.0

Nifty-M 100

18,831

0.5

Equities-Global

Close

Chg .%

S&P 500

2,779

0.3

Nasdaq

7,646

0.1

FTSE 100

7,681

-0.3

DAX

12,767

-0.3

Hang Seng

12,166

-2.0

Nikkei 225

22,695

-0.6

Commodities

Close

Chg .%

Brent (US$/Bbl)

76

-1.3

Gold ($/OZ)

1,299

0.2

Cu (US$/MT)

7,324

-0.1

Almn (US$/MT)

2,296

-0.3

Currency

Close

Chg .%

USD/INR

67.5

0.6

USD/EUR

1.2

-0.3

USD/JPY

109.6

-0.2

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.9

-0.05

10 Yrs AAA Corp

8.8

-0.05

Flows (USD b)

8-Jun

MTD

FIIs

0.0

0.4

DIIs

0.1

0.4

Volumes (INRb)

8-Jun

MTD*

Cash

315

320

F&O

4,894

8,183

Note: YTD is calendar year, *Avg

YTD.%

4.1

2.3

-10.9

YTD.%

3.9

10.8

-0.1

-1.2

3.9

-0.3

YTD.%

13.4

-0.3

1.6

1.8

YTD.%

5.7

-2.0

-2.8

YTDchg

0.6

0.9

YTD

0.2

7.7

YTD*

368

8,199

Research covered

Cos/Sector

Consumer

Sun Pharma

Tata Motors

Fuel Or Engines

Key Highlights

Consumption demand set to pick up in FY19

Halol resolution in sight; status changed to VAI

JLR’s May 2018 wholesales in-line at 48.8k units

GDP growth to remain sub-7% in FY19

Piping hot news

6 more state-run banks may come under PCA

Six more state-run banks are at risk of entering the Reserve Bank of India’s

prompt corrective action (PCA) framework, officials said. These include Punjab

National Bank, Union Bank of India and Syndicate Bank, they said, adding that

this may reduce the chances of the finance ministry’s plans to sell the good

loans of weak banks to stronger lenders coming to fruition.

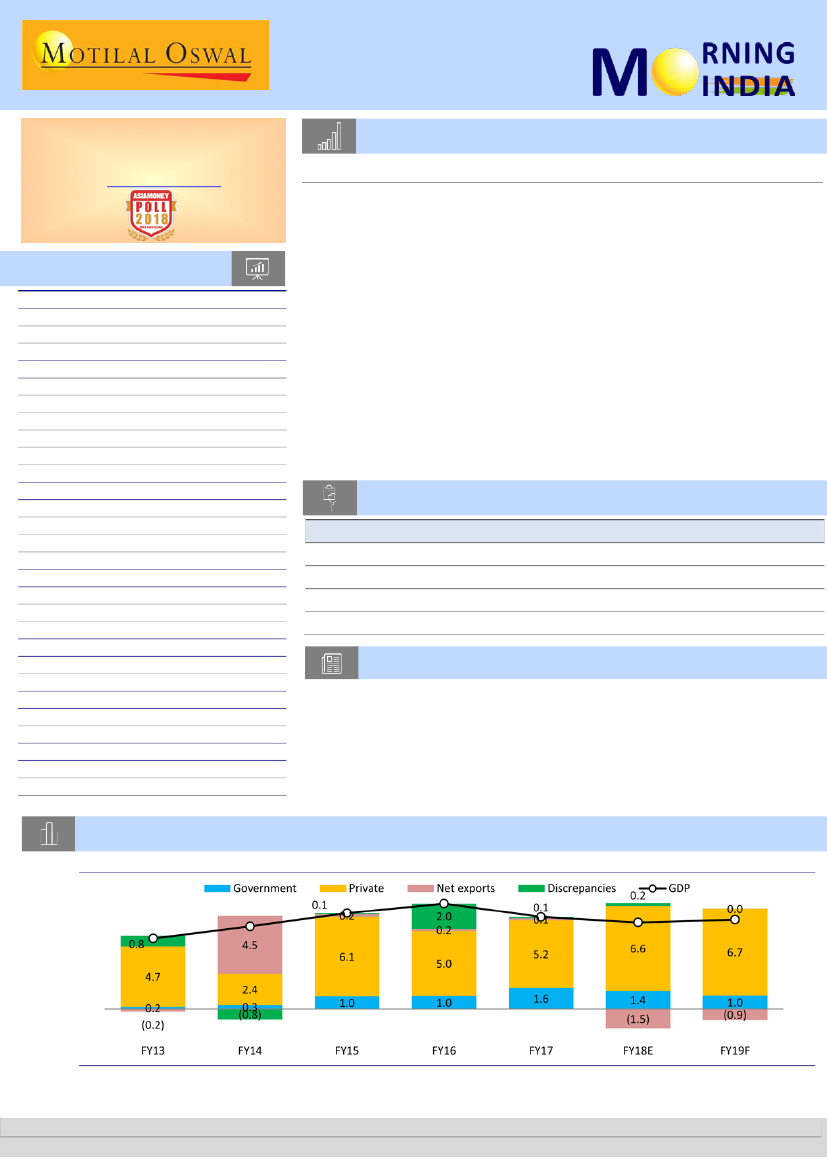

Chart of the Day:

Fuel Or Engines (Economy): GDP growth to remain sub-7% in FY19

Key drivers of GDP growth since FY13 (percentage points)

Spending = consumption + investment

F = Forecasts

E = Sectoral break-up not yet available for FY18, thus our estimates

Source: Central Statistics Office (CSO), RBI, CEIC, MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.