Thematic | July 2018

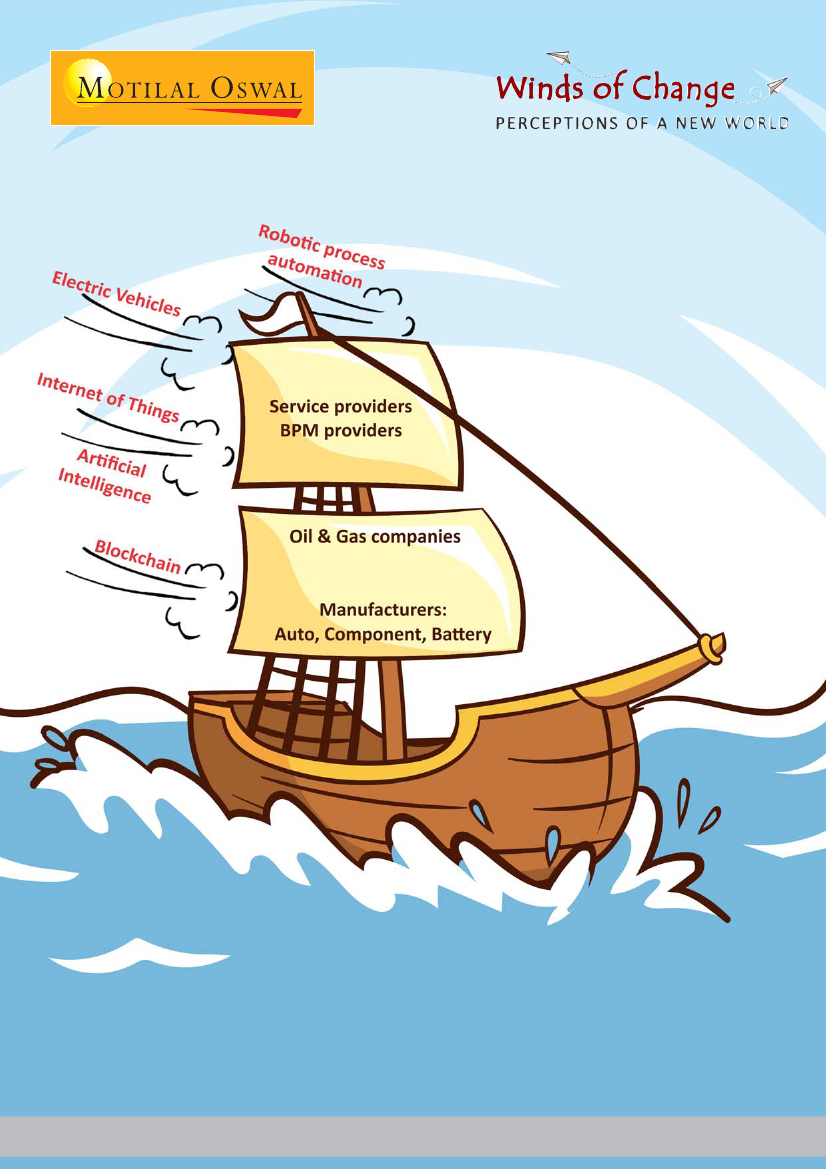

Imminent disruptions

Research Team (Gautam.Duggad@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.